USDA FSA-2037 2010-2025 free printable template

Show details

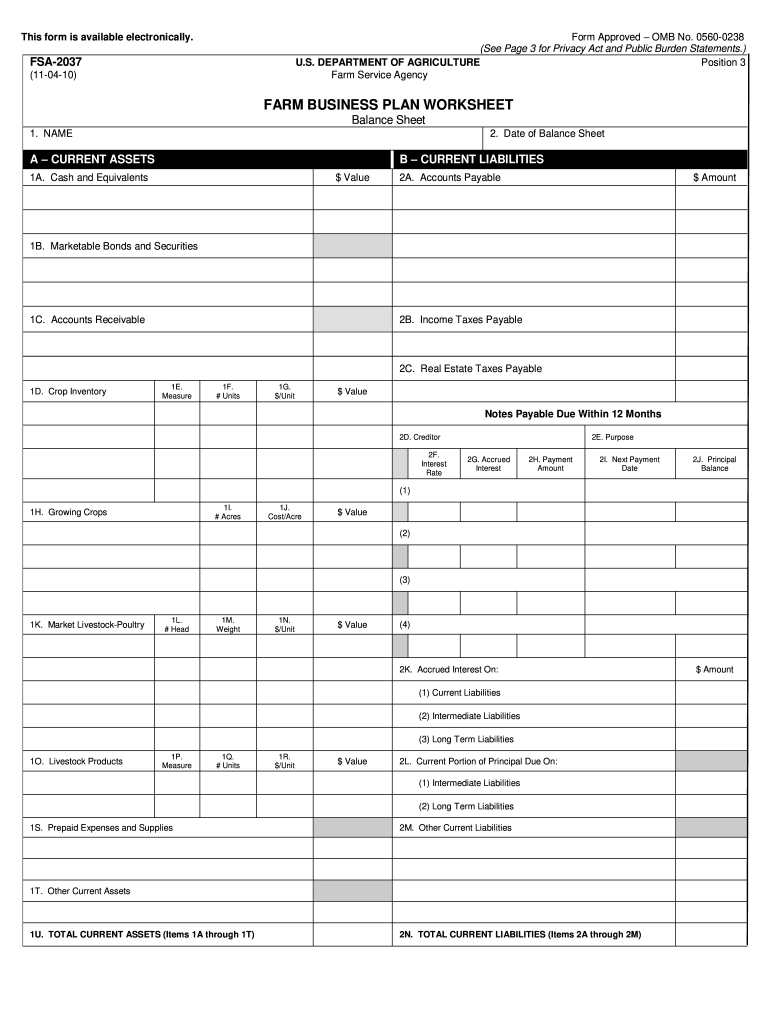

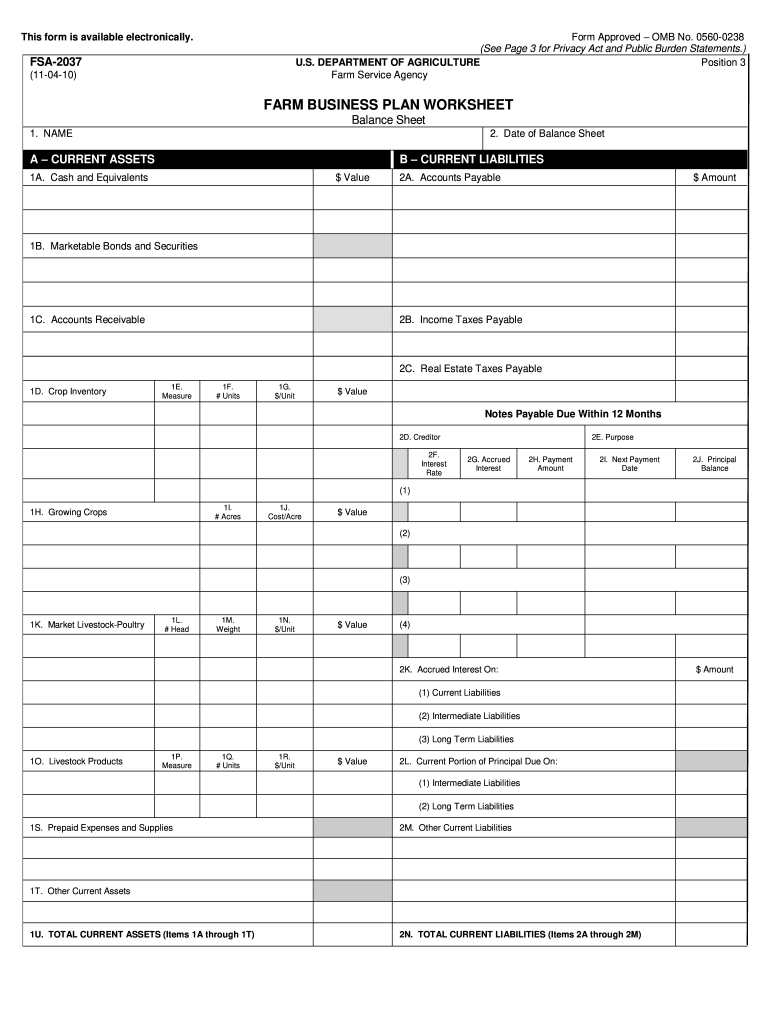

FSA-2037 11-04-10 FARM BUSINESS PLAN WORKSHEET Balance Sheet 1. NAME 2. Date of Balance Sheet A CURRENT ASSETS B CURRENT LIABILITIES 1A. Other Current Liabilities 1U. TOTAL CURRENT ASSETS Items 1A through 1T 2N. TOTAL CURRENT LIABILITIES Items 2A through 2M FSA-2037 11-04-10 C INTERMEDIATE ASSETS Page 2 of 4 E INTERMEDIATE LIABILITIES 3A. For m Appr oved OMB N o. 0560- 0238 See Page 3 for Privacy Act and Public Burden Statements. U*S* DE PARTM ENT OF AGRIC ULTURE Position 3 Farm Service...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fsa 2037 fillable form

Edit your farming balance sheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form fsa 2037 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fsa 2037 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit farm balance sheet template form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

USDA FSA-2037 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out farm balance form

How to fill out USDA FSA-2037

01

Obtain the USDA FSA-2037 form from the USDA website or your local FSA office.

02

Provide the required personal information, including your name, address, and contact information.

03

Specify the type of assistance or program you are applying for.

04

Detail your farm operation, including the location, type of crops or livestock, and size of the operation.

05

Include information about any previous USDA program participation, if applicable.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the form to your local FSA office either in person or by mail.

Who needs USDA FSA-2037?

01

Farmers and ranchers seeking financial assistance from USDA programs.

02

Individuals or entities involved in agricultural production who need disaster assistance or conservation support.

03

Those applying for farm ownership loans or operating loans.

Fill

fsa balance sheet

: Try Risk Free

People Also Ask about farm balance sheet form

What must be included in a balance sheet?

A balance sheet is a statement of a business's assets, liabilities, and owner's equity as of any given date. Typically, a balance sheet is prepared at the end of set periods (e.g., every quarter; annually). A balance sheet is comprised of two columns. The column on the left lists the assets of the company.

What is a balance sheet for a farm?

The balance sheet is a report of the farm business's financial position at a given moment in time. It lists assets, liabilities, and net worth (owner's equity), and represents a snapshot of the farm business as of a certain date.

How is farm income calculated?

Gross farm income reflects the total value of agricultural output plus Government farm program payments. Net farm income (NFI) reflects income after expenses from production in the current year and is calculated by subtracting farm production expenses from gross farm income.

What are the examples of farm liabilities?

Long-term Farm Liabilities are against long term assets. They will usually include loans, land contracts or mortgages for the purchase of land, buildings, and permanent improvements.

What goes on a farm balance sheet?

The balance sheet is a report of the farm business's financial position at a given moment in time. It lists assets, liabilities, and net worth (owner's equity), and represents a snapshot of the farm business as of a certain date.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit usda fsa balance sheet on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign how to fsa 2037 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How can I fill out fsa form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your farm balance sheet fillable, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit usda fsa 2037 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as fsa 2037 form fillable. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is USDA FSA-2037?

USDA FSA-2037 is a form used by the United States Department of Agriculture's Farm Service Agency (FSA) for reporting information related to farm operations and commodity programs.

Who is required to file USDA FSA-2037?

Farmers and producers who participate in certain FSA programs, especially those receiving federal payments or benefits, are required to file USDA FSA-2037.

How to fill out USDA FSA-2037?

To fill out USDA FSA-2037, individuals must provide accurate information regarding their farming operations, including cropping practices, land usage, and related data as specified in the form's instructions.

What is the purpose of USDA FSA-2037?

The purpose of USDA FSA-2037 is to collect necessary information to ensure compliance with federal agricultural programs and to determine eligibility for benefits.

What information must be reported on USDA FSA-2037?

Information that must be reported on USDA FSA-2037 includes details about farm operations, types of commodities produced, acreage planted, and any relevant financial data.

Fill out your USDA FSA-2037 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Farm Balance Sheet Template Excel is not the form you're looking for?Search for another form here.

Keywords relevant to farm credit balance sheet form

Related to fsa 2037 balance sheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.