VI BIR 720 2011 free printable template

Show details

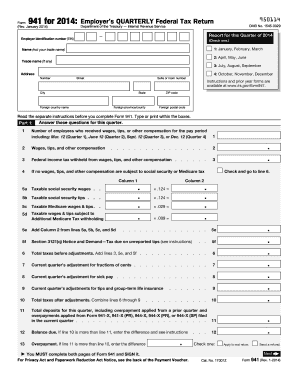

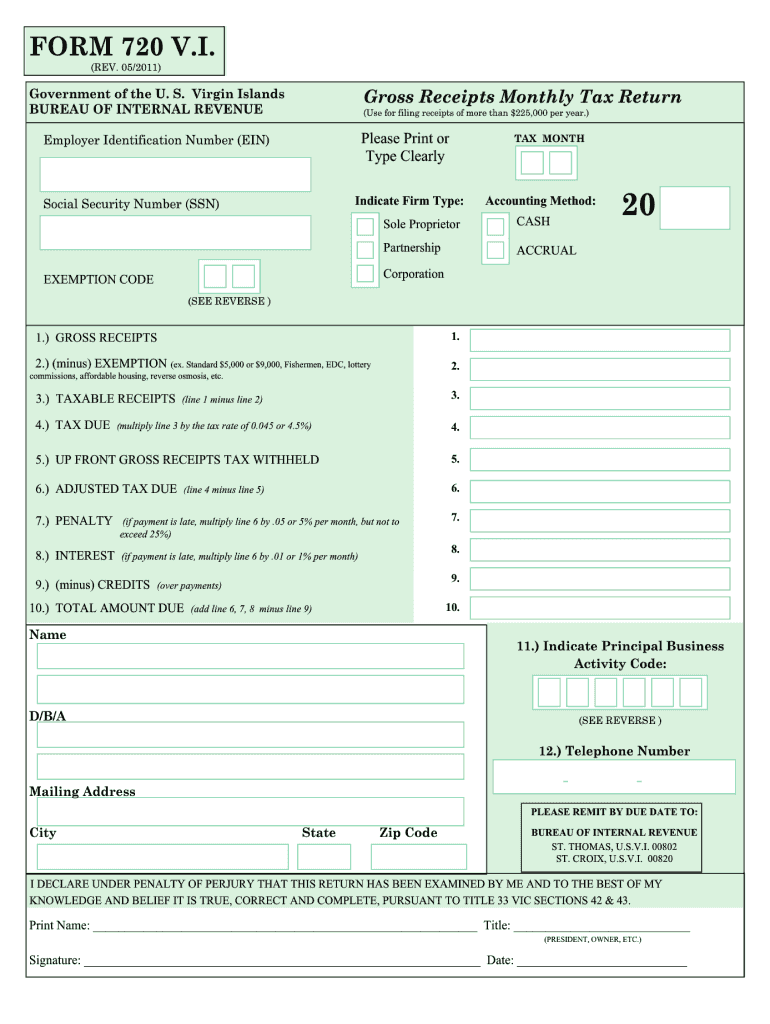

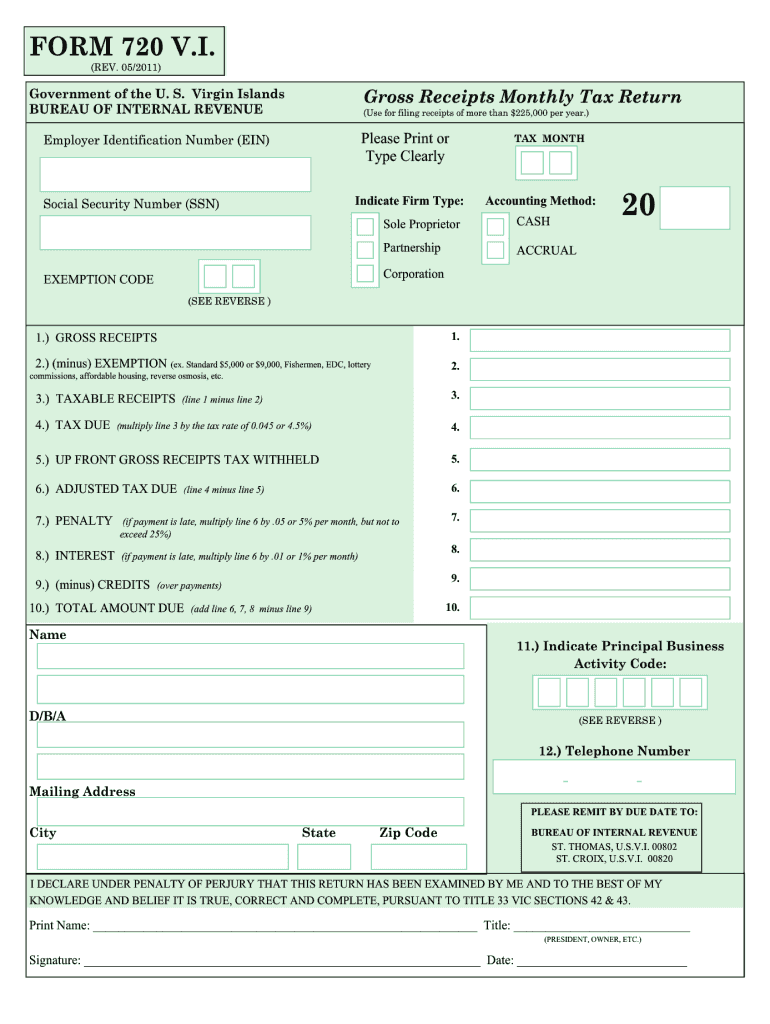

Indicate Principal Business Activity Code D/B/A 12. Telephone Number - Mailing Address PLEASE REMIT BY DUE DATE TO City State Zip Code ST. THOMAS U.S.V. I. 00802 ST. CROIX U.S.V. I. 00820 I DECLARE UNDER PENALTY OF PERJURY THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE CORRECT AND COMPLETE PURSUANT TO TITLE 33 VIC SECTIONS 42 43. Print Name Title PRESIDENT OWNER ETC. Signature Date INSTRUCTIONS FOR TAXPAYERS-FORM 720 V. I. The Virgin Islands...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VI BIR 720

Edit your VI BIR 720 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VI BIR 720 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VI BIR 720 online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit VI BIR 720. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VI BIR 720 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VI BIR 720

How to fill out VI BIR 720

01

Gather all required personal and financial information such as your taxpayer identification number, income sources, and deductions.

02

Download the VI BIR 720 form from the official website of the Virgin Islands Bureau of Internal Revenue.

03

Fill out the identification section with your name, address, and taxpayer identification number.

04

Report your total income, including wages, dividends, and other sources on the appropriate lines.

05

Input any applicable deductions and credits in their designated sections of the form.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the completed VI BIR 720 form via mail or electronically, based on the instructions provided.

Who needs VI BIR 720?

01

Residents of the U.S. Virgin Islands who earn income and are required to file an income tax return.

02

Individuals and businesses that have taxable income within the Virgin Islands.

03

Taxpayers who need to report income for tax purposes as mandated by the Virgin Islands Bureau of Internal Revenue.

Instructions and Help about VI BIR 720

Fill

form

: Try Risk Free

People Also Ask about

Who must file Form 8689?

A U.S. citizen or resident alien (other than a bona fide resident of the U.S. Virgin Islands (USVI)) with income from sources in the USVI or income effectively connected with the conduct of a trade or business in the USVI uses this form to figure the amount of U.S. tax allocable to the USVI.

How do I file my US Virgin Islands tax return?

The Virgin Islands Bureau of Internal Revenue and the IRS are not the same entity although the same tax rates and laws apply. If you are a US resident with income allocable to the Virgin Islands, file Form 8689 with your regular 1040 tax return.

Do citizens of the US Virgin Islands pay federal income tax?

Generally, instead of filing returns and paying taxes to the IRS, residents of the USVI, and corporations[3] formed in the USVI, file returns and pay income taxes directly the Virgin Islands Bureau of Internal Revenue[13].

Who is not required to file income tax return in USA?

If your income is less than your standard deduction, you generally don't need to file a return (provided you don't have a type of income that requires you to file a return for other reasons, such as self-employment income).

Who files form 8689?

Key Takeaways. U.S. Taxpayers who are not bona fide residents of the U.S. Virgin Islands but earned income there must file Form 8689. Form 8689 determines how much income tax should be allocated to the U.S. Virgin Islands.

Where do I file IRS Form 720?

Addresses for Forms Beginning with the Number 7 Form Name (For a copy of a Form, Instruction, or Publication)Address to Mail Form to IRS:Form 720 Quarterly Federal Excise Tax ReturnDepartment of the Treasury Internal Revenue Service Ogden, UT 84201-000917 more rows • Nov 29, 2022

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my VI BIR 720 in Gmail?

Create your eSignature using pdfFiller and then eSign your VI BIR 720 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit VI BIR 720 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing VI BIR 720.

How can I fill out VI BIR 720 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your VI BIR 720. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is VI BIR 720?

VI BIR 720 is a tax form used in the United States Virgin Islands to report and remit gross receipts tax.

Who is required to file VI BIR 720?

Businesses and individuals who have gross receipts exceeding a certain threshold in the US Virgin Islands are required to file VI BIR 720.

How to fill out VI BIR 720?

To fill out VI BIR 720, individuals or businesses must provide their gross receipts for the reporting period, calculate the tax owed, and submit the completed form along with payment to the Bureau of Internal Revenue.

What is the purpose of VI BIR 720?

The purpose of VI BIR 720 is to collect gross receipts tax from businesses and individuals operating in the US Virgin Islands to fund government services and operations.

What information must be reported on VI BIR 720?

The information that must be reported on VI BIR 720 includes the total gross receipts for the reporting period, exemptions, deductions, and the calculated tax liability.

Fill out your VI BIR 720 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VI BIR 720 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.