Get the free CHAPTER 32-09.1 - legis nd

Show details

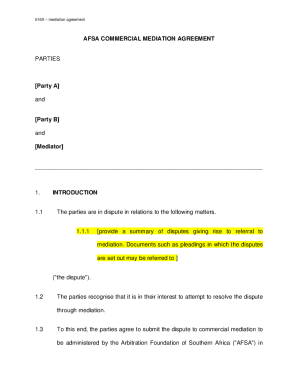

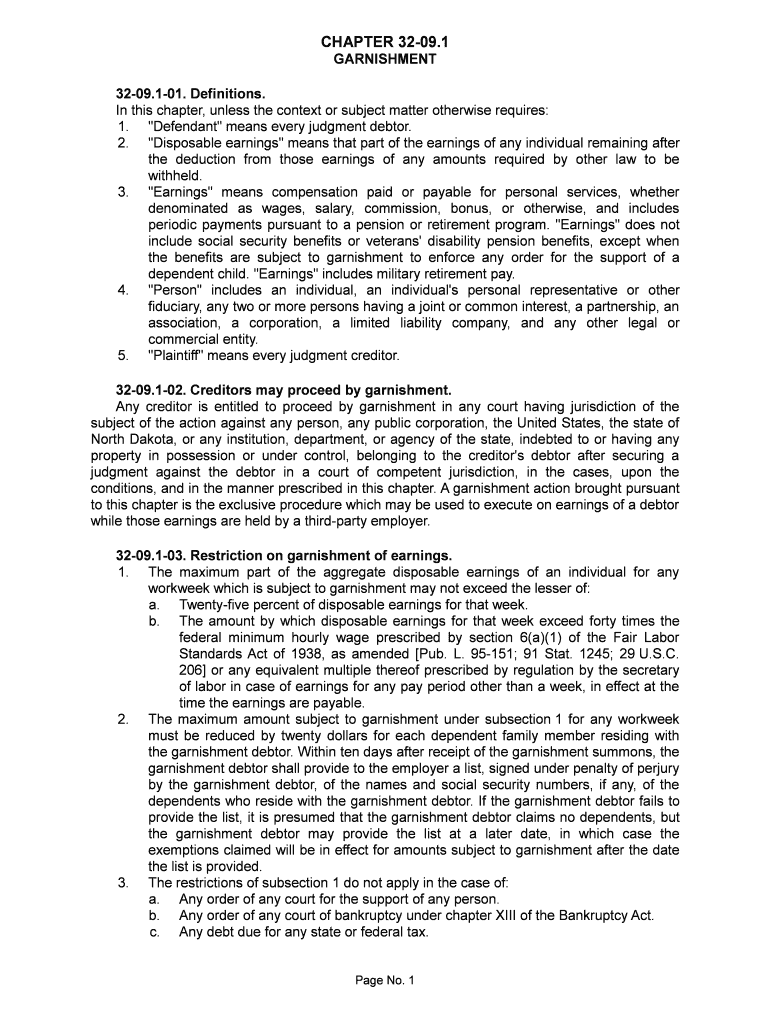

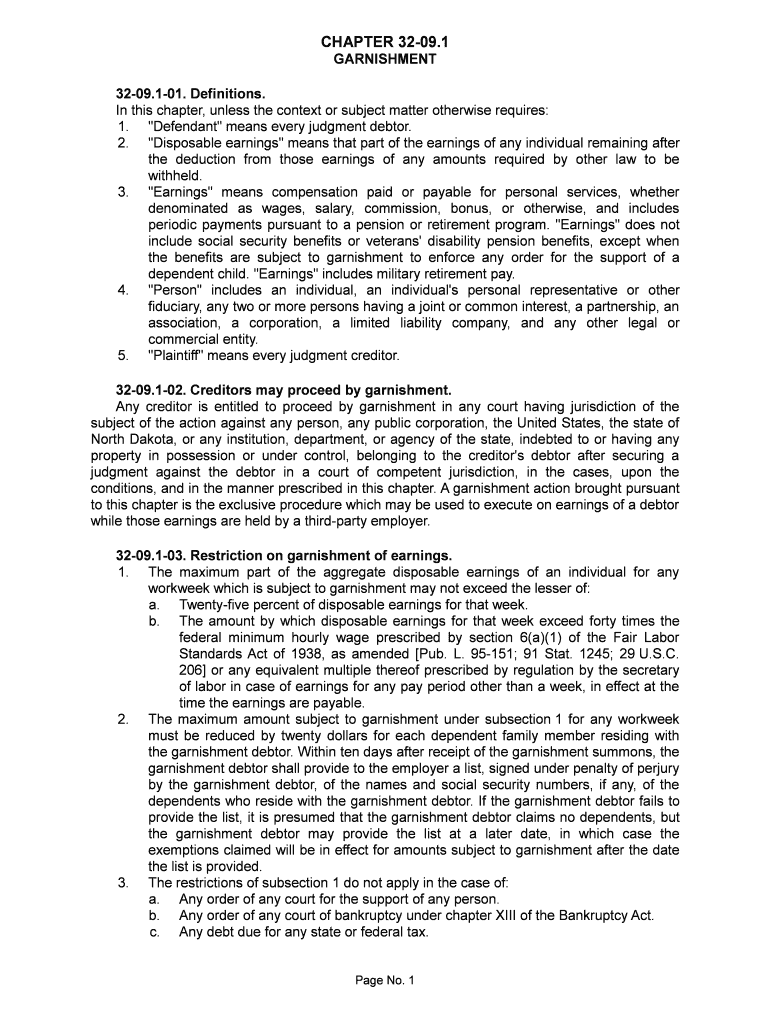

This chapter outlines the definitions and procedures related to garnishment, including the rights of creditors to garnish wages, restrictions on garnishment amounts, and the obligations of both the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 32-091 - legis

Edit your chapter 32-091 - legis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 32-091 - legis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 32-091 - legis online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit chapter 32-091 - legis. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 32-091 - legis

How to fill out CHAPTER 32-09.1

01

Begin by downloading the CHAPTER 32-09.1 form from the official website.

02

Read the instructions carefully to understand the purpose of each section.

03

Fill out your personal information in the designated fields, including your name, address, and contact information.

04

Provide any required identification numbers, such as Social Security or Tax ID numbers.

05

Complete the specific sections relevant to your application or request, following the guidelines provided.

06

Review the filled form for any errors or missing information before submission.

07

Sign and date the form as required.

08

Submit the form by the specified method, such as mail or online, according to the instructions.

Who needs CHAPTER 32-09.1?

01

Individuals applying for benefits or services outlined in CHAPTER 32-09.1.

02

Organizations or entities seeking compliance with regulations associated with CHAPTER 32-09.1.

03

Any stakeholders affected by the policies established in CHAPTER 32-09.1.

Fill

form

: Try Risk Free

People Also Ask about

What are the garnishment laws in North Dakota?

North Dakota Wage Garnishment Rules Except for a child or spousal support order, bankruptcy order, or tax levy, the maximum that employers can withhold is the lesser of? 25% of disposable earnings or the amount by which weekly disposable earnings exceed 40 times the federal minimum wage.

How long is a judgment good for in North Dakota?

How Long Can a Judgment Creditor Collect a Judgment? Money awarded as part of a Judgment may be collected using North Dakota's judgment collection options. Judgments entered on or after August 1, 2023, may be collected for 20 years (NDCC Section 28-21-01).

How much can they garnish your wages in North Dakota?

32-09.1-03. The maximum part of the aggregate disposable earnings of an individual for any workweek which is subject to garnishment may not exceed the lesser of: a. Twenty-five percent of disposable earnings for that week.

Why did I get a writ of garnishment?

To garnish is to take property – most often a portion of someone's wages – by legal authority. Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money).

How long does it take for a judgement to fall off?

Let's Summarize… If you don't pay a debt you owe, a creditor or debt collector can sue you. If they win the case they'll get a court judgment, which gives them access to serious debt collection methods like wage garnishment. In most states, judgments last for 5–10 years, but in some states the time frame is longer.

What is a continuing writ of garnishment?

A writ of continuing garnishment serves as a lien and continuing levy against the nonexempt earnings of the judgment debtor, until such time earnings are no longer due; the underlying judgment is vacated, modified or satisfied in full; or the writ is dismissed.

How long before a debt becomes uncollectible in North Dakota?

Statutes of Limitations for Each State (In Number of Years) StateWritten contractsOral contracts North Dakota 6 6 Ohio 6 4 Oklahoma 5 3 Oregon 6 647 more rows

How long are judgments good for in North Dakota?

How Long Can a Judgment Creditor Collect a Judgment? Money awarded as part of a Judgment may be collected using North Dakota's judgment collection options. Judgments entered on or after August 1, 2023, may be collected for 20 years (NDCC Section 28-21-01).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CHAPTER 32-09.1?

CHAPTER 32-09.1 is a legislative section that outlines specific regulations and requirements related to certain processes or activities within a jurisdiction.

Who is required to file CHAPTER 32-09.1?

Individuals or entities that fall under the regulations set forth in CHAPTER 32-09.1 are typically required to file it, which may include businesses, organizations, or individuals involved in the specified activities.

How to fill out CHAPTER 32-09.1?

To fill out CHAPTER 32-09.1, one must complete the required forms or documents by providing the necessary information as dictated by the instructions associated with the chapter, ensuring all relevant sections are accurately addressed.

What is the purpose of CHAPTER 32-09.1?

The purpose of CHAPTER 32-09.1 is to establish guidelines and obligations that govern specific actions, ensuring compliance with relevant laws and promoting accountability among those subject to its provisions.

What information must be reported on CHAPTER 32-09.1?

The information that must be reported on CHAPTER 32-09.1 generally includes details pertinent to the activities being regulated, such as identification information, financial data, and other relevant disclosures as required by the chapter.

Fill out your chapter 32-091 - legis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 32-091 - Legis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.