Canada FIN-400 2014 free printable template

Show details

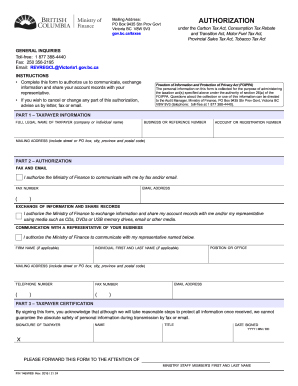

FIN 400/WEB Rev. 2014 / 2 / 12 Detach Here forward your Remittance Form Complete both sides of Remittance Form LEGAL BUSINESS NAME For Office Use Business closed permanently or temporarily YES Check the box and Send us the following information 1 business name and registration number 2 date of closure 3 reason for closure and 4 if sold provide name address and phone number of purchaser. Business Number Registration Number PROVINCIAL SALES TAX RETURN under the Provincial Sales Tax Act PST...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada FIN-400

Edit your Canada FIN-400 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada FIN-400 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada FIN-400 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada FIN-400. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada FIN-400 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada FIN-400

How to fill out Canada FIN-400

01

Gather all required personal information including your name, address, and Social Insurance Number (SIN).

02

Obtain details regarding your income, including foreign and Canadian sources.

03

Fill out the identification section at the top of the form including the agency name and contact information.

04

Report your total income in the corresponding sections, ensuring all figures are accurate.

05

If applicable, include documentation to verify any foreign income you are reporting.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

Who needs Canada FIN-400?

01

Individuals who are filing a Canadian tax return based on foreign income.

02

Residents of Canada who have received income from abroad.

03

Certain Canadian tax residents that are required to disclose foreign income under Canadian tax law.

Instructions and Help about Canada FIN-400

Fill

form

: Try Risk Free

People Also Ask about

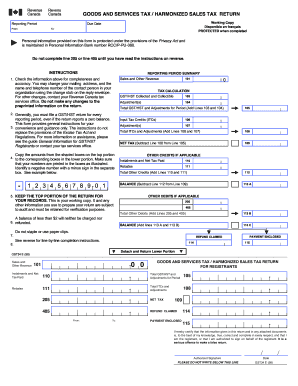

What is the PST rule in BC?

Businesses that are required to register must charge and collect tax at the time the tax is payable, unless a specific exemption applies to the sale or lease. PST generally applies to: The purchase or lease of new and used goods in B.C. Goods brought, sent or delivered into B.C. for use in B.C.

Who is BC PST payable to?

You must report and pay to us all PST and municipal and regional district tax (MRDT) you have charged, whether or not you have actually collected it from your customer. This includes tax you may have charged incorrectly, such as: At an incorrect rate (for example, you charged 10% PST on general goods instead of 7%)

Do I need to charge PST BC?

Yes, you must charge PST on all taxable goods and services you sell in B.C., unless a specific exemption applies. There are no general exemptions that apply if you sell goods or services in B.C. to customers that live outside B.C. (e.g. tourists).

Who is exempt from BC PST?

These include exemptions for: Health and medical products, and equipment for persons with disabilities (PDF, 383KB) Adult-sized clothing and footwear for kids under 15 years of age (PDF, 279KB) School supplies for students (PDF, 292KB)

What is B.C. PST self assessment?

Generally, you pay PST when you purchase or lease taxable goods from your supplier. If your supplier does not charge you PST, you must self-assess the PST due. Unlike the GST/HST, there are no PST input tax credits provided for goods purchased by a business.

Do I have to file a B.C. PST return?

You must file a PST return even if you didn't make any taxable sales or have any PST to self-assess during the reporting period. Don't use your PST return to pay any other amounts you owe us, such as amounts owing from an audit or fees for a dishonoured cheque.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete Canada FIN-400 online?

pdfFiller has made it simple to fill out and eSign Canada FIN-400. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I edit Canada FIN-400 on an iOS device?

Create, edit, and share Canada FIN-400 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Can I edit Canada FIN-400 on an Android device?

You can make any changes to PDF files, such as Canada FIN-400, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is Canada FIN-400?

Canada FIN-400 is a tax form used for reporting information to the Canada Revenue Agency (CRA) regarding certain financial transactions and accounts.

Who is required to file Canada FIN-400?

Individuals and entities that hold certain foreign property or accounts outside Canada that exceed specific thresholds are required to file Canada FIN-400.

How to fill out Canada FIN-400?

To fill out Canada FIN-400, you need to provide accurate details about your foreign property, including types, values, and income generated, along with your personal information.

What is the purpose of Canada FIN-400?

The purpose of Canada FIN-400 is to ensure compliance with tax regulations regarding foreign assets and to help the CRA monitor and prevent tax evasion.

What information must be reported on Canada FIN-400?

Information required on Canada FIN-400 includes details about foreign property holdings, such as types of assets, their values, income earned, and any associated foreign accounts.

Fill out your Canada FIN-400 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada FIN-400 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.