MI Form 5080 2015 free printable template

Show details

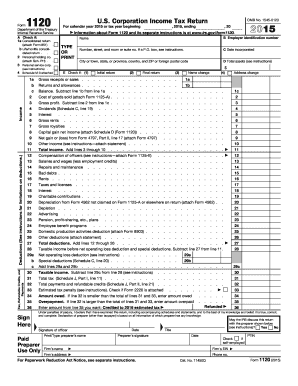

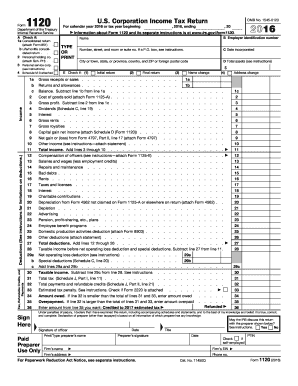

Send your return and any payment due to Michigan Department of Treasury P. O. Box 30324 Lansing MI 48909-7824 2015 66 01 27 1 Date Instructions for 2015 Sales Use and Withholding Taxes Monthly/Quarterly Return Form 5080 IMPORTANT This is a return for Sales Tax Use Tax and/ or Withholding Tax. Reset Form Michigan Department of Treasury 5080 07-14 This form cannot be used as an amended return see the Amended Monthly/Quarterly Return Form 5092. 2015 Sales Use and Withholding Taxes...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI Form 5080

Edit your MI Form 5080 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI Form 5080 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI Form 5080 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI Form 5080. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI Form 5080 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI Form 5080

How to fill out 5080 form 2022?

01

Begin by gathering all necessary information and documentation required for the form. This may include personal details, financial records, and any supporting documents related to the purpose of the form.

02

Carefully read and understand the instructions provided with the form. Make sure you have a clear understanding of the requirements and the specific sections that need to be completed.

03

Start filling out the form by entering your personal information accurately. This may include your name, address, contact details, and any other relevant identifying information.

04

Move on to the specific sections of the form that pertain to the purpose or nature of the form. Fill in all the required fields and provide any additional information or documentation as requested.

05

Review your entries thoroughly before submitting the form. Double-check for any errors, missing information, or inconsistencies. It's important to ensure the accuracy and completeness of the form to avoid delays or misunderstandings.

06

Sign and date the form as instructed. This may require a physical or electronic signature, depending on the submission method.

07

If required, make copies of the completed form and any supporting documents for your own records.

Who needs 5080 form 2022?

01

Individuals or businesses who meet the specific criteria or circumstances outlined in the form's instructions or regulations may be required to fill out the 5080 form 2022.

02

The form may be necessary for tax purposes, financial reporting, regulatory compliance, or other legal requirements. It is important to consult the relevant authorities or seek professional advice to determine if the form is applicable to your situation.

03

The specific details regarding who needs to fill out the 5080 form 2022 can vary depending on the jurisdiction, industry, or specific circumstances. It's crucial to research and understand the requirements that apply to your particular situation.

Fill

form

: Try Risk Free

People Also Ask about

What is the standard exemption for 2022?

For the 2022 tax year, tax returns were due April 18, 2023. Taxpayers who filed for an extension before the tax-filing deadline have until Oct. 16, 2023, to file. The 2022 standard deduction is $12,950 for single filers and those married filing separately, $25,900 for joint filers, and $19,400 for heads of household.

Do I have to pay Michigan state income tax if I live in Florida?

Michigan has a state income tax, which you pay on earned and unearned income if Michigan is your domicile. Florida, in comparison, does not have a state income tax. If Florida is your domicile, you will not pay tax on income you earn in Florida. (You may, however, still pay Michigan tax on income you earn in Michigan.)

What is the personal exemption for 2022 in Michigan?

Tax form information and changes for 2022. Exemption allowances and the tax rate: $5,000 for personal and dependent exemptions. $2,900 for special exemptions.

What is form 5080 for Michigan?

MI Form 5080 - Sales, Use and Withholding Taxes Monthly/Quarterly Return (and Form 5095) - CFS Tax Software, Inc. How can I find my MyCFS login email/password? Can I be invoiced or billed for my order?

Are personal exemptions gone for 2022?

The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

Are 2022 Michigan tax forms available?

The Michigan State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return. Alternatively, you can also only prepare and mail-in a MI state return. The latest deadline for e-filing a Michigan Tax Returns is April 18, 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in MI Form 5080?

With pdfFiller, the editing process is straightforward. Open your MI Form 5080 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the MI Form 5080 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your MI Form 5080 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I edit MI Form 5080 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing MI Form 5080 right away.

What is MI Form 5080?

MI Form 5080 is a form used by businesses in Michigan to report and pay the Michigan Corporate Income Tax (CIT).

Who is required to file MI Form 5080?

Businesses that have gross receipts exceeding $350,000 and are subject to the Michigan Corporate Income Tax must file MI Form 5080.

How to fill out MI Form 5080?

To fill out MI Form 5080, businesses must provide their gross receipts, calculate their tax liability based on the applicable tax rate, and report any deductions or credits before submitting the form.

What is the purpose of MI Form 5080?

The purpose of MI Form 5080 is to report corporate income and pay the tax due under the Michigan Corporate Income Tax system.

What information must be reported on MI Form 5080?

MI Form 5080 requires reporting of total gross receipts, adjusted gross receipts, deductions, tax credits, and the amount of tax owed.

Fill out your MI Form 5080 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI Form 5080 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.