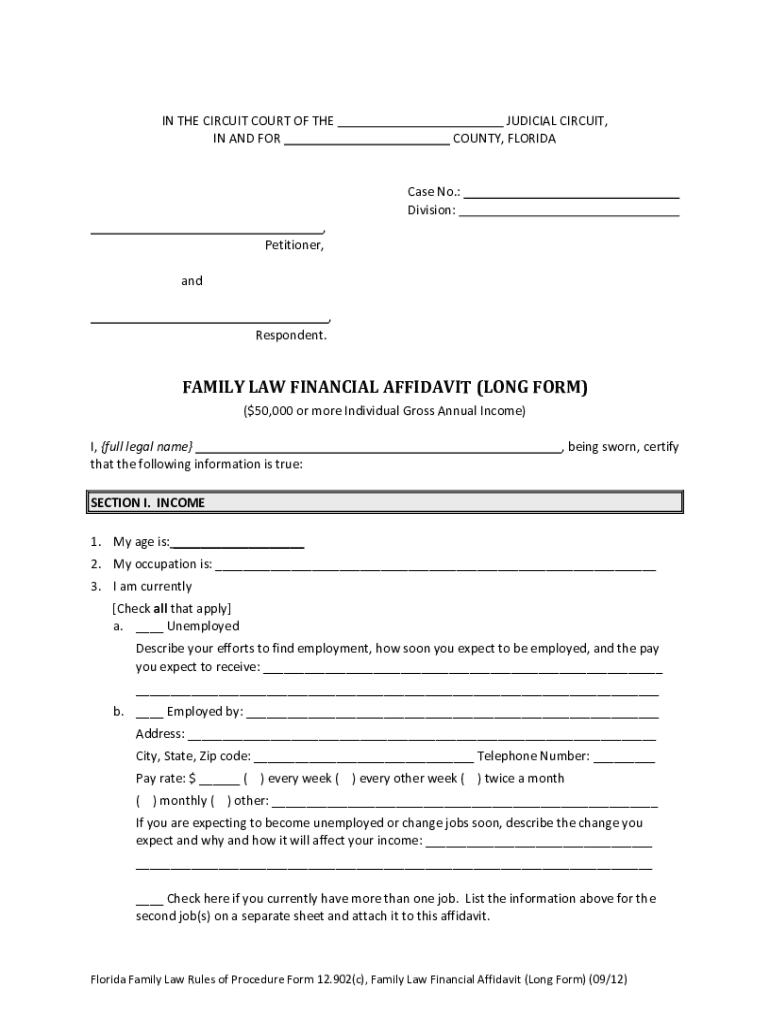

Who needs a Florida financial affidavit 12902b form?

This form should be used by persons who are involved in a family law case which requires a financial affidavit, and their individual gross income is $50,000 or more per year unless:

- the parties are going through a simplified procedure of divorce under rule 12.105;

- the parties do not have minor children and have signed an agreement on the absence of mutual financial claims; or

- the court lacks jurisdiction to determine any financial issues.

What is Florida financial affidavit 12902b form?

The Florida form o financial affidavit 12902b can be used in a variety of family litigation to provide information about the income and expenses of one spouse based on the calculation of his monthly indicators (last month). The data cover the costs of all aspects of family life — acquisition of gasoline, the pay of dental, children's school expenses, etc. Also, in the case of divorce, disputed property is taken into account.

Is Florida financial affidavit 12902b form accompanied by other forms?

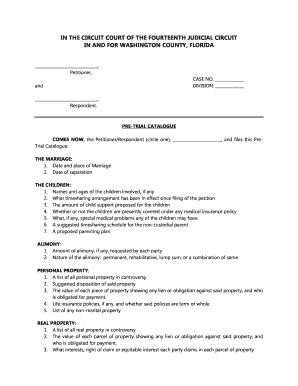

Petition for dissolution of marriage most often precedes the submission of this Florida financial affidavit 12902b form. In fact, it isn't obligatory that you file another forms, but you must mutually exchange financial information with your spouse. It can be accomplished with the help of a declaration of disclosure (FL-140 and FL-141), a schedule of assets and debts (FL-142) and income and expense declaration (FL-150).

Also, you must be prepared to provide any other documented financial information that your spouse or the court should know before the divorce. In all other cases, you must specify a particular list of required supporting documents with your lawyer.

When is Florida financial affidavit 12902b form due?

Florida requires you to send the completed and certified financial affidavit form to your spouse within 45 days of the date your petition for dissolution of marriage is served.

How do I fill out Florida financial affidavit 12902b form?

You will need to provide accurate and truthful information about the income and expenses during the reporting period together with the basic information about yourself. The document shall be certified by a notary public or deputy clerk. If a nonlawyer helped you to fill out this form, they must fill in corresponding boxes with their personal information (name, address, phone number).

Where do I send Florida financial affidavit 12902b form?

A copy of this form must be served on the other party to your case within 45 days of being served with the petition, if it is not served on them with your initial papers. The original document is used in legal proceedings and is kept by the person who filled it out.