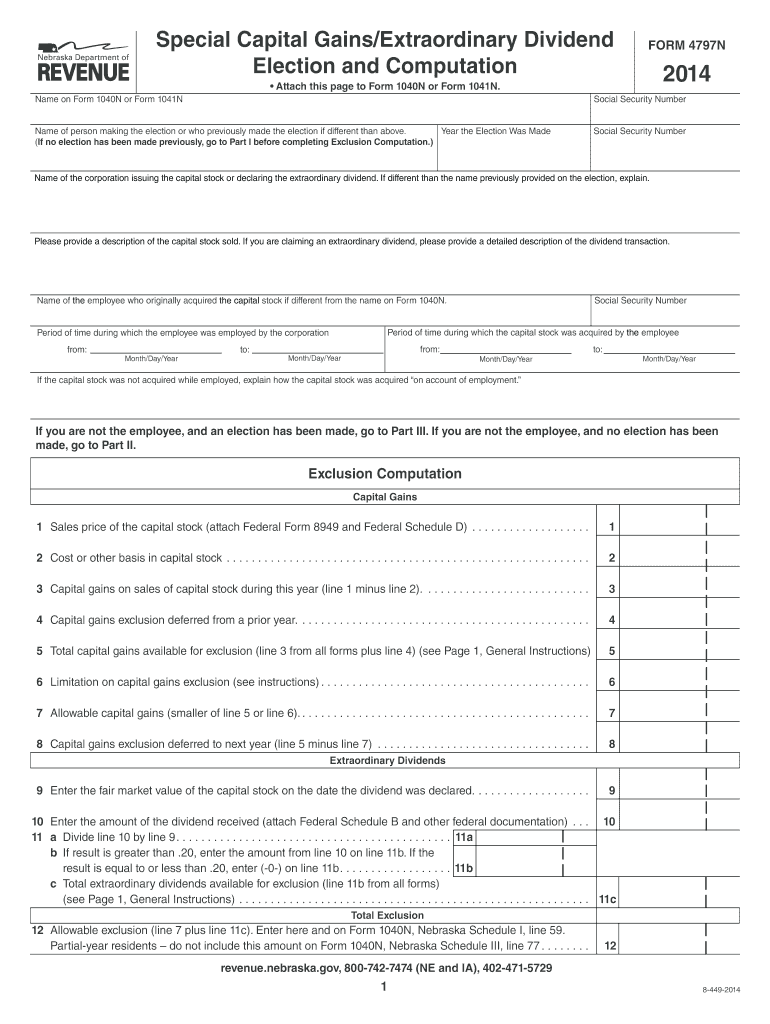

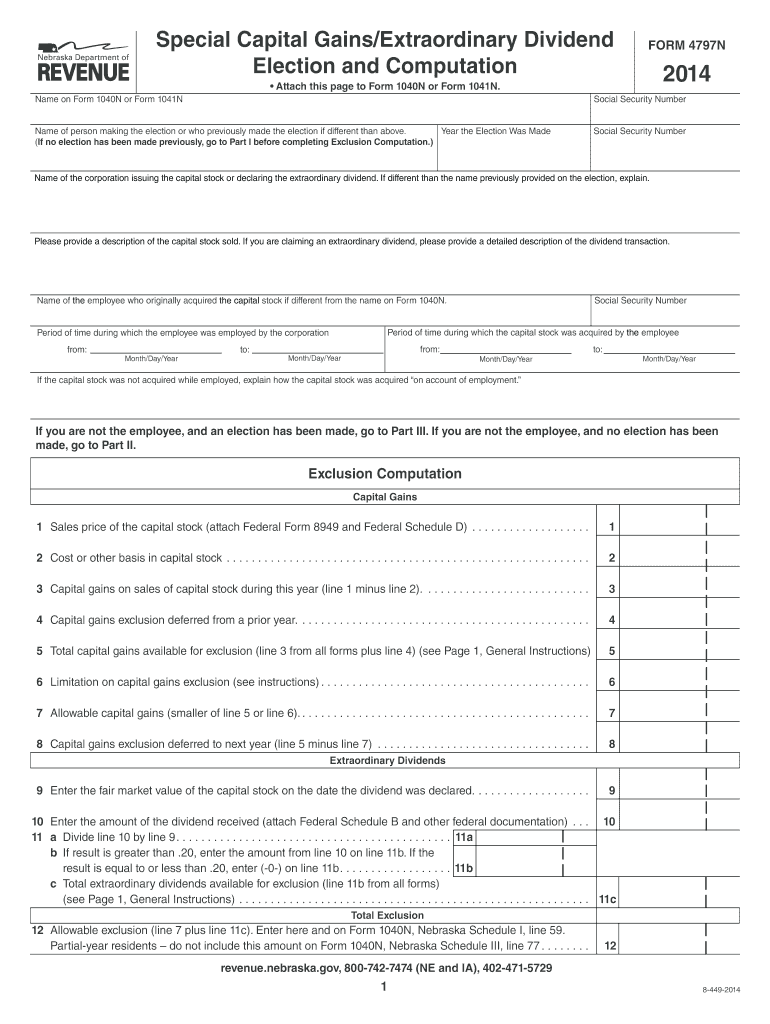

Get the free Special Capital Gains/Extraordinary Dividend Election and ...

Show details

Revenue.Nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729 .... also applies to the capital stock of a corporation that was a party to a tax-free reorganization ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign special capital gainsextraordinary dividend

Edit your special capital gainsextraordinary dividend form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your special capital gainsextraordinary dividend form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit special capital gainsextraordinary dividend online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit special capital gainsextraordinary dividend. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out special capital gainsextraordinary dividend

How to fill out special capital gainsextraordinary dividend:

01

Gather all the necessary documentation, such as investment statements, stock transaction records, and dividend income statements.

02

Begin by accurately reporting your capital gains and dividend income on your tax return. Make sure to include any gains or dividends that fall under the special capital gainsextraordinary dividend category.

03

Double-check the current tax laws and regulations to ensure that you are correctly reporting and calculating the special capital gainsextraordinary dividend. This may involve consulting a tax professional or referring to the IRS guidelines.

04

Fill out the appropriate sections on your tax form dedicated to reporting special capital gainsextraordinary dividend. Follow the instructions provided by the tax form and pay attention to specific line items or codes that correspond to this type of income.

05

Review your filled-out tax form for any errors or omissions before submitting it. Ensure that all information is accurate and properly recorded to avoid any potential audits or penalties.

Who needs special capital gainsextraordinary dividend?

01

Investors who have received capital gains from selling certain assets, such as stocks, bonds, or real estate, and want to report those gains on their tax return. These capital gains may qualify as special capital gainsextraordinary dividend if they meet the specific criteria defined by the tax laws.

02

Individuals or businesses who have received extraordinary dividends from their investments or holdings, which exceed the normal or expected dividend payments. These extraordinary dividends may be subject to different tax treatments and reporting requirements compared to regular dividends.

03

Taxpayers who have engaged in complex investment strategies or transactions that involve special capital gainsextraordinary dividend and want to ensure compliance with the tax regulations while maximizing tax benefits or minimizing tax liabilities. It is advisable in such cases to consult a tax professional for proper guidance and assistance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify special capital gainsextraordinary dividend without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your special capital gainsextraordinary dividend into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send special capital gainsextraordinary dividend for eSignature?

When you're ready to share your special capital gainsextraordinary dividend, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit special capital gainsextraordinary dividend on an iOS device?

You certainly can. You can quickly edit, distribute, and sign special capital gainsextraordinary dividend on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is special capital gainsextraordinary dividend?

Special capital gains are profits that result from the sale of certain types of assets, such as stocks or real estate. Extraordinary dividends are distributions made by a company that are larger than the regular dividends typically paid out.

Who is required to file special capital gainsextraordinary dividend?

Individuals or entities who have realized special capital gains or received extraordinary dividends during the tax year are required to report them on their tax return.

How to fill out special capital gainsextraordinary dividend?

To fill out special capital gains or extraordinary dividends, taxpayers must accurately report the amount of the gain or dividend on the appropriate tax forms, such as Schedule D for capital gains or Form 1099-DIV for dividends.

What is the purpose of special capital gainsextraordinary dividend?

The purpose of reporting special capital gains and extraordinary dividends is to ensure that taxpayers are accurately reporting their income and paying the appropriate amount of taxes on these types of earnings.

What information must be reported on special capital gainsextraordinary dividend?

Taxpayers must report the amount of the special capital gains or extraordinary dividends they have received, as well as any relevant information about the assets or companies from which they were derived.

Fill out your special capital gainsextraordinary dividend online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Special Capital Gainsextraordinary Dividend is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.