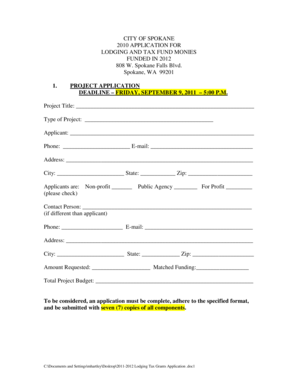

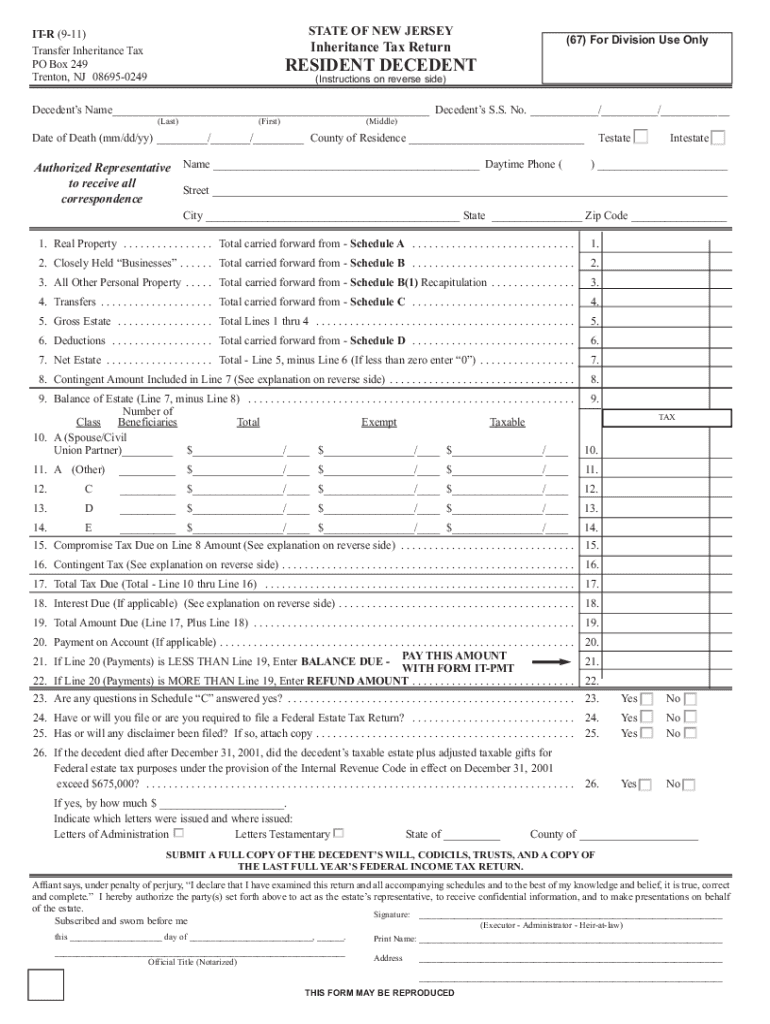

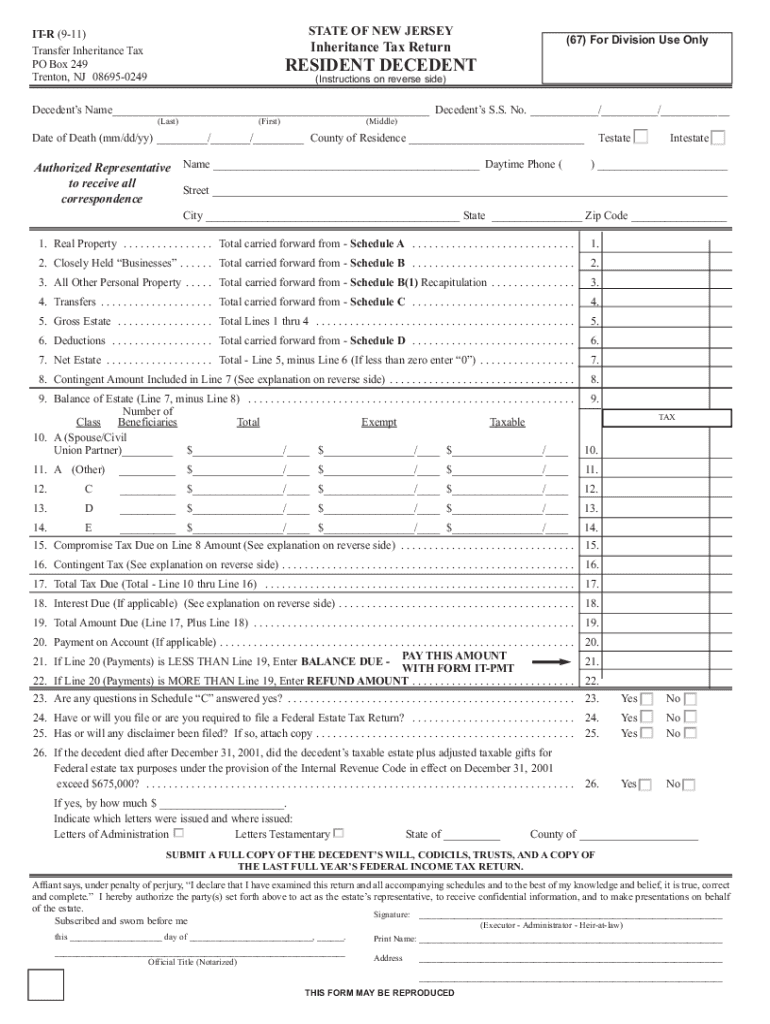

NJ DoT IT-R 2011 free printable template

Show details

16 974. 56 Balance. 51 415. 14 58. 73 Overpayment to be refunded. 7 501. 82 IT-PMT 10-11 DIVISION OF TAXATION INHERITANCE AND ESTATE TAX FOR USE ONLY WHEN FILING IT-R RETURN. FOR OTHER PAYMENTS USE FORM IT-EP. Decedent s S.S. No. // ATTACH CHECKS HERE AMOUNT PAID WITH RETURN From IT-R Line 21 Code 67 1. for the refund of an overpayment must be made in writing within the three year statutory period in accordance with and in the manner set forth in N.J.A. O Include separate checks and vouchers...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ DoT IT-R

Edit your NJ DoT IT-R form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ DoT IT-R form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ DoT IT-R online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NJ DoT IT-R. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT IT-R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ DoT IT-R

How to fill out NJ DoT IT-R

01

Obtain the NJ DoT IT-R form from the official New Jersey Department of Transportation website or office.

02

Fill out the header section with your name, address, and contact information.

03

Provide vehicle information, including make, model, year, and VIN (Vehicle Identification Number).

04

Detail the reason for the form submission, such as reporting a crash or vehicle inspection results.

05

Complete the section regarding accident details if applicable, including date, time, and location of the incident.

06

Sign and date the form certifying that the information provided is true and accurate.

07

Make a copy of the completed form for your records before submission.

08

Submit the form according to the instructions provided (via mail, in-person, or online if applicable).

Who needs NJ DoT IT-R?

01

Drivers involved in accidents that require reporting to the New Jersey Department of Transportation.

02

Vehicle owners needing to report inspection results or vehicle-related issues.

03

Individuals filing insurance claims related to vehicle incidents.

04

Anyone needing to maintain compliance with state vehicle regulations.

Fill

form

: Try Risk Free

People Also Ask about

Where do I file my ITR in NJ?

All returns except the L-8 are to be filed with the New Jersey Division of Taxation, Individual Tax Audit Branch, Transfer Inheritance and Estate Tax, 3 John Fitch Way, 6th Floor, Trenton, New Jersey 08695-0249.

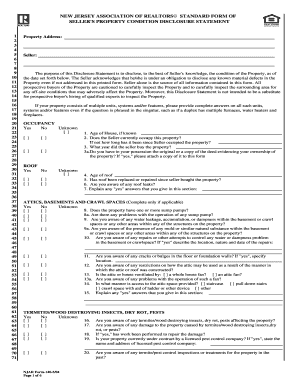

Do I need to file an estate tax return in NJ?

A New Jersey Estate Tax Return must be filed if the decedent's gross estate, as determined in ance with the provisions of the Internal Revenue Code, exceeds $2 million. The return must be filed within nine (9) months from the decedent's date of death.

What is a NJ L-8 form?

Form L-8 (Affidavit & Self-Executing Waiver) This form may be used in most cases to transfer bank accounts, stocks, bonds and brokerage accounts, when the transfer or release is to a Class "A" beneficiary.

What is the threshold for estate tax return in NJ?

If the resident decedent died: On December 31, 2016, or before, the Estate Tax exemption was capped at $675,000; On or after January 1, 2017, but before January 1, 2018 , the Estate Tax exemption was $2 million; On or after January 1, 2018, no Estate Tax will be imposed.

What is NJ-1040 form?

New Jersey Form NJ-1040 – Personal Income Tax Return for Residents. New Jersey Form NJ-1040NR – Personal Income Tax Return for Nonresidents. New Jersey 100S K1 – Shareholder's Share of Income/Loss.

Do estates need to file tax returns?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NJ DoT IT-R online?

With pdfFiller, you may easily complete and sign NJ DoT IT-R online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out the NJ DoT IT-R form on my smartphone?

Use the pdfFiller mobile app to fill out and sign NJ DoT IT-R on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete NJ DoT IT-R on an Android device?

Complete your NJ DoT IT-R and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NJ DoT IT-R?

NJ DoT IT-R is the New Jersey Department of Transportation's Income Tax Return, which is required for reporting income and expenses related to transportation activities.

Who is required to file NJ DoT IT-R?

Any individual, partnership, corporation, or other entity that earns income from transportation services in New Jersey is required to file NJ DoT IT-R.

How to fill out NJ DoT IT-R?

To fill out NJ DoT IT-R, you need to gather your income and expense data from transportation activities, complete the forms provided by the New Jersey Department of Transportation, and submit them by the specified deadline.

What is the purpose of NJ DoT IT-R?

The purpose of NJ DoT IT-R is to ensure that transportation-related income is accurately reported and taxed in accordance with New Jersey state laws.

What information must be reported on NJ DoT IT-R?

The NJ DoT IT-R requires the reporting of income earned from transportation services, detailed expenses incurred during operations, and any applicable deductions or credits.

Fill out your NJ DoT IT-R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ DoT IT-R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.