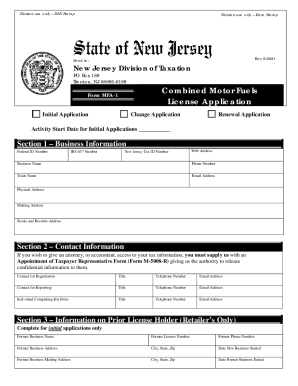

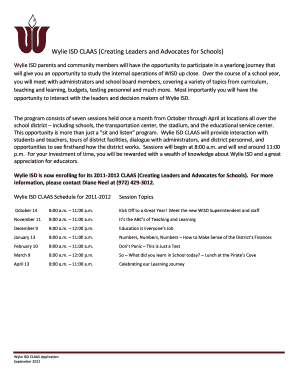

NJ DoT MFA-1 2010 free printable template

Show details

The applicant agrees to provide accurate and timely reports and to make timely payments. Inaccurate or incomplete information in any section is cause for denial of the requests made in Section 15 or 16 and/or the denial of the entire application. New Jersey Form MFA-1 Instructions Complete all appropriate sections and remit this to State of New Jersey LMF to Be sure to check whether this is an Initial Change or changes of Address Activity etc check Change. Failure to provide all required...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ DoT MFA-1

Edit your NJ DoT MFA-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ DoT MFA-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ DoT MFA-1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NJ DoT MFA-1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT MFA-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ DoT MFA-1

How to fill out NJ DoT MFA-1

01

Obtain the NJ DoT MFA-1 form from the NJ Department of Transportation website or local office.

02

Fill in the required personal information, including name, address, and contact details.

03

Provide your vehicle information, including make, model, year, and VIN.

04

Indicate the purpose of the form and any relevant details pertaining to your request.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form as required.

07

Submit the form in accordance with the instructions provided, either in person or via mail.

Who needs NJ DoT MFA-1?

01

Individuals applying for financial assistance related to vehicle repairs or modifications.

02

New Jersey residents seeking to qualify for specific transportation-related programs or services.

Fill

form

: Try Risk Free

People Also Ask about

What is New Jersey's fuel tax and what does it support?

New Jersey's gas tax is a mixture of a fluctuating petroleum products gross receipts tax and a static motor fuels tax. The latter is set at 10.5 cents for gasoline and 13.5 cents for diesel fuel. The gas tax last year fell by 8.3 cents after rising 9.3 cents the year before.

How do I get my tax refund from motor fuels in New Jersey?

In order for a refund claim to be timely it must be postmarked within six (6) months of the payment of tax. Refund claim forms may be obtained by writing to the New Jersey Division of Taxation, Motor Fuels Group, Office Audit, 50 Barrack Street, Trenton, New Jersey 08646.

What is the fuel tax in New Jersey?

Under the formula explicitly outlined in the 2016 law, the PPGR tax rate will decrease on October 1, 2022 from 31.9 cents to 30.9 cents for gasoline and from 35.9 cents to 34.9 cents for diesel fuel.

How much tax is in a gallon of gas in NJ?

Under the formula explicitly outlined in the 2016 law, the PPGR tax rate will decrease on October 1, 2022 from 31.9 cents to 30.9 cents for gasoline and from 35.9 cents to 34.9 cents for diesel fuel.

How much is the application fee for motor fuel retail dealer license in New Jersey?

Retailer of Motor Fuels An Application Fee of $150 is due for a 3-year license. You must file a separate MFA-1 for each retail establishment. 1. You engage in the business of selling or dispensing motor fuel to the consumers in this state.

What is the gas tax in New Jersey?

Under the formula explicitly outlined in the 2016 law, the PPGR tax rate will decrease on October 1, 2022 from 31.9 cents to 30.9 cents for gasoline and from 35.9 cents to 34.9 cents for diesel fuel.

Which state has highest gas tax?

Fact: In 2023, state gas tax rates averaged 30 cents per gallon. Rates were lowest in Alaska (9 cents) and Hawaii (16 cents), and highest in Pennsylvania (58 cents) and California (63 cents).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NJ DoT MFA-1 for eSignature?

When your NJ DoT MFA-1 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get NJ DoT MFA-1?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific NJ DoT MFA-1 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out NJ DoT MFA-1 on an Android device?

Complete NJ DoT MFA-1 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is NJ DoT MFA-1?

NJ DoT MFA-1 is a form used by the New Jersey Department of Transportation to report motor fuel tax information.

Who is required to file NJ DoT MFA-1?

Entities involved in the distribution or sale of motor fuel in New Jersey are required to file NJ DoT MFA-1.

How to fill out NJ DoT MFA-1?

To fill out NJ DoT MFA-1, you need to provide information such as your business details, fuel types sold or distributed, and the total gallons sold during the reporting period.

What is the purpose of NJ DoT MFA-1?

The purpose of NJ DoT MFA-1 is to ensure compliance with state fuel tax regulations and to report the volume of fuel sold or distributed.

What information must be reported on NJ DoT MFA-1?

Information that must be reported on NJ DoT MFA-1 includes the name and address of the filer, fuel types, total gallons sold, and applicable tax amounts.

Fill out your NJ DoT MFA-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ DoT MFA-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.