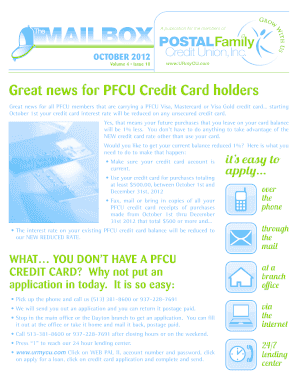

DC Federal Reserve Board H-4 2011-2025 free printable template

Show details

Jan 12, 2011 ... http://www.ftc.gov/ BCP/online/include/requestformfina.pd)) to: ... Federal Reserve Board×39’s website at www.federalreserve.gov, or the Federal ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DC Federal Reserve Board H-4

Edit your DC Federal Reserve Board H-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DC Federal Reserve Board H-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing DC Federal Reserve Board H-4 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit DC Federal Reserve Board H-4. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

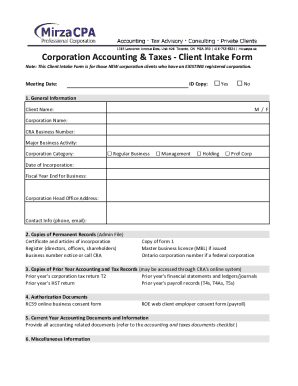

How to fill out DC Federal Reserve Board H-4

How to fill out DC Federal Reserve Board H-4

01

Obtain the DC Federal Reserve Board H-4 form.

02

Fill out the applicant's personal information, including name, address, and contact details.

03

Specify the type of activity or business related to the application.

04

Provide relevant financial information, if applicable, such as income sources or assets.

05

Include any necessary supporting documentation as specified in the instructions.

06

Review all entered information for accuracy.

07

Sign and date the application where required.

08

Submit the completed form to the appropriate federal reserve board office.

Who needs DC Federal Reserve Board H-4?

01

Individuals or entities applying for specific regulatory approvals or licenses from the DC Federal Reserve Board.

02

Financial institutions seeking to establish new accounts or services under federal regulations.

03

Business applicants requiring federal oversight in their operations.

Fill

form

: Try Risk Free

People Also Ask about

What is the FCRA credit score disclosure?

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

When must the credit score disclosure be provided?

The notice described in paragraph (f)(1)(iii) of this section must be provided to the consumer as soon as reasonably practicable after the person has requested the credit score, but in any event not later than consummation of a transaction in the case of closed-end credit or when the first transaction is made under an

When must a bank provide a risk-based pricing notice in a closed end credit transaction?

Under section 615(h) of the FCRA, a person generally must provide a risk-based pricing notice to a consumer when the person uses a consumer report in connection with an extension of credit and, based in whole or in part on the consumer report, extends credit to the consumer on terms materially less favorable than the

What is included on a credit score disclosure?

In short, this is a disclosures that includes things like the credit score of the applicant, the range of possible scores, key factors that adversely affected the credit score, the date of the score, and the name of the person or entity that provided the score.

What does RBP mean on credit report?

The Risk-Based Pricing (RPB) Rule was approved last year by the Federal Reserve in an effort to addresses a concern that consumers are not sufficiently informed of the impact their credit reports can have on the price of new credit.

What is the meaning of risk-based pricing?

Risk-based pricing occurs when lenders offer different consumers different interest rates or other loan terms, based on the estimated risk that the consumers will fail to pay back their loans.

What is a risk based pricing notice?

Risk-based pricing occurs when lenders offer different interest rates and loan terms to borrowers, based on individual creditworthiness. The Risk-Based Pricing Rule requires you to notify consumers if they are getting worse terms because of information in their credit report.

What is a credit score disclosure notice?

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

What does exception mean in court?

763. In contracts, statutes, and deeds,an exception is a statement that something is not included, as in "Landlord rents to Tenant the first floor, with the exception of the storage room.” To "take exception" to a judge's ruling, is a way a lawyer might tell a judge that they disagree.

What is a credit disclosure?

A credit card disclosure is a document that outlines all of the fees, costs, interest rates, and terms that a customer could experience while using the credit card. Institutions that offer credit cards are required by law to disclose this information.

What is Notice of Exception mean?

Notices of exceptions are used in various legal settings, but generally are used to register a formal objection to a proposed action.

Is a credit score disclosure required?

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) required institutions to disclose to bank customers and applicants a credit score and information related to that score if used as part of an adverse action decision.

What is a credit score disclosure exception notice?

The credit score exception notice (model forms H-3, H-4, H-5) is a disclosure that is provided in lieu of the risk-based-pricing notice (RBPN, which are H-1, H-2, H-6 & H-7). The RBPN is required any time a financial institution provides different rates based on the credit score of the applicant.

What is a credit score disclosure exception?

The credit score exception notice (model forms H-3, H-4, H-5) is a disclosure that is provided in lieu of the risk-based-pricing notice (RBPN, which are H-1, H-2, H-6 & H-7). The RBPN is required any time a financial institution provides different rates based on the credit score of the applicant.

What is an exception notice?

An exception occurs when a package or shipment encounters an unforeseen event, which could result in a change to the expected delivery day. Examples of exception include: address unknown, damage to shipment, or signature not received.

Why did I get a credit score disclosure?

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my DC Federal Reserve Board H-4 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your DC Federal Reserve Board H-4 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit DC Federal Reserve Board H-4 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing DC Federal Reserve Board H-4.

How can I fill out DC Federal Reserve Board H-4 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your DC Federal Reserve Board H-4. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

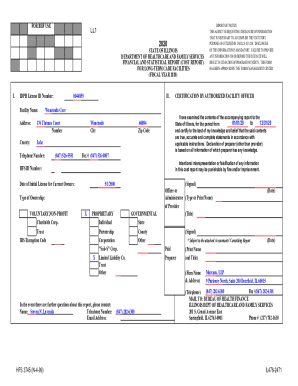

What is DC Federal Reserve Board H-4?

The DC Federal Reserve Board H-4 is a reporting form used by financial institutions to collect and report data related to their activities and finances. It is part of the regulatory framework for monitoring the health and behavior of financial entities.

Who is required to file DC Federal Reserve Board H-4?

Financial institutions that meet certain criteria set by the Federal Reserve are required to file the DC Federal Reserve Board H-4 to ensure compliance with regulatory standards.

How to fill out DC Federal Reserve Board H-4?

To fill out the DC Federal Reserve Board H-4, an institution must gather the relevant financial data, complete the form according to the guidelines provided by the Federal Reserve, and submit it by the specified deadline.

What is the purpose of DC Federal Reserve Board H-4?

The purpose of the DC Federal Reserve Board H-4 is to provide the Federal Reserve with comprehensive information about the financial performance and stability of reporting institutions, which aids in regulatory oversight.

What information must be reported on DC Federal Reserve Board H-4?

Entities must report a range of information, including balance sheet data, income statement figures, and other relevant financial metrics that accurately reflect their operational status and compliance with regulations.

Fill out your DC Federal Reserve Board H-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DC Federal Reserve Board H-4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.