Get the free pdffiller

Show details

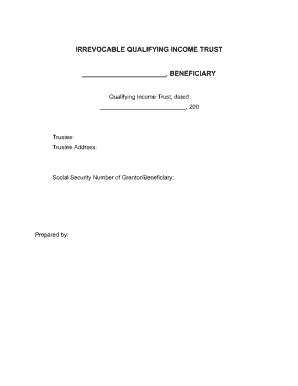

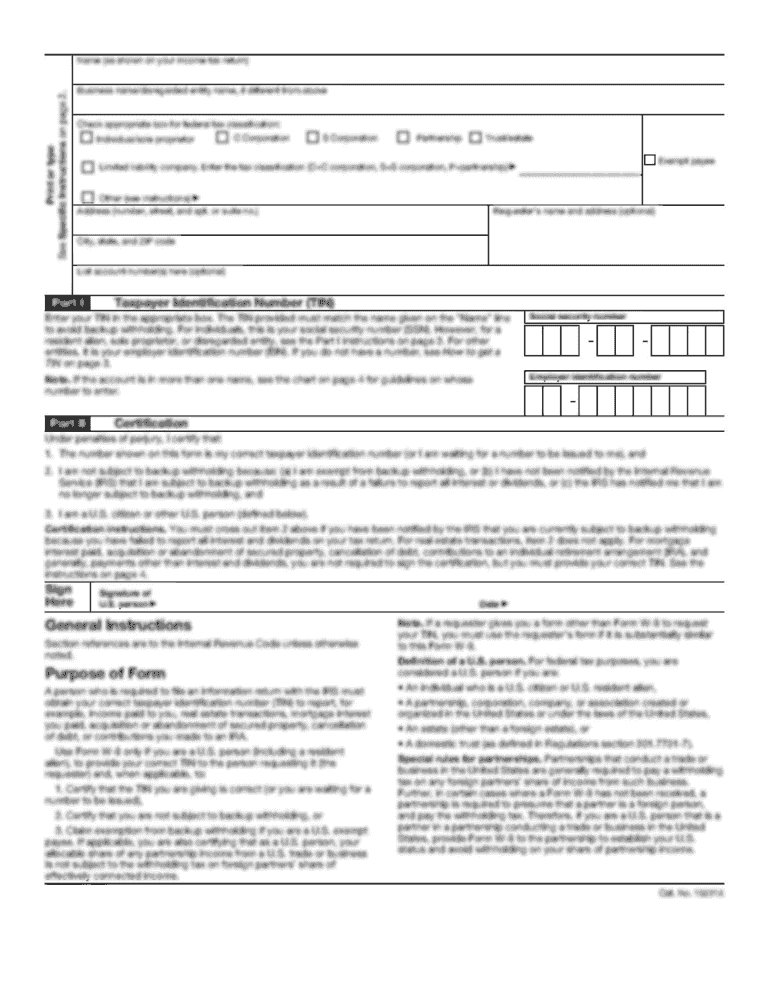

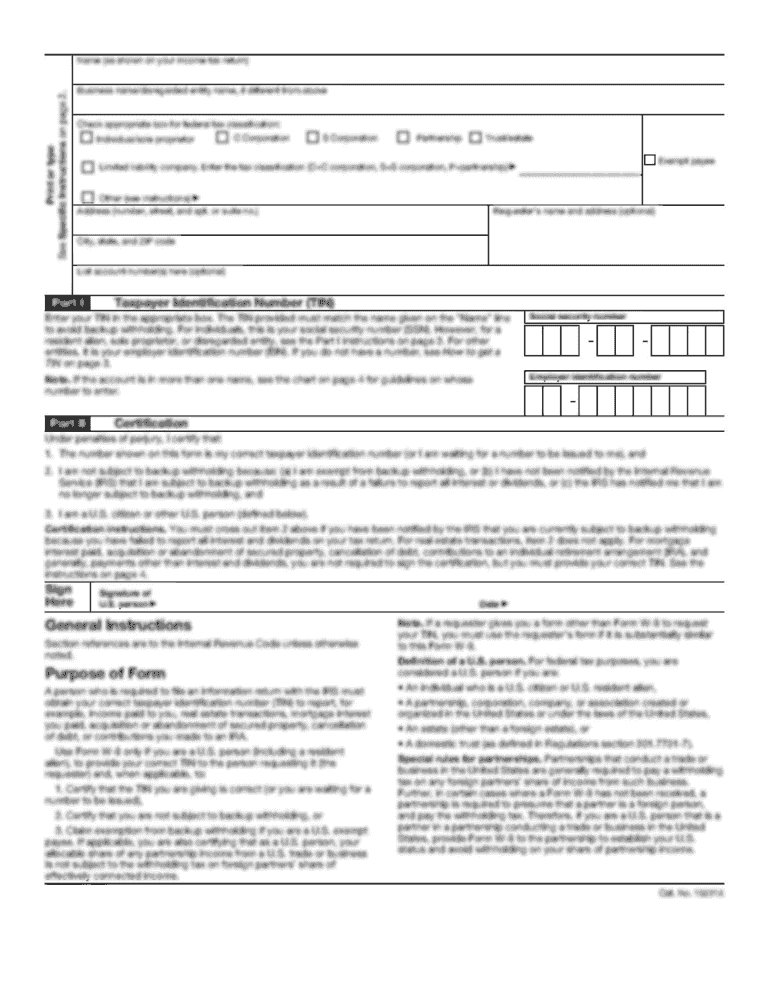

This document serves as a guide for individuals seeking to establish a Qualifying Income Trust to qualify for Medicaid eligibility when their income exceeds the limit. It provides step-by-step instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign miller trust indiana form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdffiller form online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pdffiller form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out Indiana Miller Trust:

01

Gather the necessary documents, which may include the trust agreement, the individual's financial information, and any relevant legal documents.

02

Determine the purpose and goals of the trust, such as protecting assets or managing funds for a disabled individual.

03

Consult with an experienced attorney specializing in estate planning or elder law to ensure a proper understanding of the legal requirements and implications.

04

Review and modify the trust agreement as necessary to reflect the individual's specific needs and circumstances.

05

Follow all legal and procedural requirements when signing and executing the trust agreement, which may involve notarization or witnessing by qualified individuals.

06

Fund the trust with the appropriate assets, which may include bank accounts, real estate, investments, or other valuable property.

07

Regularly review and update the trust as needed to account for any changes in the individual's financial situation or personal circumstances.

Who needs Indiana Miller Trust?

01

Individuals who want to protect their assets while managing funds for a disabled beneficiary.

02

Individuals who want to ensure that their assets are distributed according to their wishes after their passing.

03

Individuals who want to minimize the potential impact of estate taxes on their assets.

04

Individuals who want to provide financial support and assistance to loved ones with special needs or disabilities.

05

Individuals who want to have control over how their assets are managed and distributed in the event of their incapacity or death.

06

Individuals who want to avoid the probate process and maintain privacy with regard to their financial affairs.

Fill

form

: Try Risk Free

People Also Ask about

What assets are exempt from Medicaid in Indiana?

There are also many assets that are considered exempt (non-countable). Exemptions include personal belongings, household furnishings, an automobile, irrevocable burial trusts, a non-applicant spouse's IRA / 401K, and generally one's primary home.

What assets are protected in Indiana?

Assets that are protected include such items as cash, savings and checking account money, IRA's, certificates of deposit, and real property. Income such as social security and a monthly pension check is not protected.

What is another name for Miller trust?

Miller Trusts are called by a variety of names and include the following: Qualifying Income Trusts, QITs, Income Diversion Trusts, Income Cap Trusts, Irrevocable Income Trusts, Income Trusts, d4B trusts, and Income Only Trusts. These names are often state specific.

What expenses can be paid from a Miller trust in Texas?

Every month, the Trustee of the Miller Trust will make certain distributions: Personal Needs Allowance. Under current law, the personal needs allowance is $60. Spousal Maintenance. If the beneficiary has a spouse, the trustee can distribute a monthly maintenance needs allowance to the spouse. Medical Payments.

What assets can you keep when you go on Medicare?

As of July 1, 2022, you may have up to $130,000 in assets as an individual, up to $195,000 in assets as a couple, and an additional $65,000 for each family member. These asset levels are for all the programs listed below except Supplemental Security Income (SSI).

What is a Miller trust in Indiana?

based services whose income may exceed the Medicaid eligibility limit. Such individuals may. need to establish a Qualifying Income Trust, also known as a Miller trust, in order to be eligible. for Medicaid coverage for the aforementioned services.

Which of the following is not a Medicaid exempt asset?

Household goods and personal effects are resources that are not counted (are excluded) for the purpose of determining Medicaid eligibility. Personal effects include, but are not limited to, clothing, jewelry, items of personal care, recreational equipment, musical instruments and hobby items.

Can I sell my house and still qualify for Medicaid?

Selling your house could disqualify you from receiving Medicaid if the profits from the sale bring your assets over your state's Medicaid asset threshold. However, if your total countable assets stay below your state's threshold, which is just $2,000 in most states, you can still qualify for Medicaid.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in pdffiller form without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing pdffiller form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an eSignature for the pdffiller form in Gmail?

Create your eSignature using pdfFiller and then eSign your pdffiller form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit pdffiller form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute pdffiller form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is indiana miller trust?

An Indiana Miller Trust is a type of trust used in Indiana to allow individuals to qualify for Medicaid while having a higher income.

Who is required to file indiana miller trust?

Individuals who have excess income that exceeds the Medicaid eligibility limit and wish to qualify for Medicaid assistance are required to file an Indiana Miller Trust.

How to fill out indiana miller trust?

To fill out an Indiana Miller Trust, you must complete the trust document by providing the necessary information such as the names of the trust beneficiaries, the income sources, and the trustee's details, and it must be signed and notarized.

What is the purpose of indiana miller trust?

The purpose of an Indiana Miller Trust is to allow individuals with incomes above the Medicaid limit to still qualify for Medicaid benefits by redirecting excess income into the trust.

What information must be reported on indiana miller trust?

Information that must be reported on an Indiana Miller Trust includes the income to be deposited into the trust, the beneficiaries of the trust, details of the trustee, and any specific terms and conditions of the trust.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.