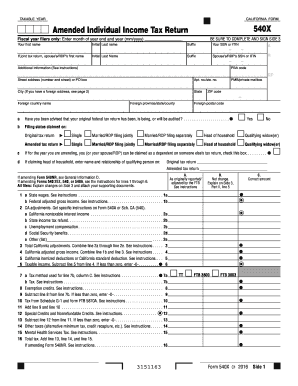

CA FTB 540X 2013 free printable template

Show details

14 For Privacy Notice get FTB 1131 ENG/SP. 3151133 Form 540X C1 2013 Side 1 Your name 17 California income tax withheld. 7 8 Alternative minimum tax. 8 10 Other taxes and credit recapture. 10 Side 2 Form 540X C1 2013 Part II Explanation of Changes 1 Enter name s and address as shown on original return below if same as shown on this tax return write Same. TAXABLE YEAR CALIFORNIA FORM Amended Individual Income Tax Return BE SURE TO COMPLETE AND SIGN SIDE 3 Fiscal year filers only Enter month of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2013 540x form

Edit your 2013 540x form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 540x form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 540x form online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2013 540x form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 540X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2013 540x form

How to fill out CA FTB 540X

01

Obtain a copy of CA FTB 540X form from the California Franchise Tax Board website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate the tax year you are amending.

04

Review your original tax return and identify the corrections that need to be made.

05

Enter the correct figures in the appropriate sections of the form.

06

Complete the 'Explanation of Changes' section, detailing why you are amending your return.

07

Recalculate your tax liability, taking into account the new information.

08

Sign and date the form.

09

Mail the completed CA FTB 540X form to the address specified in the instructions.

Who needs CA FTB 540X?

01

Individuals who have filed a California personal income tax return (Form 540) and need to correct errors or changes.

02

Taxpayers who have received a notice from the California Franchise Tax Board requiring a revision of their previously filed return.

03

Anyone who needs to claim a refund due to corrections or changes in their financial situation.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my California state tax transcript?

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.

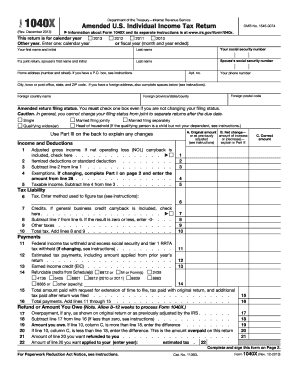

Do I need to attach 1040 to CA 540?

Attach both the federal Schedule A (Form 1040) and California Schedule CA (540) to the back of your tax return. Standard deduction. Find your standard deduction on the California Standard Deduction Chart for Most People on this page.

Can I file CA 540 online?

Accepted forms Forms you can e-file for an individual: California Resident Income Tax Return (Form 540) California Resident Income Tax Return (Form 540 2EZ) California Nonresident or Part-Year Resident Income Tax Return (Form 540NR)

Where is my CA inflation check?

If you believe you should have received your payment already but haven't, the FTB suggests contacting customer service at 1-800-542-9332. A customer service agent will help you confirm you qualify, explain what payment you'll receive and when.

How do I know if I'm getting a California rebate?

Determine your eligibility You are eligible if you: Filed your 2020 tax return by October 15, 2021 [i] Meet the California adjusted gross income (CA AGI) limits described in the What you may receive section. Were not eligible to be claimed as a dependent in the 2020 tax year.

How do I get my California rebate?

You will receive your payment by mail in the form of a debit card if you: Filed a paper return. Had a balance due. Received your Golden State Stimulus (GSS) payment by check.

Is there a form 540X?

A claim for refund of an overpayment of tax should be made by filing Form 540X. Do not file Form 540X to correct your SSN, name, or address. Instead, call or write us. See General Information G, Contacting the Franchise Tax Board, for instructions.

Do I need to fill out Schedule CA 540?

If there are no differences between your federal and California income or deductions, do not file a Schedule CA (540), California Adjustments - Residents. If there are differences between your federal and California income or deductions, complete Schedule CA (540).

Can form 540X be filed electronically?

Accepted forms Forms you can e-file for an individual: California Resident Income Tax Return (Form 540)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 2013 540x form in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 2013 540x form in seconds.

Can I create an electronic signature for signing my 2013 540x form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 2013 540x form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit 2013 540x form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share 2013 540x form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is CA FTB 540X?

CA FTB 540X is a form used by California taxpayers to amend their state income tax return, allowing them to correct mistakes or make changes to previously filed returns.

Who is required to file CA FTB 540X?

Taxpayers who need to correct errors on their original California income tax return or who wish to claim a refund or additional tax credits are required to file CA FTB 540X.

How to fill out CA FTB 540X?

To fill out CA FTB 540X, provide your personal information, details of the original return, itemized changes, and the reason for the amendment. Follow the instructions provided on the form carefully.

What is the purpose of CA FTB 540X?

The purpose of CA FTB 540X is to allow taxpayers to amend their existing tax returns to correct any inaccuracies and ensure compliance with California tax laws.

What information must be reported on CA FTB 540X?

The information required on CA FTB 540X includes personal identifying information, the period of the return being amended, changes made to income, deductions, credits, and the reason for the amendments.

Fill out your 2013 540x form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 540x Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.