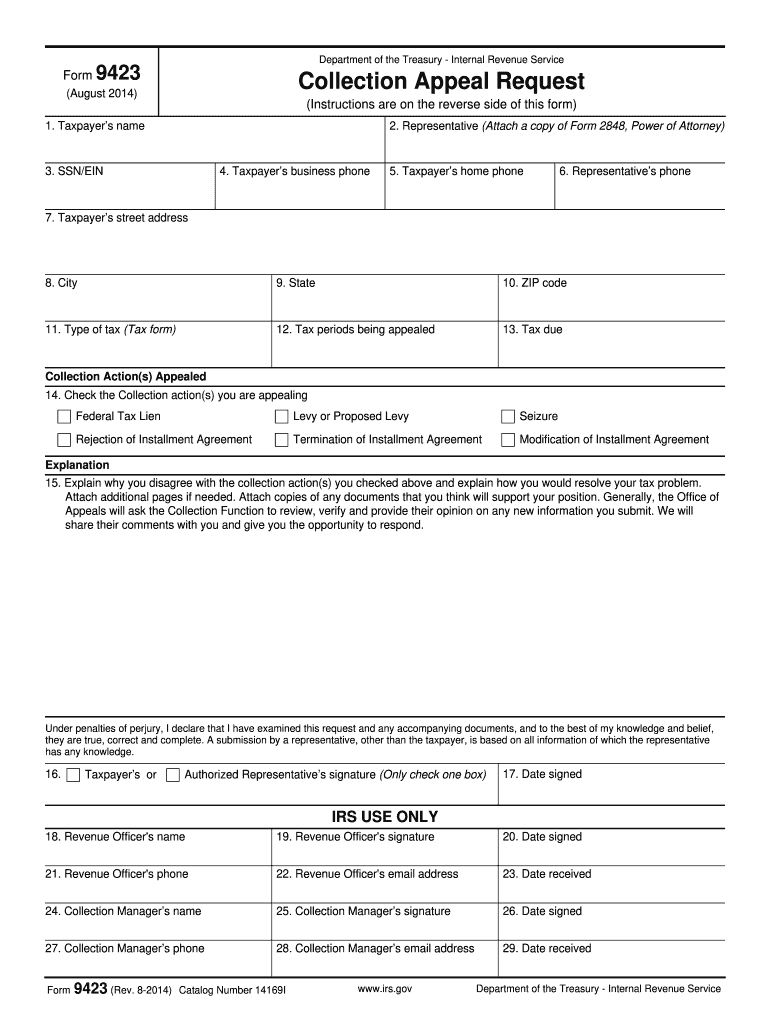

Who needs a 9423 Form?

The form 9423 is the United States Internal Revenue Service form, fully called a Collection Appeal Request. The form should be by a taxpayer or a third party whose property was subject to a collection action, but who wants to appeal the action according to the provisions of the Collection Appeals Program (CAP). The CAP regulates such actions:

-

The already taken action of levy or seizure or the one that is about to be taken.

-

The already filed or upcoming NFL (Notice of Federal Tax Lien).

-

Rejection of requests to issue lien certificates (subordination, withdrawal, discharge or non-attachment).

-

The rejections, terminations or changes made to installment agreements.

-

Disallowance of taxpayer's request to return levied property as defined in IRC 6343(d).

-

Disallowance of property owner's claim for return of property as defined in IRC 6343(b), etc.

Is the 9423 Form accompanied by any other forms?

There is no need to attach any supporting forms to the filled out 9423 form unless the filer themselves considers it necessary. If the claimant believes there are documents that can contribute to the approval of the request, it is necessary to provide the copies of such documents.

If the claimant is represented by an attorney, the form 2848, Power of Attorney and Declaration of Representative must be attached.

When is the Collection Appeal Request form due?

Depending on the specific action appeal, the deadlines for the Form 9423 submission vary. There are clearly indicated in the instruction on the second page of the form itself.

How to fill out the 9423 Appeal Request?

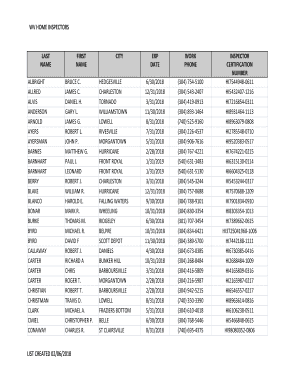

The following information is required on the completed form 9423:

The taxpayer’s name;

Their SSN or EIN;

Full address;

Tax type and which period is being appealed;

Collection actions appealed;

And the thorough explanation.

Finally it must be signed by the taxpayer (or their attorney) and dated.

The bottom part of the form will be filled out by the IRS officers.