Get the free 2014 ma form

Show details

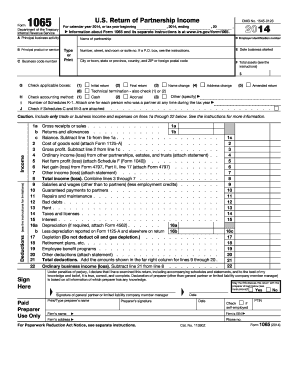

MASSACHUSETTS DEPARTMENT OF REVENUE 2014 INTERNATIONAL FUEL TAX AGREEMENT IFTA Registration Period 01/01/2014 through 12/31/2014 1 Federal Employer Identification or Social Security Number Legal Name of Business Business Address Number and Street City State US - DOT 4 Trade Name DBA Zip Code 6 Mailing Address for license/decals/returns Business Telephone Number Type of Business Corporation Individual Partnership Other specify Office where fuel records are available for audit if different from...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2014 ma form

Edit your 2014 ma form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2014 ma form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2014 ma form online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2014 ma form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2014 ma form

How to fill out MA DoR IFTA-1

01

Obtain the MA DoR IFTA-1 form from the Massachusetts Department of Revenue website.

02

Fill in the name and address of the carrier or business.

03

Enter the IFTA account number if you have one, or provide the necessary information to apply for one.

04

Provide details about the type of fuel used, including diesel or gasoline.

05

Report the total miles traveled in each state or province.

06

Record the total gallons of fuel purchased in each jurisdiction.

07

Calculate the miles per gallon for each jurisdiction and record them.

08

Complete any additional sections or disclosures requested by the form.

09

Review the information for accuracy before submission.

10

Submit the completed IFTA-1 form to the Massachusetts Department of Revenue.

Who needs MA DoR IFTA-1?

01

Motor carriers that operate in multiple jurisdictions and are involved in international fuel tax agreements.

02

Businesses that operate commercial vehicles weighing over a certain threshold (usually 26,001 pounds or more).

03

Companies that are required to report fuel consumption for tax purposes across various states.

Fill

form

: Try Risk Free

People Also Ask about

What is MA Form 355S?

S corporations will file Form 355S indicating on the face of such return that they are subject to combined reporting for their income measure of excise and exclude from that separate return the income that is reported on the group's Form 355U (Schedule E is not required unless the taxpayer has income from a source

Who must file MA Form 3?

A Massachusetts partnership return, Form 3, must be filed if the partnership: ◗ Has a usual place of business in Massachusetts; ◗ Receives federal gross income of more than $100 during the taxable year that is subject to Massachusetts taxation jurisdiction under the U.S. Constitution.

Can I download my tax forms?

There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and publications. They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center.

Who must file MA Form 2?

Every executor, administrator, trustee, guardian, conservator, trustee in a noncorporate bankruptcy or receiver of a trust or estate that re- ceived income which is taxable under Ch. 62 in excess of $100 and that is subject to Massachusetts jurisdiction must file a Form 2.

Who must file a Massachusetts fiduciary return?

Every executor, administrator, trustee, guardian, conservator, trustee in a noncorporate bankruptcy or receiver of a trust or estate that received in- come in excess of $100 that is taxable under MGL ch 62 at the entity level or to a beneficiary(ies) and that is subject to Massachusetts jurisdiction must file a Form 2.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2014 ma form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the 2014 ma form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete 2014 ma form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your 2014 ma form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete 2014 ma form on an Android device?

On Android, use the pdfFiller mobile app to finish your 2014 ma form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is MA DoR IFTA-1?

MA DoR IFTA-1 is a tax form used by the Massachusetts Department of Revenue to report and pay International Fuel Tax Agreement (IFTA) taxes. It is intended for interstate carriers who operate qualified motor vehicles.

Who is required to file MA DoR IFTA-1?

Those required to file MA DoR IFTA-1 include motor carriers who operate vehicles that meet IFTA qualifications, such as vehicles weighing over 26,000 pounds, or vehicles designed to transport more than 15 passengers.

How to fill out MA DoR IFTA-1?

To fill out MA DoR IFTA-1, one must report total miles traveled in jurisdictions, gallons of fuel purchased in each jurisdiction, and any credits or deductions. Accurate record-keeping is essential for corresponding information.

What is the purpose of MA DoR IFTA-1?

The purpose of MA DoR IFTA-1 is to ensure proper reporting and payment of fuel taxes owed by carriers who operate across state lines, thus facilitating fair tax distribution among participating states.

What information must be reported on MA DoR IFTA-1?

The information that must be reported includes total miles driven in each state, the total gallons of fuel purchased, the tax rates, tax calculations, and any additional adjustments or credits.

Fill out your 2014 ma form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2014 Ma Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.