MD SDAT HTC-60 2013 free printable template

Show details

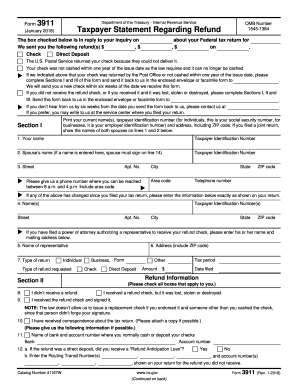

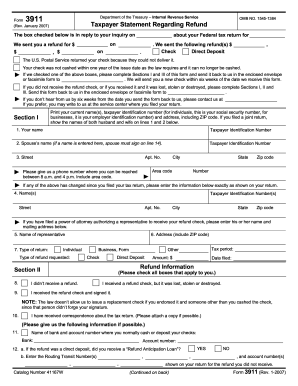

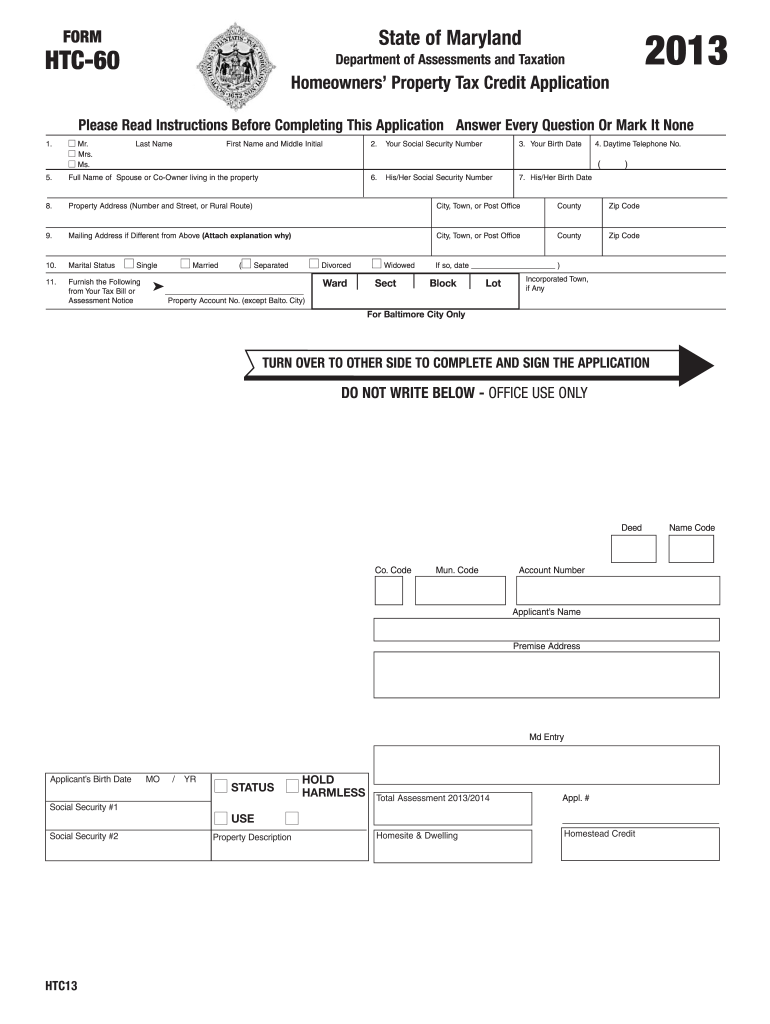

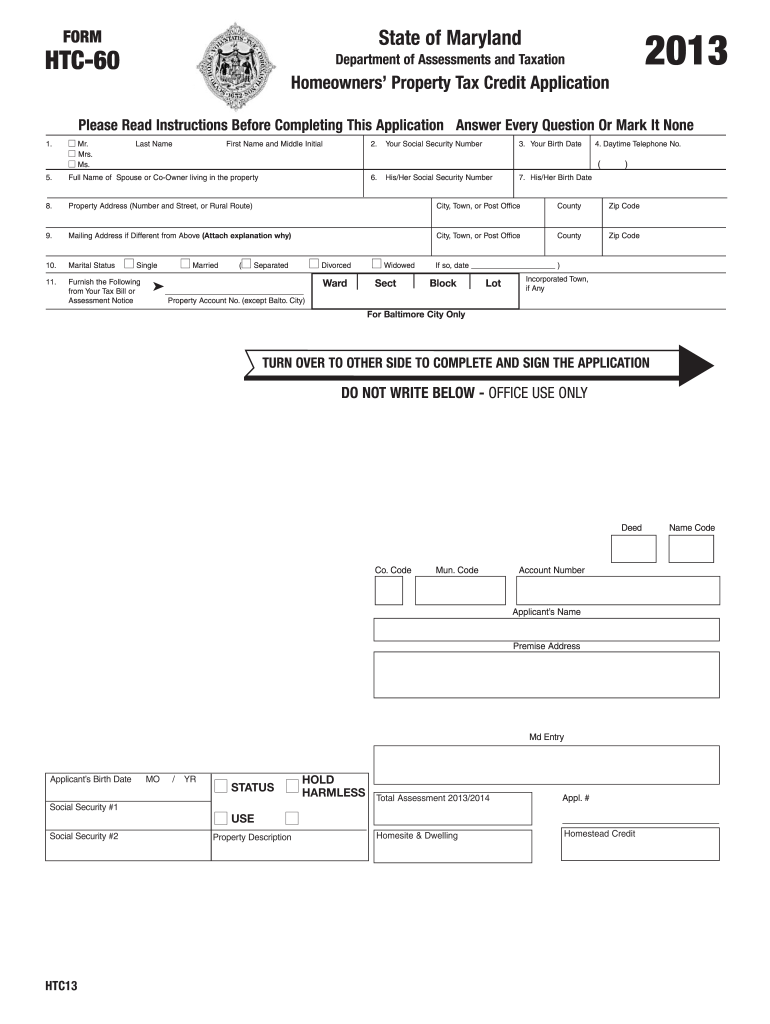

FORM State of Maryland Department of Assessments and Taxation HTC-60 2013 4. Daytime Telephone No. Homeowners' Property Tax Credit Application Please Read Instructions Before Completing This Application

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mdsdat 2013 form

Edit your mdsdat 2013 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mdsdat 2013 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mdsdat 2013 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mdsdat 2013 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD SDAT HTC-60 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mdsdat 2013 form

How to fill out MD SDAT HTC-60

01

Obtain the MD SDAT HTC-60 form from the official website or local office.

02

Start by entering your personal information, including your name, address, and contact details.

03

Provide information about the property, such as its address, type, and any existing financing.

04

Fill in the section related to property use, specifying whether it is residential or commercial.

05

Indicate the details regarding the entity or individual filing the form.

06

Review all information for accuracy before submission.

07

Submit the completed form to the appropriate local authority as instructed.

Who needs MD SDAT HTC-60?

01

Individuals or businesses looking to document property ownership in Maryland.

02

Anyone seeking to qualify for certain tax benefits related to property ownership.

03

Real estate professionals assisting clients with property transactions.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to fill out a MW507 form?

All Maryland residents or employees must complete form MW507 to ensure their employer withholds the correct amount from their paycheck. This document is similar to the W-4 document that all Americans complete for federal withholding of their working wages, only it is specific to the state of Maryland.

What is the MW507 form for?

The Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

What is MD form 502?

Choose the Right Income Tax Form If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000. If you lived in Maryland only part of the year, you must file Form 502. If you are a nonresident, you must file Form 505 and Form 505NR.

What is the Maryland tax form called?

2022 Individual Income Tax Forms NumberTitle502Maryland Resident Income Tax Return502BMaryland Dependents InformationPVPersonal Tax Payment Voucher for Form 502/505, Estimated Tax and Extensions502ACMaryland Subtraction for Contribution of Artwork14 more rows

Do you need to fill out MW507?

Yes, you must fill out Form MW507 so your employer can withhold the proper amount of taxes from your income.

Who must file Maryland form 510?

Every Maryland pass-through entity must file a return on Form 510, even if it has no income or the entity is inactive. Every other pass-through entity that is subject to Maryland income tax law must also file on Form 510.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the mdsdat 2013 form in Gmail?

Create your eSignature using pdfFiller and then eSign your mdsdat 2013 form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit mdsdat 2013 form on an Android device?

You can make any changes to PDF files, such as mdsdat 2013 form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete mdsdat 2013 form on an Android device?

Use the pdfFiller Android app to finish your mdsdat 2013 form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is MD SDAT HTC-60?

MD SDAT HTC-60 is a form used in Maryland for businesses to report certain information to the State Department of Assessments and Taxation.

Who is required to file MD SDAT HTC-60?

All corporations and certain entities registered in Maryland are required to file MD SDAT HTC-60 annually.

How to fill out MD SDAT HTC-60?

To fill out MD SDAT HTC-60, one must provide the required business information, including the entity's name, address, and various financial details as specified in the form instructions.

What is the purpose of MD SDAT HTC-60?

The purpose of MD SDAT HTC-60 is to ensure compliance with Maryland state regulations regarding the reporting of business activities and to keep the state's business records up to date.

What information must be reported on MD SDAT HTC-60?

Information that must be reported includes the business's legal name, principal office address, contact information, financial statements, and any changes in ownership or structure.

Fill out your mdsdat 2013 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mdsdat 2013 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.