Get the free sallie mae forbearance form

Show details

Mail to: Sallie Mae Department of Education Loan Services P.O. Box 9635 Wilkes-Barre, PA 18773-9635 1-800-722-1300 Email Address: Name: Address: City/State/Zip: Telephone Home: Telephone Other: FEDERAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sallie mae forbearance form

Edit your sallie mae forbearance form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sallie mae forbearance form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sallie mae forbearance form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sallie mae forbearance form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sallie mae forbearance form

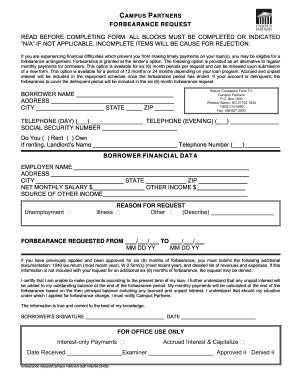

How to fill out ED General Forbearance Request

01

Step 1: Obtain the ED General Forbearance Request form from the official website or your loan servicer.

02

Step 2: Fill in your personal details, including your name, address, and Social Security number.

03

Step 3: Indicate the types of loans that you are requesting forbearance on.

04

Step 4: Provide a reason for the forbearance request, such as financial hardship or unemployment.

05

Step 5: Include any necessary supporting documentation, like proof of income or job loss.

06

Step 6: Sign and date the form.

07

Step 7: Submit the completed form to your loan servicer via mail or online, if applicable.

Who needs ED General Forbearance Request?

01

Borrowers facing temporary financial difficulties that prevent them from making their loan payments.

02

Individuals who are unemployed or have reduced income due to circumstances beyond their control.

03

Students or graduates who need a break from loan payments during transitional periods.

Fill

form

: Try Risk Free

People Also Ask about

Can you put private student loans in forbearance?

Private student loans are not eligible for federal deferment or forbearance programs. But some private lenders will let you postpone student loan payments temporarily if you run into financial hardship. This process is typically not automatic; you'll need to apply online or by calling your student loan servicer.

Does Sallie Mae have repayment options?

After your grace period, you can generally request a plan (standard, extended, or graduated) to help you adjust the amount of time you have to pay or an income-based repayment plan that bases your payments on your income.

Can Sallie Mae loans be forbearance?

You can request a deferment of up to 48 months for a Smart Option Student Loan® or a Sallie Mae graduate student loan so long as you're enrolled full-time or half-time.

How do you get a forbearance on a private student loan?

Private student loans are not eligible for federal deferment or forbearance programs. But some private lenders will let you postpone student loan payments temporarily if you run into financial hardship. This process is typically not automatic; you'll need to apply online or by calling your student loan servicer.

How do you get forbearance in Sallie Mae?

If you're experiencing financial difficulty, please chat with us or call 800-472-5543 so we can discuss any options that may be available for your loan.

Do Sallie Mae loans qualify for deferment?

You can request a deferment of up to 48 months for a Smart Option Student Loan® or a Sallie Mae graduate student loan so long as you're enrolled full-time or half-time.

How do I get rid of my Sallie Mae student loans?

If you want to get rid of Sallie Mae loans, you can do so. Just make sure it's for the right reasons.Temporarily defer payments Returning to college. Attending graduate school. Starting an internship, clerkship, fellowship, or residency.

How do you qualify for Sallie Mae forbearance?

Sallie Mae offers payment plans for some of its private student loans.It lists the following reasons for granting a deferment: Economic hardship. Unemployment. Military deployment. Enrollment in school. Internship. National service. Similar situations.

Does Sallie Mae do forbearance?

You can request a deferment of up to 48 months for a Smart Option Student Loan® or a Sallie Mae graduate student loan so long as you're enrolled full-time or half-time.

Does student loan moratorium include private loans?

Payments are currently suspended, without interest, for most federal student loan borrowers until sometime in 2023. This policy does not apply to private student loans.

What circumstance would make someone eligible for forbearance?

You can request a general forbearance if you are temporarily unable to make your scheduled monthly loan payments for the following reasons: Financial difficulties. Medical expenses. Change in employment.

What happens if I dont pay Sallie Mae back?

You may be charged late fees for delinquency, which can add to your Total Loan Cost. You may lose any interest-rate reduction programs for which you were eligible. Late payments may be reported to consumer reporting agencies and can have a negative impact on your credit report.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sallie mae forbearance form without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your sallie mae forbearance form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send sallie mae forbearance form to be eSigned by others?

Once your sallie mae forbearance form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make edits in sallie mae forbearance form without leaving Chrome?

sallie mae forbearance form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is ED General Forbearance Request?

The ED General Forbearance Request is a form used by borrowers to request a temporary suspension or reduction in their student loan payments due to financial hardship or other qualifying circumstances.

Who is required to file ED General Forbearance Request?

Borrowers who are experiencing financial difficulties, unemployment, or other qualifying circumstances that inhibit their ability to make standard loan payments are required to file an ED General Forbearance Request.

How to fill out ED General Forbearance Request?

To fill out the ED General Forbearance Request, borrowers need to provide their personal information, loan details, and the reason for the forbearance request. They must also sign and date the form to certify the information provided is accurate.

What is the purpose of ED General Forbearance Request?

The purpose of the ED General Forbearance Request is to allow borrowers a mechanism to temporarily pause their loan payments or reduce them based on financial difficulties, thereby preventing default on their student loans.

What information must be reported on ED General Forbearance Request?

The information that must be reported on the ED General Forbearance Request includes the borrower's name, contact information, the type of loans being serviced, the reason for requesting forbearance, and any supporting documentation if required.

Fill out your sallie mae forbearance form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sallie Mae Forbearance Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.