OK OTC 921 2015 free printable template

Show details

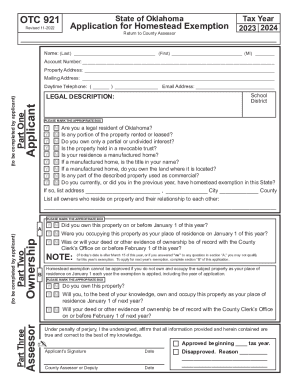

OTC 921 State of Oklahoma Application for Homestead Exemption Revised 6-2014 County Return to County Assessor Tax Year 2015 Name: (Last) (First) (MI) Account Number: Property Address: Daytime Telephone:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign otc 921 2015 form

Edit your otc 921 2015 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your otc 921 2015 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit otc 921 2015 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit otc 921 2015 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 921 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out otc 921 2015 form

How to fill out OK OTC 921

01

Gather all necessary documentation and information required for the application.

02

Begin by filling out the basic applicant information including name, address, and contact details.

03

Provide details of the OTC (Over-the-Counter) transaction including product name and quantity.

04

Include any pertinent regulatory compliance information as required.

05

Review the filled form for accuracy and completeness.

06

Submit the completed form to the appropriate regulatory body.

Who needs OK OTC 921?

01

Individuals or businesses engaging in Over-the-Counter transactions.

02

Entities looking to comply with regulatory requirements for OTC trading.

03

Financial institutions and brokers handling OTC securities.

Instructions and Help about otc 921 2015 form

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for homestead exemption in Oklahoma?

A Homestead Exemption is an exemption of $1,000 of the assessed valuation of the homestead property. Homestead Exemption is granted to the homeowner who resides in the property on a permanent basis on January 1.

How do you become exempt from property taxes in Oklahoma?

The application for homestead exemption shall be filed with the county assessor of the county in which the homestead is located. A taxpayer applying for homestead exemption shall not be required to appear before the county assessor in person to submit such application.

How long do you have to pay property taxes in Oklahoma?

PAYMENT SCHEDULE Your property taxes may be paid in full or in two installments: The one half or the full amount must be paid by December 31st. If nothing is paid by December 31st, then the full amount becomes delinquent January 1st and interest is added.

What is the purpose of homestead exemption Oklahoma?

Oklahoma homeowners can exempt the entire value of their homes in bankruptcy using the Oklahoma homestead exemption.

Who are exempted from paying real property tax?

“Charitable institutions, churches, parsonages or convents appurtenant thereto, mosques, non-profit or religious cemeteries and all lands, buildings and improvements actually, directly, and exclusively used for religious, charitable, or educational purposes.”

How do I homestead My house in Oklahoma?

To receive homestead exemption, a taxpayer shall be required to file an application for homestead exemption with the county assessor in which their property is located. Click for County Assessor's Listing For any questions or comments, please call 713-1235, or e-mail us. number and the legal description.

What is considered a homestead in Oklahoma?

The homestead of any person in this State, not within any city or town, shall consist of not more than one hundred sixty acres of land, which may be in one or more parcels, to be selected by the owner.

What qualifies as a homestead in Oklahoma?

Any person 65 years of age or older or any totally disabled person, who is head of household, was a resident of this state during the entire preceding calendar year and whose gross household income does not exceed $12,000 is qualified for the program and may apply.

Who qualifies for homestead exemption in Oklahoma?

Anyone who is 65 or older or totally disabled, who is head of household, and a resident of the state of Oklahoma during the previous year and whose gross household income does not exceed 12,000 is qualified for this program.

Who is exempt from paying property taxes in Oklahoma?

You may qualify for a real and personal property tax exemption. You must be an Oklahoma resident and eligible for homestead exemption. An exemption from property tax on homesteads is available for 100% disabled veterans. The exemption would apply to 100% disability rated veterans and their surviving spouses.

How do you qualify for homestead exemption in Oklahoma?

Anyone who is 65 or older or totally disabled, who is head of household, and a resident of the state of Oklahoma during the previous year and whose gross household income does not exceed 12,000 is qualified for this program.

What age do you stop paying property taxes in Oklahoma?

The property owner must be age 65 or over as of January 1st to qualify. Gross household income from the preceding year does not exceed the 2022 maximum income qualification of $73,200.

How much does homestead exemption save you in Oklahoma?

Homestead Exemption is an exemption of $1,000 of the assessed valuation. This can be a savings of $87 to$134 depending on which area of the county you are located.

Who is exempt from property taxes in Oklahoma?

Anyone who is 65 or older or totally disabled, who is head of household, and a resident of the state of Oklahoma during the previous year and whose gross household income does not exceed 12,000 is qualified for this program.

At what age do you stop paying property tax in Oklahoma?

The property owner must be age 65 or over as of January 1st to qualify. Gross household income from the preceding year does not exceed the 2022 maximum income qualification of $73,200.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my otc 921 2015 form directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your otc 921 2015 form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete otc 921 2015 form online?

Easy online otc 921 2015 form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I edit otc 921 2015 form on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing otc 921 2015 form.

What is OK OTC 921?

OK OTC 921 is a specific form or document used for reporting certain kinds of transactions or activities, often related to over-the-counter activities in a regulatory context.

Who is required to file OK OTC 921?

Individuals or entities engaged in activities that fall under the jurisdiction of the Oklahoma Tax Commission, particularly those involved in specific types of transactions that require reporting, are required to file OK OTC 921.

How to fill out OK OTC 921?

To fill out OK OTC 921, one must provide accurate information as specified on the form, including details about the transactions being reported, the parties involved, and any relevant financial data required by the Oklahoma Tax Commission.

What is the purpose of OK OTC 921?

The purpose of OK OTC 921 is to ensure transparency and compliance with state regulations regarding specific transactions, allowing for accurate tracking and reporting to the Oklahoma Tax Commission.

What information must be reported on OK OTC 921?

Information that must be reported on OK OTC 921 typically includes details about the transaction type, the amounts involved, identification of the parties, and any applicable regulatory compliance details as required by the Oklahoma Tax Commission.

Fill out your otc 921 2015 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Otc 921 2015 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.