Who Needs Application for Employee’s Registration?

Employee’s Old-Age Benefits Institution is Pakistan government entity responsible for providing various types of social insurance benefits to the insured individuals. GOBI issues Form PE-01 that is officially called Application for Employee’s Registration. It is created for individuals who’d like to become members of the GOBI.

What is Application for Employee’s Registration for?

Form PE-01 is used to register new employees who qualify to get benefits once they reach certain age. With your PE-01 you prove that you are eligible to be paid certain benefits.

Is Application for Employee’s Registration Accompanied by Other Forms?

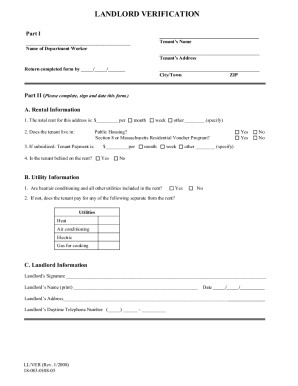

The application may not be accepted if you fail to provide the complete list of documents. They include certificate from provincial council for the rehabilitation of disabled people and a photocopy of identity card.

When is Application for Employee’s Registration due?

The Application for Employee’s Registration is due when an employee reaches the age when they are eligible to get benefits.

How Do I Fill out Application for Employee’s Registration?

Form PE-01 is a single document that contains ten fillable fields. An applicant should provide their name as it appears in National identity card, gender, nature of disability, data of birth, etc. There is also section for employer where they have to indicate the date when an applicant was employed, name of the establishment and registration number.

Where Do I Send Application for Employee’s Registration?

The completed Form PE-01 is sent to the Employee’s Old-Age Benefits Institution.