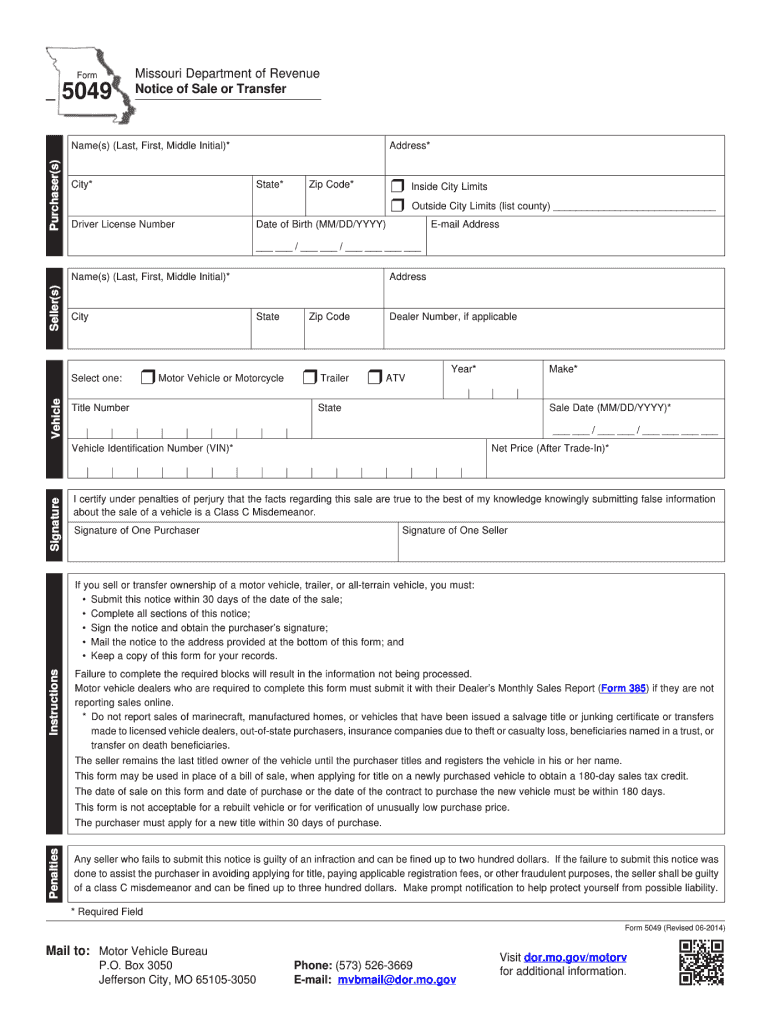

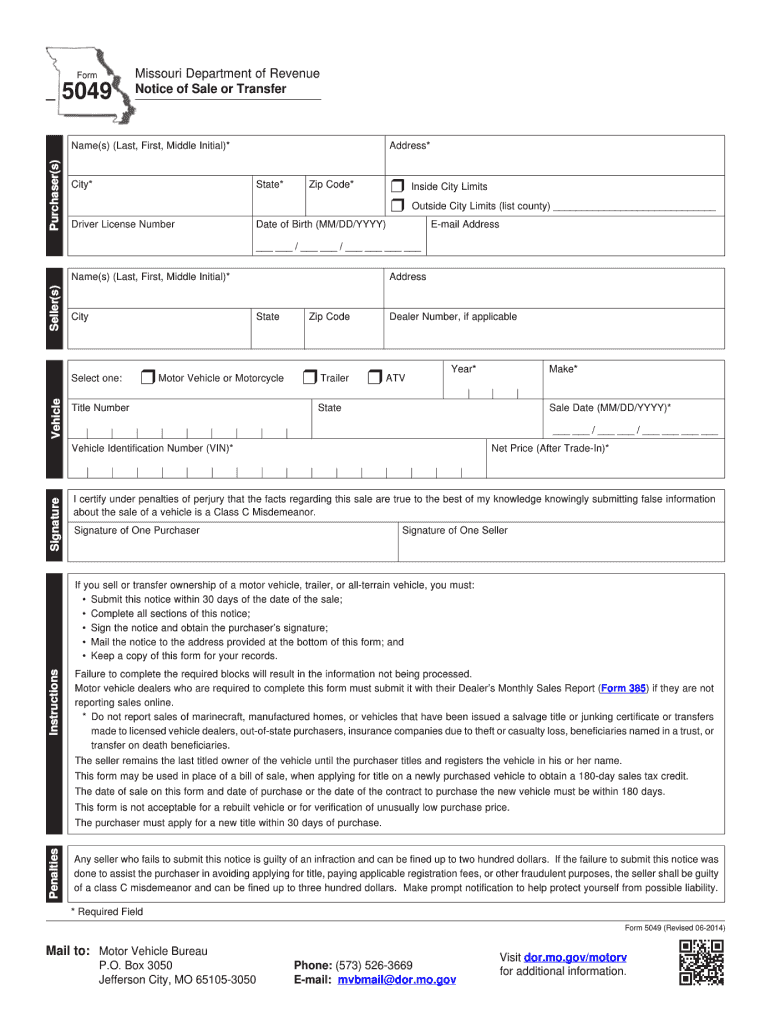

MO DOR 5049 2014 free printable template

Get, Create, Make and Sign

Editing missouri form 5049 2014 online

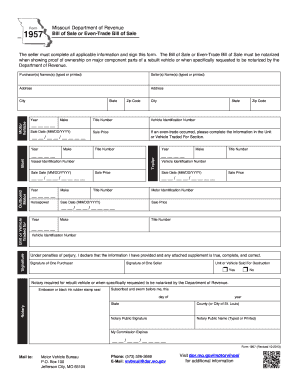

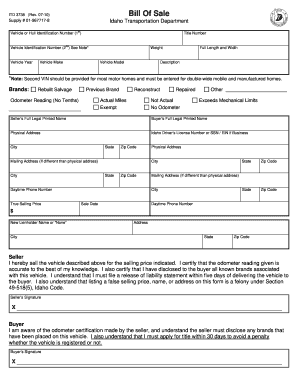

MO DOR 5049 Form Versions

How to fill out missouri form 5049 2014

How to fill out Missouri form 5049 2014?

Who needs Missouri form 5049 2014?

Instructions and Help about missouri form 5049 2014

Hi this is how to file for divorce Oregon today we're going to show you how to file for divorce in the state of Missouri so if you want to come on this page, and you're going to show you the step-by-step guide step 1 getting right on it, you're going to need to download the Missouri divorce papers now they are completely free, and you can download them right on our website just by clicking this link will bring you to another page that has a list of what all of them are, and you can download for free step 2 the person that has decided to file for divorce must fill out the following forms and submit to the Missouri circuit clerk's office now even if the both of you have decided to file for divorce one of the spouses has to take the lead here and do all the filing paying the fees you can decide to obviously split up the fees behind closed doors but one of you is going to have to fill all these out paper fees, so I'm not going to go through what all the forms are, but you have to fill out these three forms and pay the hundred and sixty-three dollar filing fee now that was the filing fee at the time of this video, so you want to double-check with the circuit court clerk's office to make sure that's the one hundred and sixty-three dollars, so after you do that you're going to have to send these three forms to your spouse as well as the waiver of service and entry of appearance so if your spouse does not return the waiver of service and entry of appearance because your spouse's got to fill all this out basically just says that you let your spouse know that you're filing for divorce and that you filed these three required forms, but you have to get that form back from your spouse and if you do not get it back the court will allow you to serve a summons to the unresponsive spouse to answer the petition for dissolution of marriage that was filed the chances are if you're doing a divorce this way you're not getting the attorneys involved hopefully you and your spouse for the most part are an agreement on the divorce so that hopefully this won't be an issue step forward now you must find a way to get a completed answer in waiver form from your spouse once you receive this form back you will have to deliver and file this form with the clerk step 5 each spouse will need to fill out the following forms in front of a notary public now if you don't know what a notary is done't worry there's one at every branch bank it's basically just someone licensed by the state to witness legal documents it's not a big deal, but every branch bank has them and I know I personally use the bank all the time to assign whatever legal forms I have that need a notary, but after you get that done you file the forms with the clerk these forms right here now if you have children obviously you're going to need to do both of these forms in green and if you don't have children then you are smart, and you don't have to but if you have children you and your spouse also must complete divorce...

Fill form : Try Risk Free

People Also Ask about missouri form 5049 2014

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your missouri form 5049 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.