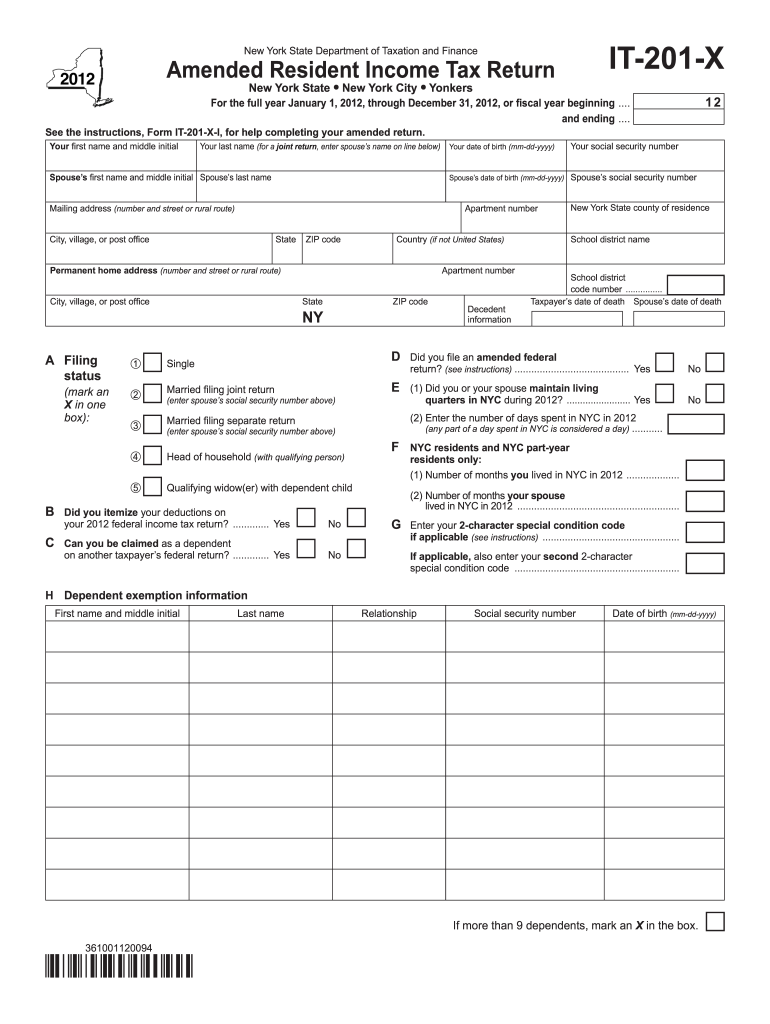

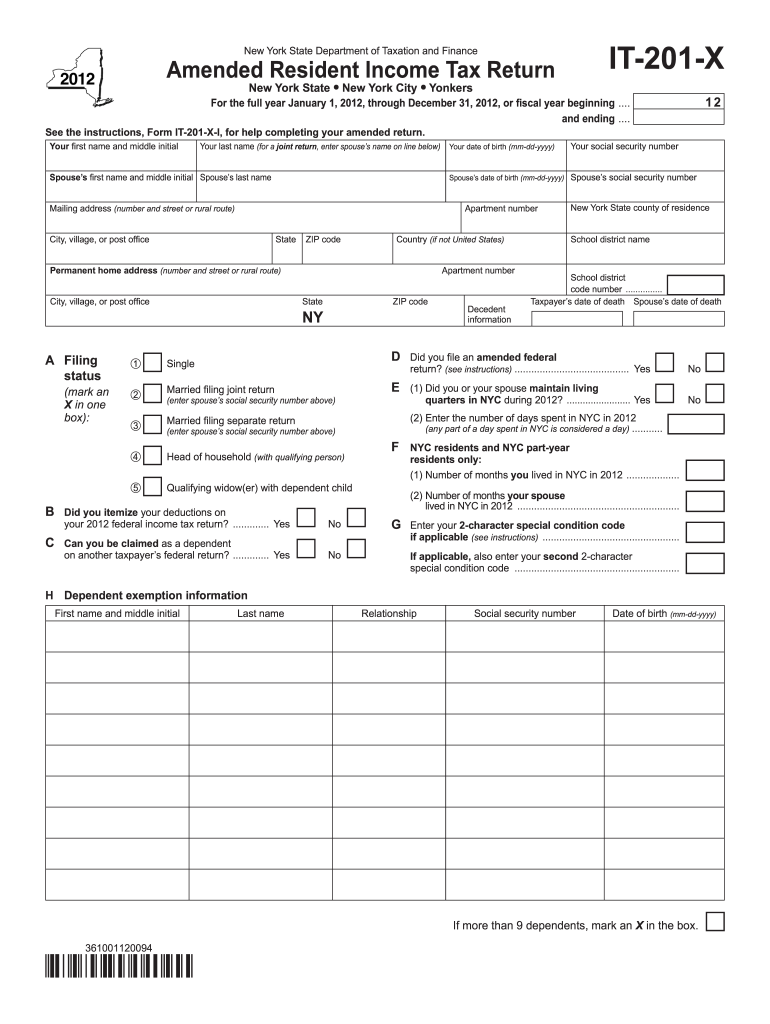

NY DTF IT-201-X 2012 free printable template

Get, Create, Make and Sign NY DTF IT-201-X

Editing NY DTF IT-201-X online

Uncompromising security for your PDF editing and eSignature needs

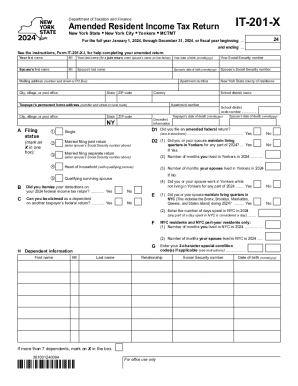

NY DTF IT-201-X Form Versions

How to fill out NY DTF IT-201-X

How to fill out NY DTF IT-201-X

Who needs NY DTF IT-201-X?

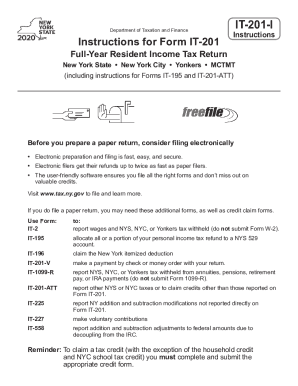

Instructions and Help about NY DTF IT-201-X

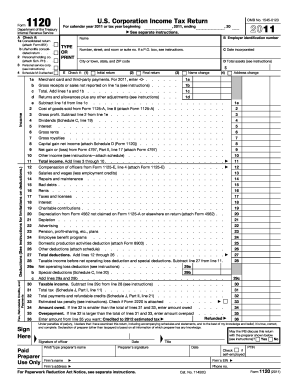

Hi guys this is a tremendous senior program coordinator for York College and what I'm going to be going through today for you guys is I'm going to be showing you how to do amendments to returns now I want to point out a couple differences between you know doing an amendment and between just filing a return before actually getting to the process of showing you how it's done now major difference between an amendment and just filing a return is that when you're filing an amendment you're assuming that this return has already been accepted and what has happened is that when it was the amount that was originally accepted is incorrect and this person now needs to go back and fix those incorrect amounts so that the correct amount may not be reflected now when you're finding a regular return you are doing with a goal so that it can be accepted so at this point you are filing everything under the assumption that all the information is already correct, and you are just trying to get your client your refund or get into it see what exactly they're going to be owing the IRS regardless of the outcome, so that's the first thing I want to point out as far as amendments and just filing a return when you're doing an amendment you definitely want to make sure that your client is from our site why I say this is because before you can start making any changes to a return you have to make sure that the return that you have in your system it was done exactly the way that it was done where they originally filed so if a client went, and they file their taxes with somebody else the Camp;R Block Jack's give away whatever the case may be, and then they come to our side to you know do their taxes I mean getting amendments what's going to happen is it's going to be very difficult for us to reflect exactly how it was done originally because they made a view they may have used a different tax program or whatever the case may be so first thing they wanted second thing you want to make sure is that not only the did your client already file a return any was accepted, but also they did it at our site now once you've made sure that these two things are you know in line what's going to happen is you're going to pull up your client return to the system make sure that you know go back over it make sure everything that you have in the system was done exactly how they did it originally they should have a copy of that year's return that where you could double-check and just look back to make sure that nothing in always change between the time when they filed and right now once you make sure that everything is good what you're going to do next is you're going to be adding in the amendment forms now I'm going to go to add, and I'm going to type in 1040 X this is the amendment form for the federal then I'm going to add in the tool on X which is the state amendment form all right now I'm going to kind of give you guys the overview of this form if you guys remember what I said earlier you...

People Also Ask about

What is the difference between it 201 and it 203?

What does it mean when your tax return is amended?

How do I fill out an amended return?

What is the IL 1040 X form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NY DTF IT-201-X directly from Gmail?

How can I send NY DTF IT-201-X to be eSigned by others?

How do I complete NY DTF IT-201-X on an iOS device?

What is NY DTF IT-201-X?

Who is required to file NY DTF IT-201-X?

How to fill out NY DTF IT-201-X?

What is the purpose of NY DTF IT-201-X?

What information must be reported on NY DTF IT-201-X?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.