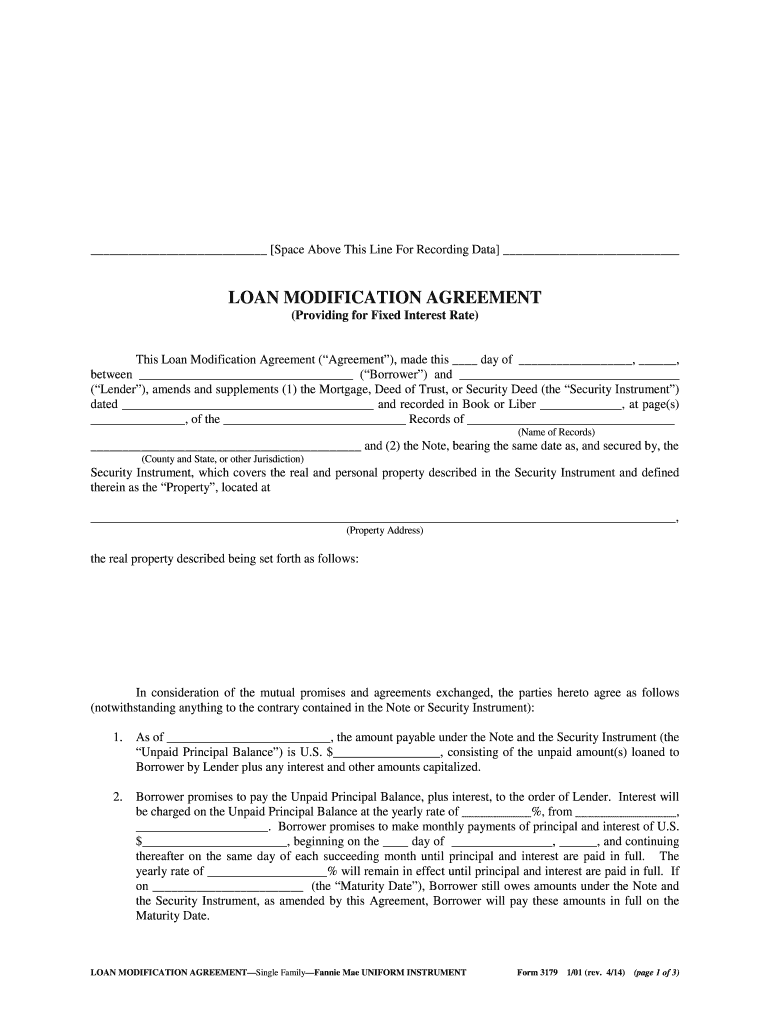

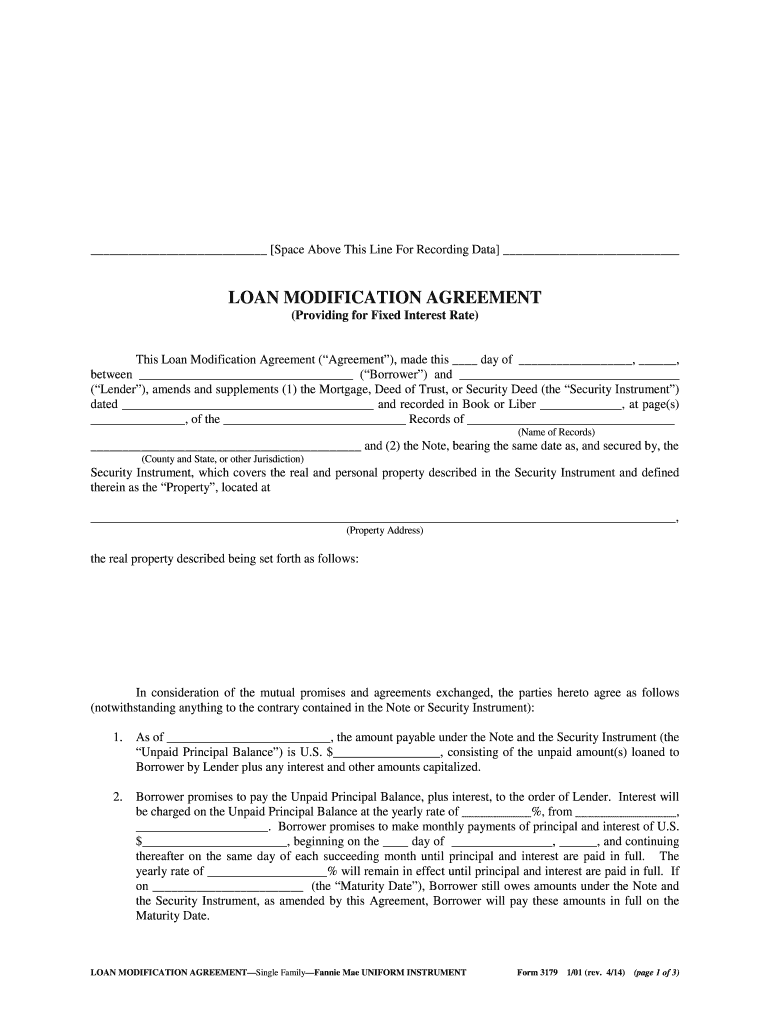

Fannie Mae 3179 free printable template

Get, Create, Make and Sign fannie mae form 3179

How to edit fannie mae form 3179 online

Uncompromising security for your PDF editing and eSignature needs

Fannie Mae 3179 Form Versions

Instructions and Help about fannie mae form 3179

Hello in our ongoing efforts to make servicing Fannie make loans more simple and certain we're pleased to share with you recent policy changes that support those efforts last month we introduced the Fannie make flex modification to give services an easy flexible way of helping more borrowers qualify for a loan modification in a changing housing environment with the retirement of CAMP my city modification and the principal reduction modification the Flex modification simplifies the process and aligns programs across the Uses flex modification eliminates most documentation collection and is adaptable for regional and even local variations in housing the Flex modification will replace our standards and streamline modification programs this year services can start implementing the Flex modification in their servicing process as early as March first but must implement it by October first 2017 next effective immediately we retired the non-eligible list services no longer need to check the non-eligible list and should benefit from this simpler process finally we'd like to remind you that changes to our investor reporting process become effective on February first these updates use industry-standard best practices that will save services time and effort while bringing greater standardization and efficiency to the investor reporting process automation will replace several manual processes making it easier to do business with us these automated changes include elimination of MBS pool balance reporting services no longer need to report single-family MBS swap security bounces to Fannie Mae and changes to due dates for Fannie make monthly investor reporting services will now report removal transactions by the first business day after processing the transaction in their system the data reporting cycle has also been aligned so that investors reporting due dates for schedule schedule schedule actual and actual are in sync please refer to the servicing guide and release notes for details on the changes and new reporting requirements you may also refer to this page on our website search Fannie make changes to reporting for helpful tools and resources supporting the changes and while you're there be sure to register for one of our monthly service or form webinars available through January for detail on these servicing policy updates see lender letter 2016 06 and our January servicing guide update thank you for your continued support and feedback we look forward to another great year of partnership

People Also Ask about

What happens after loan modification is approved?

What is a flex mod?

How do you qualify for FNMA Flex Mod?

What is the Fannie Mae modification interest rate today?

What is modification and extension of a loan agreement?

What happens after trial period of loan modification?

How long does it take for a loan modification to be completed?

What is a Freddie Mac Flex modification?

What are the pros and cons of a loan modification?

What is a capitalized amount on a loan modification?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find fannie mae form 3179?

How can I fill out fannie mae form 3179 on an iOS device?

How do I complete fannie mae form 3179 on an Android device?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.