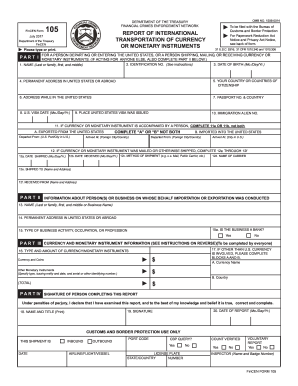

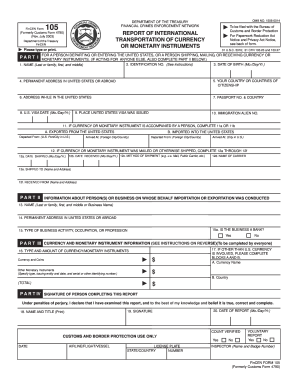

FinCen 105 2011 free printable template

Show details

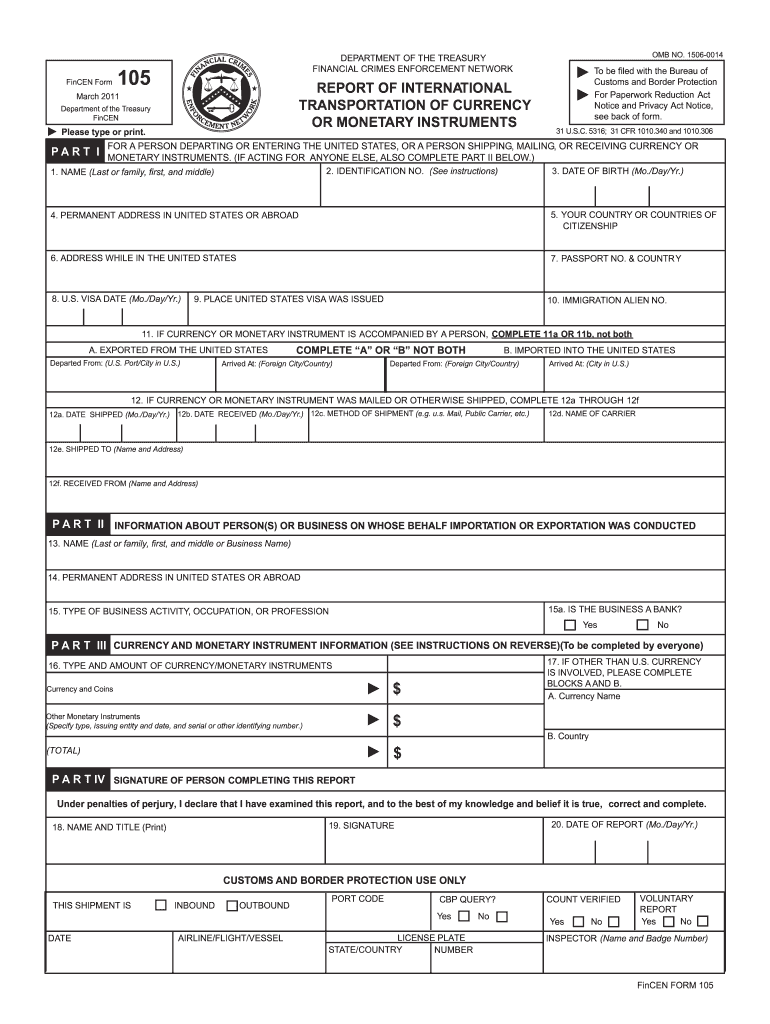

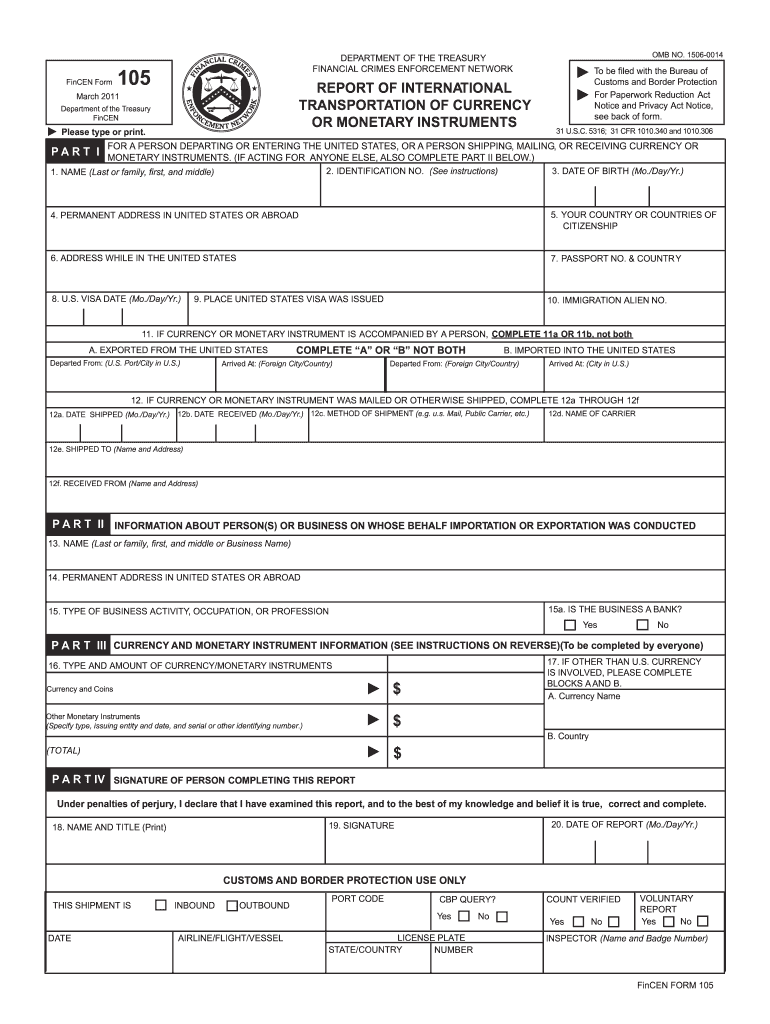

C. Travelers Travelers carrying currency or other monetary instruments with them shall file FinCEN Form 105 at the time of entry into the United States or at the time of departure from the United States with the Customs officer in charge at any Customs port of entry or departure. B. Shippers or Mailers lf the currency or other monetary instrument does not accompany the person entering or departing the United States FinCEN Form 105 may be filed by mail on or before the date of entry departure...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FinCen 105

Edit your FinCen 105 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FinCen 105 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FinCen 105 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FinCen 105. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FinCen 105 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FinCen 105

How to fill out FinCen 105

01

Obtain a copy of the FinCEN Form 105 from the FinCEN website.

02

Fill in your personal information in Part I (Name, address, date of birth).

03

Provide information about the financial institution that manages your funds in Part II.

04

Report the type of transaction you are conducting in Part III.

05

Include any applicable amounts in the designated fields.

06

Review your responses for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to FinCEN as per the instructions.

Who needs FinCen 105?

01

Individuals who are traveling outside of the United States with more than $10,000 in currency or monetary instruments.

02

U.S. persons involved in any international monetary transactions that require reporting to FinCEN.

03

Any entity that must declare currency transactions under the Bank Secrecy Act.

Fill

form

: Try Risk Free

People Also Ask about

How do I show proof of funds for customs?

Travelers visiting the United States from a foreign country must be able to prove to a U.S. Customs and Border Protection (CBP) officer that they have sufficient funds, i.e., credit card, cash, travelers' checks, money order to cover travel, lodging, entertainment, meals, etc. to be admitted into the United States.

How do I declare over $10000 customs?

There is no maximum limit, however, any amount exceeding $10,000 USD must be declared upon arrival on both the Form 6059B and FinCEN 105. All forms must be filled in completely and truthfully. The penalties for inaccurate declaration and non-compliance can be severe including heavy fines and/or confiscation of funds.

How do I declare money leaving the US online?

You may bring into or take out of the country, including by mail, as much money as you wish. However, if it is more than $10,000, you will need to report it to CBP. Use the online Fincen 105 currency reporting site or ask a CBP officer for the paper copy of the Currency Reporting Form (FinCen 105).

How do I submit FinCEN 105?

Each person who receives currency or other monetary instruments in the United States must file FinCEN Form 105, within 15 days after receipt of the currency or monetary instruments, with the Customs officer in charge at any port of entry or departure or by mail.

Does FinCEN 105 reported to IRS?

Money reported via FinCEN Form 105 is reported to the IRS to help cut down on money laundering.

What is the purpose of the FinCEN 105?

A FinCEN form 105 is filed to prevent Currency Seizures at the departure or arrival of the traveler.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my FinCen 105 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your FinCen 105 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find FinCen 105?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the FinCen 105. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in FinCen 105 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your FinCen 105, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is FinCen 105?

FinCen 105 is a form used to report certain transactions involving the transportation of currency or monetary instruments into or out of the United States.

Who is required to file FinCen 105?

Any individual or entity that physically transports, mails, or ships currency or monetary instruments in amounts exceeding $10,000 into or out of the United States is required to file FinCen 105.

How to fill out FinCen 105?

To fill out FinCen 105, individuals must provide details including the filer’s information, the amount and type of currency or monetary instruments being transported, the date of the transaction, and any relevant details about the transport.

What is the purpose of FinCen 105?

The purpose of FinCen 105 is to help the U.S. government monitor and regulate the movement of currency and monetary instruments to combat money laundering and other financial crimes.

What information must be reported on FinCen 105?

Information that must be reported on FinCen 105 includes the name and address of the person conducting the transaction, details of the transaction including amounts, the type of currency or instruments, and travel route details.

Fill out your FinCen 105 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FinCen 105 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.