Who needs a T2 short return?

T2 short return is requested by Canadian Department of revenue from corporations with their main office in Canada or from the non-profit organizations. Also, these companies must have a permanent establishment in only one province or territory and report their taxes in Canadian currency. Additionally, in order to use this short return, the organization should not have received or paid any taxable dividends or claimed any refundable tax credits. These companies should not have an Ontario transitional tax debit or an amount calculated under section 34.2 of the federal Income Tax Act.

What is a T2 return for?

A T2 short return is used to report loss or nil net income throughout the tax year. It is also suitable for organizations that are exempt from tax under section 149 of the Federal Income Tax Act. If the corporation gained profit, it has to complete a regular T2 Corporation Income Tax Return. The T2 short return also serves as a provincial or territorial income tax return except in Quebec and Alberta.

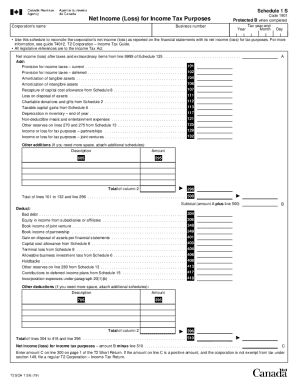

Is it accompanied by other forms?

Corporations are to attach Schedule 100, Schedule 125 or Schedule 141 (Balance Sheet Information, Income Statement Information and Notes Checklist). See more on the issue of attachments on T2 Guide at www.cra.gc.ca/forms.

When is T2 return due?

It is an annual form for reporting taxes. The T2 short return is to be filed no later than 6 months after the end of tax year.

How do I fill out a T2 short return?

Just answer the questions and follow the instructions provided in the document. You can call the Business Inquiries line at 1-800-959-5525 if you need help.

Where do I send it?

File it at the official webpage of Canada Revenue Agency (www.cra.gc.ca). If you want to send a paper version, check this website for the closest tax service offices.