UK HMRC IHT400 2023-2026 free printable template

Show details

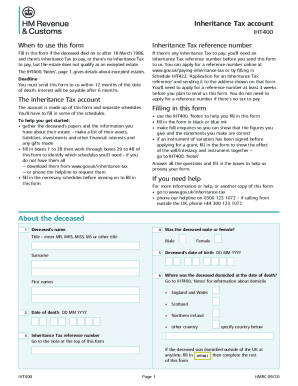

Inheritance Tax account

IHT400When to use this formInheritance Tax reference numbering in this form if the deceased died on or after 18 March 1986,

and there's Inheritance Tax to pay, or there's no

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign iht 400 forms

Edit your iht400 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hmrc inheritance tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing iht400 form pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit iht400 form download. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC IHT400 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out iht400 form online

How to fill out UK HMRC IHT400

01

Gather all necessary documents including details of the deceased's estate, assets, and liabilities.

02

Start filling out the IHT400 form, providing the deceased's personal information including name, address, and date of death.

03

Provide information about the estate's value, including property, bank accounts, investments, and personal possessions.

04

List any debts and funeral expenses that are to be deducted from the estate value.

05

Complete the relevant supplementary pages if needed, such as those for foreign assets or special valuations.

06

Review the completed form for accuracy and ensure all required signatures are included.

07

Submit the IHT400 form to HMRC along with any supporting documents and payment for Inheritance Tax, if applicable.

Who needs UK HMRC IHT400?

01

The UK HMRC IHT400 needs to be completed by the executors or administrators of an estate when someone dies and their estate is valued at over a certain threshold.

02

It is also required for individuals who are responsible for administering estates where Inheritance Tax is due.

Fill

iht400 form printable

: Try Risk Free

People Also Ask about hmrc inheritance form

What is IHT400?

If Inheritance Tax is due or full details are needed. You must report the value of the estate to HM Revenue and Customs ( HMRC ) by completing form IHT400. You must submit the form within 12 months of the person dying. You may have to pay a penalty if you miss the deadline.

What happens after IHT421?

If there's Inheritance Tax to pay Fill out and send form IHT400 and form IHT421 to HMRC and wait 20 working days before applying for probate. You normally have to pay at least some of the tax before you'll get probate. You can claim the tax back from the estate, if you pay it out of your own bank account.

How do I submit IHT400?

You need to download and complete form IHT400. Send it to the address on the form. You can read guidance on how to complete form IHT400. You can ask HMRC to work out how much Inheritance Tax is due if you're filling in the form without the help of a probate professional, such as a solicitor.

Do I need to complete IHT400?

You must complete the form IHT400, as part of the probate or confirmation process if there's Inheritance Tax to pay, or the deceased's estate does not qualify as an 'excepted estate'. You can use the notes and forms IHT401 to IHT436 to support you.

Do I need to complete IHT421?

If there is inheritance tax to pay (i.e. the estate is not excepted), and the person dies on or after 1 January 2022, you will need to fill in and file an IHT400 and IHT421 with HMRC, and wait 20 working days before you can apply to the registry for probate.

Do I need an IHT400?

You must complete the form IHT400, as part of the probate or confirmation process if there's Inheritance Tax to pay, or the deceased's estate does not qualify as an 'excepted estate'. You can use the notes and forms IHT401 to IHT436 to support you.

How long do you have to pay IHT in the UK?

You must pay Inheritance Tax by the end of the sixth month after the person died. For example, if the person died in January, you must pay Inheritance Tax by 31 July.

What happens after submitting IHT400?

Fill out and send form IHT400 and form IHT421 to HMRC and wait 20 working days before applying for probate. You normally have to pay at least some of the tax before you'll get probate. You can claim the tax back from the estate, if you pay it out of your own bank account.

Do I need to fill in Inheritance Tax form UK?

for deaths on or after 1 January 2022 you do not need to fill in a HMRC form however you must give details of the assets you need a Grant of Representation for and extra information for Inheritance Tax on the Estate Summary Form (NIPF7) below. if Inheritance Tax is due or full details are needed HMRC use form IHT400.

What can I do with IHT400?

If Inheritance Tax is due or full details are needed. You must report the value of the estate to HM Revenue and Customs ( HMRC ) by completing form IHT400. You must submit the form within 12 months of the person dying. You may have to pay a penalty if you miss the deadline.

Which IHT form do I complete?

Details. You must complete the form IHT400, as part of the probate or confirmation process if there's Inheritance Tax to pay, or the deceased's estate does not qualify as an 'excepted estate'. You can use the notes and forms IHT401 to IHT436 to support you.

How can I inherit a house without paying tax UK?

There's normally no Inheritance Tax to pay if either: the value of your estate is below the £325,000 threshold. you leave everything above the £325,000 threshold to your spouse, civil partner, a charity or a community amateur sports club.

How long does it take to complete IHT400?

processing form IHT400s within 15 working days of receipt. issuing the form IHT421 within 15 working days of receiving the form IHT400 or payment of the tax due on delivery of the account, whichever is later.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit hmrc iht400 online from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your iht 400 form into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send uk iht400 for eSignature?

Once your inheritance tax account form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute uk iht400 pdf online?

pdfFiller has made it simple to fill out and eSign hmrc iht400. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

What is UK HMRC IHT400?

The IHT400 is a form used to report Inheritance Tax (IHT) to Her Majesty's Revenue and Customs (HMRC) in the UK. It is typically required when someone has died and their estate's value exceeds the IHT threshold.

Who is required to file UK HMRC IHT400?

The Executor, Administrator, or Personal Representative of a deceased person's estate is required to file the IHT400 if the total value of the estate exceeds the nil-rate band for Inheritance Tax.

How to fill out UK HMRC IHT400?

To fill out the IHT400, gather details about the deceased's assets, debts, and any previous gifts made. Complete the form by providing information as prompted, ensuring all values are accurate and any necessary supplementary forms are included.

What is the purpose of UK HMRC IHT400?

The purpose of the IHT400 is to assess the value of a deceased person's estate for tax purposes and to calculate the amount of Inheritance Tax owed.

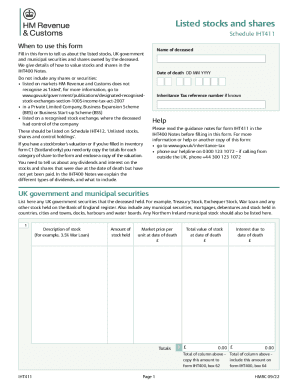

What information must be reported on UK HMRC IHT400?

The IHT400 requires detailed information about the deceased's assets (such as property, savings, and investments), liabilities (debts and mortgages), any gifts made in the seven years prior to death, and details of the deceased's funeral expenses.

Fill out your UK HMRC IHT400 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form iht400 is not the form you're looking for?Search for another form here.

Keywords relevant to iht400 account template

Related to iht400 online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.