Get the free R-1081 Business Wind or Solar Energy Income Tax Credit - revenue louisiana

Show details

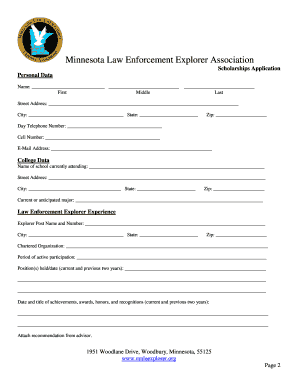

R-1081 1/10 FILING PERIOD Business Wind or Solar Energy Income Tax Credit PLEASE PRINT OR TYPE. Name of Taxpayer claiming credit Louisiana Revenue Account No. Location where system installed City State New System and installation Addition to existing system Solar Electric System Wind Electric System ZIP Solar Thermal System Wind Mechanical System Date the energy system was purchased and installed mm/dd/yyyy in a Residential Rental Apartment...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign r-1081 business wind or

Edit your r-1081 business wind or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your r-1081 business wind or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing r-1081 business wind or online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit r-1081 business wind or. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out r-1081 business wind or

How to fill out R-1081 Business Wind or Solar Energy Income Tax Credit

01

Obtain the R-1081 form from your local tax agency or download it from the official website.

02

Fill out your business information, including name, address, and tax identification number.

03

Provide details about the wind or solar energy system installed, including installation costs and energy generation capacity.

04

Indicate the type of tax credit you are applying for (wind or solar) and provide any required documentation.

05

Calculate the amount of credit you are eligible for based on the state’s guidelines.

06

Sign and date the form to certify that all information provided is accurate.

07

Submit the completed R-1081 form along with your tax return by the appropriate deadline.

Who needs R-1081 Business Wind or Solar Energy Income Tax Credit?

01

Businesses that have installed wind or solar energy systems and are seeking tax incentives.

02

Companies looking to reduce their tax liability through renewable energy investments.

03

Small to medium-sized enterprises aiming to adopt sustainable energy practices.

Fill

form

: Try Risk Free

People Also Ask about

Do you actually get money back from solar tax credit?

When you purchase solar equipment for your home and have tax liability, you generally can claim a solar tax credit to lower your tax bill. The Residential Clean Energy Credit is non-refundable meaning that it can offset your income tax liability dollar-for-dollar, but any excess credit won't be refunded.

Can a business get the solar tax credit?

If you're a business owner interested in going solar, the federal Investment Tax Credit (ITC) is one of the smartest ways to cut the cost of your installation by 30%, as well as reduce your federal taxable income liability.

What is the wind and solar tax credit?

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034.

What disqualifies you from a solar tax credit?

You must own the system: To use the tax credit, you must purchase the solar panels with cash or a loan. You will not get the tax credit if your solar panels are installed through a solar lease or a power purchase agreement (PPA) because you are not the owner of the system. You must have taxable income.

How does the solar tax credit work?

For any solar project that finishes construction between 2022 and 2032, the value of the solar tax credit is 30% of the project's cost. After that date, the step-down schedule is as follows: 30% - Projects where construction finishes between 2022 and 2032. 26% - Projects where construction finishes in 2033.

Do you actually get money back from solar tax credit?

When you purchase solar equipment for your home and have tax liability, you generally can claim a solar tax credit to lower your tax bill. The Residential Clean Energy Credit is non-refundable meaning that it can offset your income tax liability dollar-for-dollar, but any excess credit won't be refunded.

How do wind energy credits work?

One REC represents one megawatt-hour (MWh) of energy produced and delivered by a renewable energy source. The tradable renewable certificates can be exchanged on a market between businesses and owners as a method of raising cash or meeting sustainability goals.

What is the 30% federal tax credit for solar?

The Inflation Reduciton Act (passed in 2022) provides for a 30% Solar Tax Credit, a generous incentive that allows you to claim a tax credit when you solar photovoltaic (PV) panels. Think of the solar tax credit as a “gift card” from Uncle Sam.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is R-1081 Business Wind or Solar Energy Income Tax Credit?

The R-1081 Business Wind or Solar Energy Income Tax Credit is a tax incentive provided to businesses that invest in wind or solar energy projects, allowing them to receive credit against their income tax obligations based on the amount invested.

Who is required to file R-1081 Business Wind or Solar Energy Income Tax Credit?

Businesses that have invested in qualifying wind or solar energy systems and wish to claim the tax credit must file the R-1081 form.

How to fill out R-1081 Business Wind or Solar Energy Income Tax Credit?

To fill out the R-1081 form, businesses should provide their identifying information, details of the investment in wind or solar energy, and any applicable financial data as required by the form's instructions.

What is the purpose of R-1081 Business Wind or Solar Energy Income Tax Credit?

The purpose of the R-1081 Business Wind or Solar Energy Income Tax Credit is to encourage businesses to invest in renewable energy sources, thereby promoting sustainability and reducing dependency on fossil fuels.

What information must be reported on R-1081 Business Wind or Solar Energy Income Tax Credit?

Businesses must report their tax identification number, the type of energy system installed, the date of installation, the total cost of the project, and the eligible amount of credit claimed on the R-1081 form.

Fill out your r-1081 business wind or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

R-1081 Business Wind Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.