IRS 5304-SIMPLE 2012-2025 free printable template

Show details

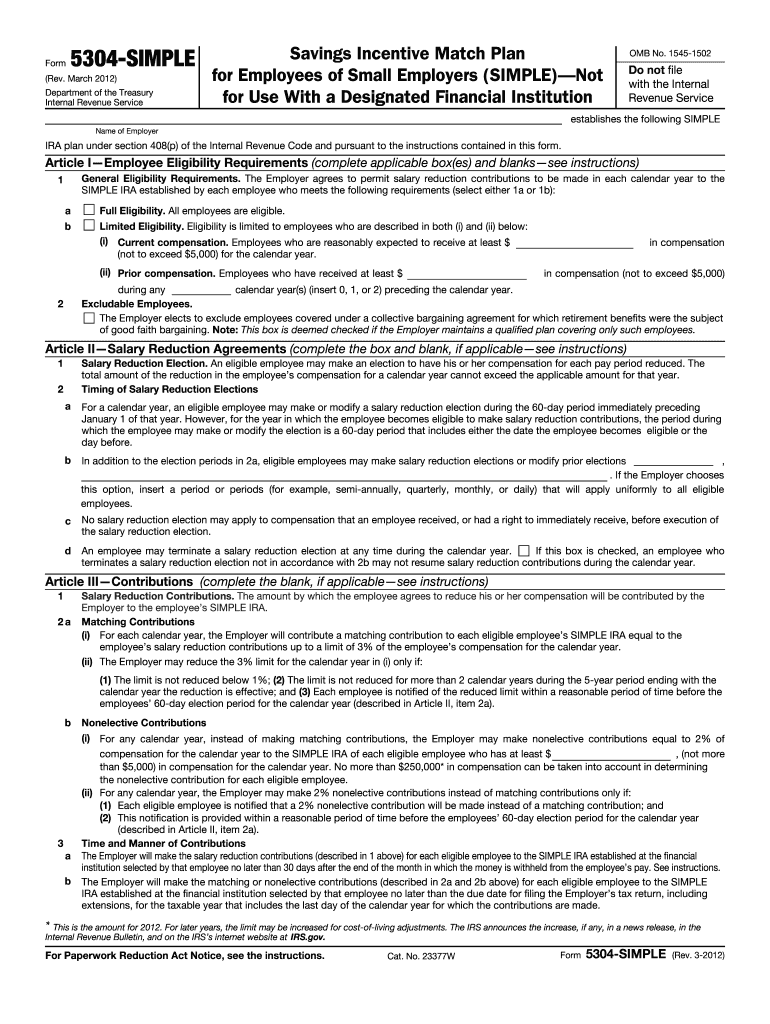

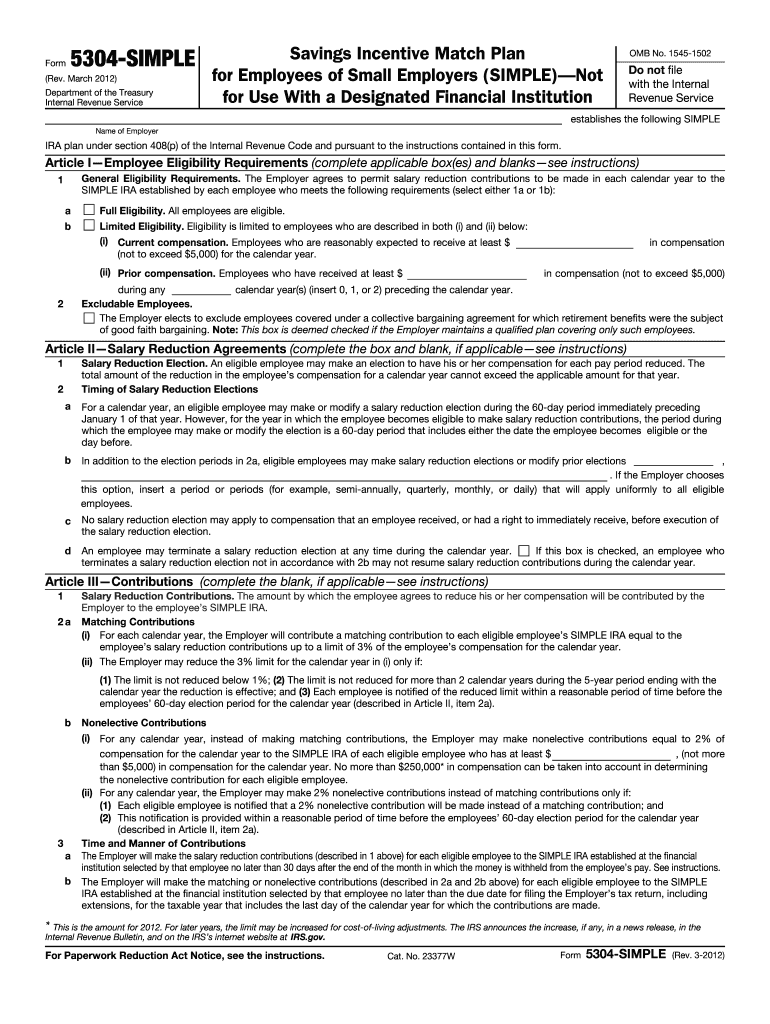

When To Use Form by using this Model Form or any other Do not use Form 5304-SIMPLE if 1. You want to require that all SIMPLE IRA plan contributions initially go to a financial institution designated by you. You want to establish a SIMPLE 401 k plan. Completing Form Pages 1 and 2 of Form 5304-SIMPLE contain the operative provisions of your is considered adopted when you have completed all applicable boxes and blanks and it has been executed by you. This requirement may be satisfied by...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 5304 simple

Edit your irs form 5304 simple form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 5304 simple form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 5304 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pdffiller form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5304-SIMPLE Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs 5304 simple employees fillable form

How to fill out IRS 5304-SIMPLE

01

Obtain a copy of IRS Form 5304-SIMPLE from the IRS website or your employer.

02

Fill in the tax year at the top of the form.

03

Enter the employer's information, including name, address, and employer identification number (EIN).

04

Complete the section that describes eligible employees who will participate in the SIMPLE IRA plan.

05

Specify the contribution amounts and the matching or non-elective contribution details.

06

Provide the information required for the designated financial institution administering the SIMPLE IRA.

07

Review all information for accuracy.

08

Sign and date the form before submission.

Who needs IRS 5304-SIMPLE?

01

Self-employed individuals who want to establish a SIMPLE IRA plan.

02

Small businesses with 100 or fewer employees who want to offer retirement savings to their employees.

03

Employees eligible for a SIMPLE IRA plan through their employer.

Fill

form 5304 simple fillable

: Try Risk Free

People Also Ask about 5304 simple

What is a 5305-simple form?

∎ IRS Form 5305-SIMPLE, Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) - for Use with a Designated Financial Institution, if you require that all contributions under the SIMPLE IRA plan be initially deposited with a designated financial institution.

What is a 5304-simple form?

Use Form 5304-SIMPLE if you permit plan participants to select the financial institution to receive their SIMPLE IRA plan contributions. Use Form 5305-SIMPLE if you require all contributions under the SIMPLE IRA plan to be initially deposited at a financial institution you designate.

How to fill out 5304-simple?

How to Fill Out the Form Provide the Name of the Company. Choose the Eligibility Requirements. Indicate Whether There Are Excludable Employees. Extend the Period for Modifying the Contributions. Prohibit the Employee to Terminate a Salary Reduction Election at any Time. Indicate Contributions Amount.

What is SIMPLE IRA 5305 5304?

An employer should use Form 5304-SIMPLE if it allows each plan participant to select the financial institution for receiving the participant's SIMPLE IRA plan contributions. An employer should use Form 5305-SIMPLE if it will deposit all SIMPLE IRA plan contributions at an employer-designated financial institution.

How to fill out Form 5305?

1:19 11:53 Contributions, Benefits, Obligations and IRS Form 5305-SEP - YouTube YouTube Start of suggested clip End of suggested clip If you're self-employed you might not have many options for tax advantage retirement savings but theMoreIf you're self-employed you might not have many options for tax advantage retirement savings but the SEP IRA is a great option. Next our tax deferred your contributions are made with pre-tax dollars.

What is 5305-simple?

Use Form 5304-SIMPLE if you permit plan participants to select the financial institution to receive their SIMPLE IRA plan contributions. Use Form 5305-SIMPLE if you require all contributions under the SIMPLE IRA plan to be initially deposited at a financial institution you designate.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

Fill out your IRS 5304-SIMPLE online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

5304 Simple Ira Form is not the form you're looking for?Search for another form here.

Keywords relevant to 5304 form

Related to irs simple ira form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.