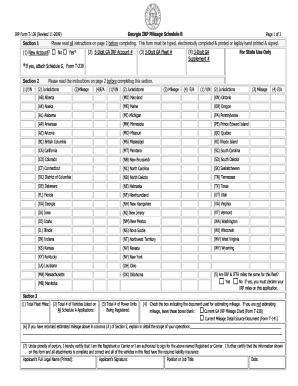

GA DoR IRP T-139 2013-2025 free printable template

Get, Create, Make and Sign georgia irp - motor

Editing georgia irp - motor online

Uncompromising security for your PDF editing and eSignature needs

GA DoR IRP T-139 Form Versions

How to fill out georgia irp - motor

How to fill out GA DoR IRP T-139

Who needs GA DoR IRP T-139?

Instructions and Help about georgia irp - motor

Across North America millions of professional truck drivers are on the road each day delivering the products to keep our economy moving this efficient flow can be interrupted or even stopped for a number of compliance reasons keeping the economy and your truck moving is made easier through up-to-date compliance with the International registration plan the International registration plan or IRP is an agreement for the registration of commercial motor vehicles involved in interjurisdictional travel throughout the United States and provinces of Canada in this video you'll learn how to be compliant with IRP requirements and avoid problems that result from incomplete distance record-keeping IRP facilitates the collection and distribution of registration fees you pay between member jurisdictions while reducing the requirement of multiple license plates cab cards or registration trip permits to ensure that jurisdictions receive their fair share of revenue based on distance traveled over their highways it provides for the payment of registration fees based on the percentage of total distance the registered fleet of vehicles operated in each jurisdiction before the early 1970s no single registration reciprocity agreement existed that was fair to the motor transportation industry and provided a fair share of revenue to all jurisdictions that changed in 1973 when the International registration plan became the first international uniform interjurisdictional registration agreement this initial agreement included nine jurisdictions and allowed for the apportioning of registration fees based on distance traveled today the 48 contiguous United States the District of Columbia and ten provinces in Canada participate in the IRP facilitates the freedom of vehicle movement for interjurisdictional travel which is the operation of a vehicle into and through a jurisdiction as well as for introduce diction 'El travel such as when a truck picks up a load and delivers that same load within a jurisdiction while motor carriers operating in more than one jurisdiction used to be required to obtain multiple registrations and display multiple plates they now need only a single license plate and cap card because registration from multiple jurisdictions is processed through the base jurisdiction the IRP provides for a smooth registration process for over two million vehicles and ensures fair and accurate registration cost based on the actual operation of vehicles with IRP license plates for the more than two billion dollars in revenue generated through IRP member jurisdictions each year is used to support highway infrastructure and safety related programs in those jurisdictions this provides safer more efficient highways for the motoring public under the IRP jurisdictions must register apportion vehicles which includes issuing license plates and cab cards or proper credentials calculate collect and distribute IRP fees audit carriers for accuracy of reported distance and fees...

People Also Ask about

How much are apportioned plates in GA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit georgia irp - motor on an iOS device?

How do I edit georgia irp - motor on an Android device?

How do I complete georgia irp - motor on an Android device?

What is GA DoR IRP T-139?

Who is required to file GA DoR IRP T-139?

How to fill out GA DoR IRP T-139?

What is the purpose of GA DoR IRP T-139?

What information must be reported on GA DoR IRP T-139?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.