CA FTB 3533 2011 free printable template

Show details

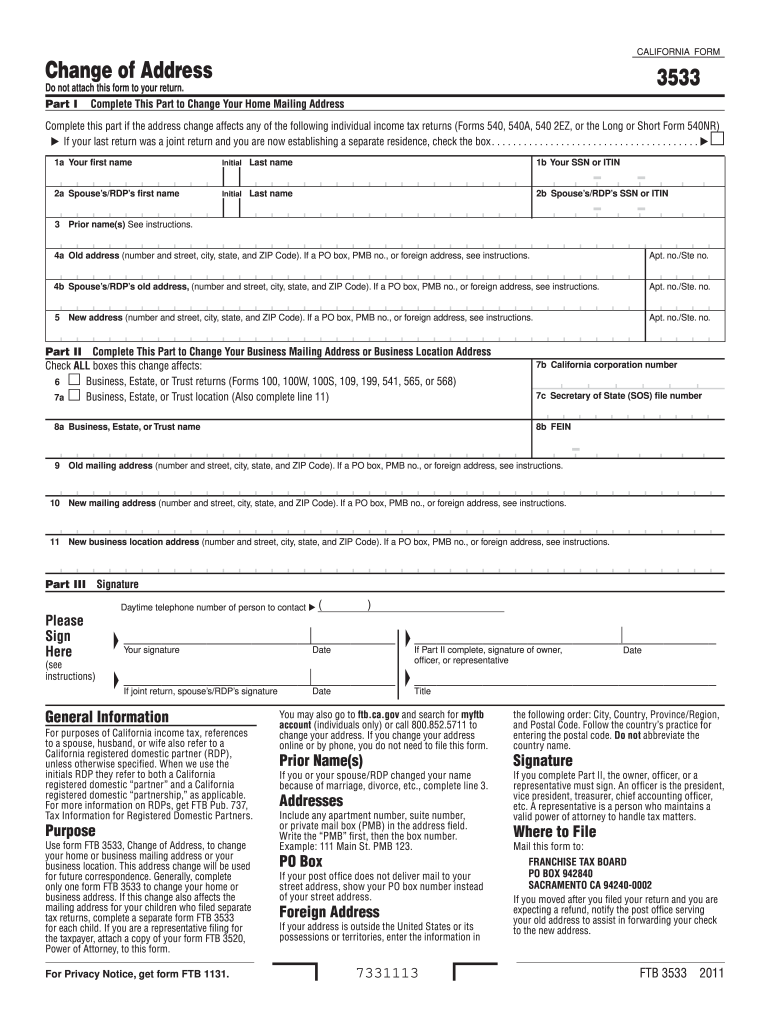

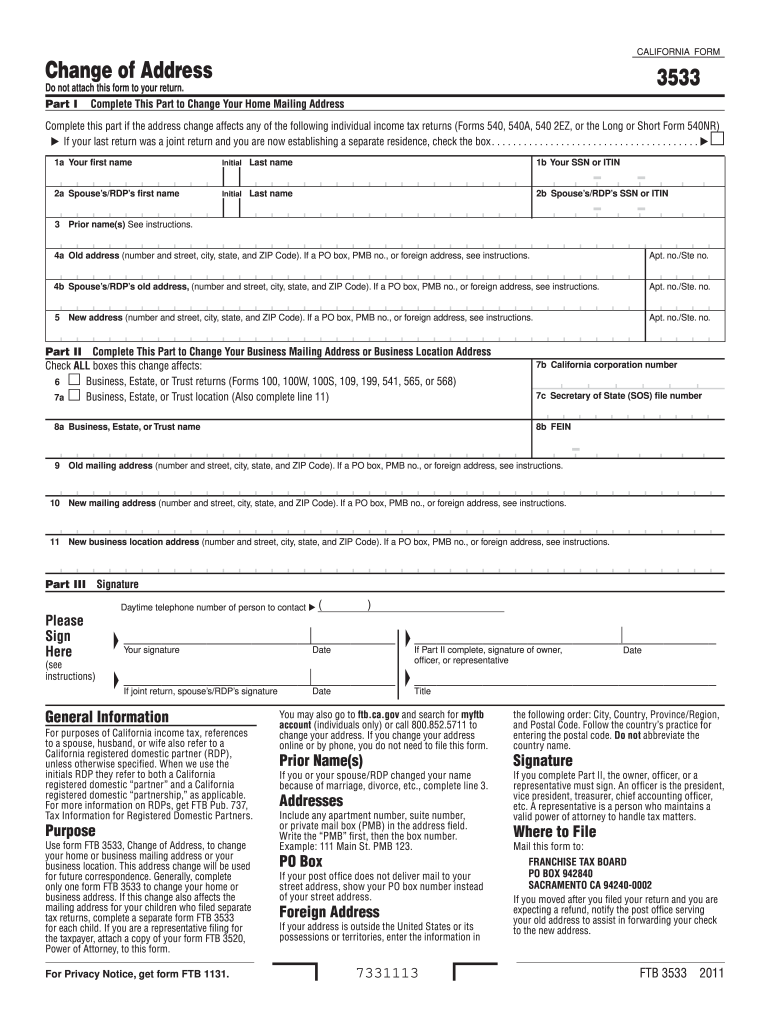

737 Tax Information for Registered Domestic Partners. Purpose Use form FTB 3533 Change of Address to change your home or business mailing address or your business location. This address change will be used for future correspondence. Generally complete only one form FTB 3533 to change your home or business address. If this change also affects the mailing address for your children who filed separate tax returns complete a separate form FTB 3533 for each child. Generally complete only one form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 3533

Edit your CA FTB 3533 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 3533 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 3533 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA FTB 3533. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 3533 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 3533

How to fill out CA FTB 3533

01

Obtain the CA FTB 3533 form from the California Franchise Tax Board website or your nearest FTB office.

02

Start by filling in your personal information, including your name, address, and social security number or taxpayer identification number.

03

Indicate the tax year for which you are filing the form.

04

Provide details of any tax credits you are claiming, if applicable.

05

Complete any required sections regarding your income or deductions as necessary.

06

Review the completed form to ensure all information is accurate and complete.

07

Sign and date the form before submission.

08

Submit the form by the due date through the specified submission method (online or by mail).

Who needs CA FTB 3533?

01

Individuals who have overpaid their California state taxes and wish to claim a refund.

02

Taxpayers who need to report changes in tax credits or income that affect their tax situation in California.

03

Any person who has an adjustment to make in relation to their California tax filings for the specified tax year.

Fill

form

: Try Risk Free

People Also Ask about

How do I change my address on my California stimulus?

By calling 1-800-829-1040 from 7 a.m. to 7 p.m. local time. By filing Form 8822, Change of Address. By using your new address on your next tax return.

How do I change my address with the California Secretary of State?

You can also submit a change of address by submitting a signed written request by mail or fax at (916) 653-7625 that includes: your old and new address, your new telephone numbers, your Safe at Home four-digit Authorization ID number, the effective date of the change, your name, and your signature.

How do I submit a ca power of attorney?

To establish a power of attorney relationship, you must fill out and submit the correct FTB form. Choose the correct form. Fill out the form correctly. Sign the form. Provide supporting documentation, if necessary, such as: Submit the form. After you submit.

Do I need to amend my California tax return?

If you discover an error on a previously filed return, you should file an amended return and pay any additional tax or fee due, including interest. If you have questions, please contact our Customer Service Center at 1-800-400-7115. For assistance in calculating the interest due use the Interest Rate Calculator.

How do I report a change of address to FTB?

Online Login to MyFTB. Select “Profile” from the tool bar. Choose “Update contact information” View your account information. Select the “Edit address” link and enter your new address. Select the “Save” button.

How do I get in contact with the tax Franchise Board?

How do you speak to a live person at the California Franchise Tax Board? The California Franchise Tax Board telephone number is 1-888-635-0494.

How to paper file California state tax return?

File by paper U.S. Postal Service. If you would like to file a paper tax return by mail, you'll need to download and print our forms and instructions . To find out what form you need to use, visit our file page and select your filing situation . Your return must be postmarked by the extended due date to be timely.

When can I amend my California tax return?

You can generally amend a return up to three years from the date the original return was filed (or up to two years after the tax was paid, whichever is later).

How do I change my address for my taxes?

To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party — Business and send them to the address shown on the forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA FTB 3533 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your CA FTB 3533 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send CA FTB 3533 for eSignature?

To distribute your CA FTB 3533, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out CA FTB 3533 using my mobile device?

Use the pdfFiller mobile app to fill out and sign CA FTB 3533 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is CA FTB 3533?

CA FTB 3533 is a California Tax Form used to claim a tax credit for contributions to the California College Access Tax Credit Fund.

Who is required to file CA FTB 3533?

Individuals and entities that wish to claim the California College Access Tax Credit must file CA FTB 3533.

How to fill out CA FTB 3533?

To fill out CA FTB 3533, taxpayers need to provide their personal information, details of the contribution made to the College Access Tax Credit Fund, and any additional required information as specified in the instructions.

What is the purpose of CA FTB 3533?

The purpose of CA FTB 3533 is to facilitate the claiming of tax credits for donations made to promote college access for low-income Californians.

What information must be reported on CA FTB 3533?

CA FTB 3533 requires reporting of the contributor's name, taxpayer identification number, the amount of the contribution, and any other relevant details as outlined in the form instructions.

Fill out your CA FTB 3533 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 3533 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.