Who Needs Notice to Cosigner and Guarantor?

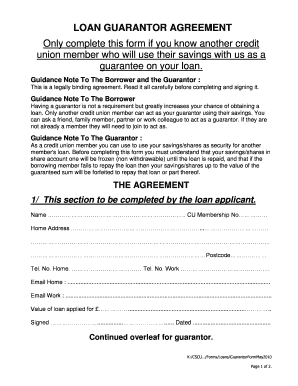

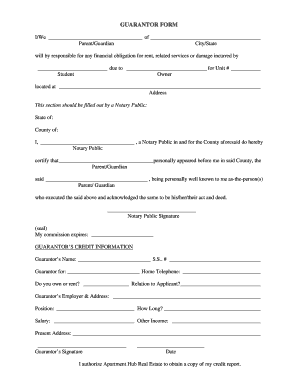

Generally, notice to cosigner and guarantor is a document that is often used when taking loan from banks or other financial institutions. It is filled out by the cosigner or guarantor. This is an individual who agrees to take responsibility for repaying the loan if the borrower can’t do it.

What is Notice to Cosigner and Guarantor for?

With the notice to cosigner a person is informed about the circumstances of not paying the debt by the primary borrower. A cosigner is also notified about the fact that a creditor can collect debt from the cosigner without trying to collect it from the primary borrower. By signing this notice a person acknowledges the receipt of it. The notice doesn’t obligate a person on the debt.

Is Notice to Cosigner and Guarantor Accompanied by Other Forms?

Notice to cosigner is accompanied by the loan agreement, so a person may revise it.

When is Notice to Cosigner and Guarantor due?

There is no specific due date for this notice. It is sent and filled out when it is needed.

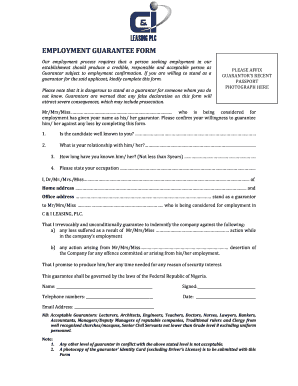

How Do I Fill out Notice to Cosigner and Guarantor?

Notice is a very brief form. It contains one page with several fillable fields. There are fields for loan obligation description. They’re filled out by the institution that approves this notice. The notice also contains lender’s identifying information and the date when the agreement was signed. A cosigner is just required to acknowledge this notice, sign it and date it.

Where Do I Send Notice to Cosigner and Guarantor?

One copy of this document is sent to the lender while another copy is kept by the cosigner for the records.