GA DoR G-4 2014 free printable template

Show details

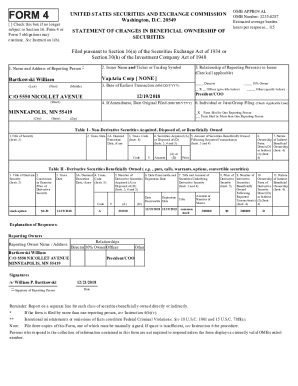

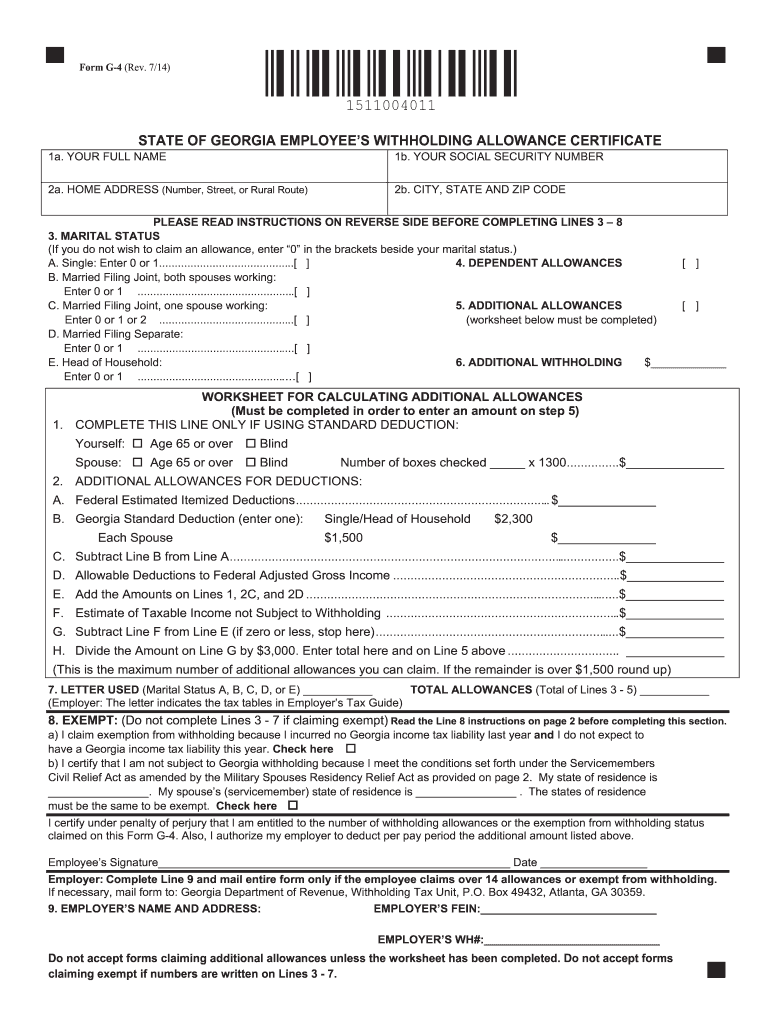

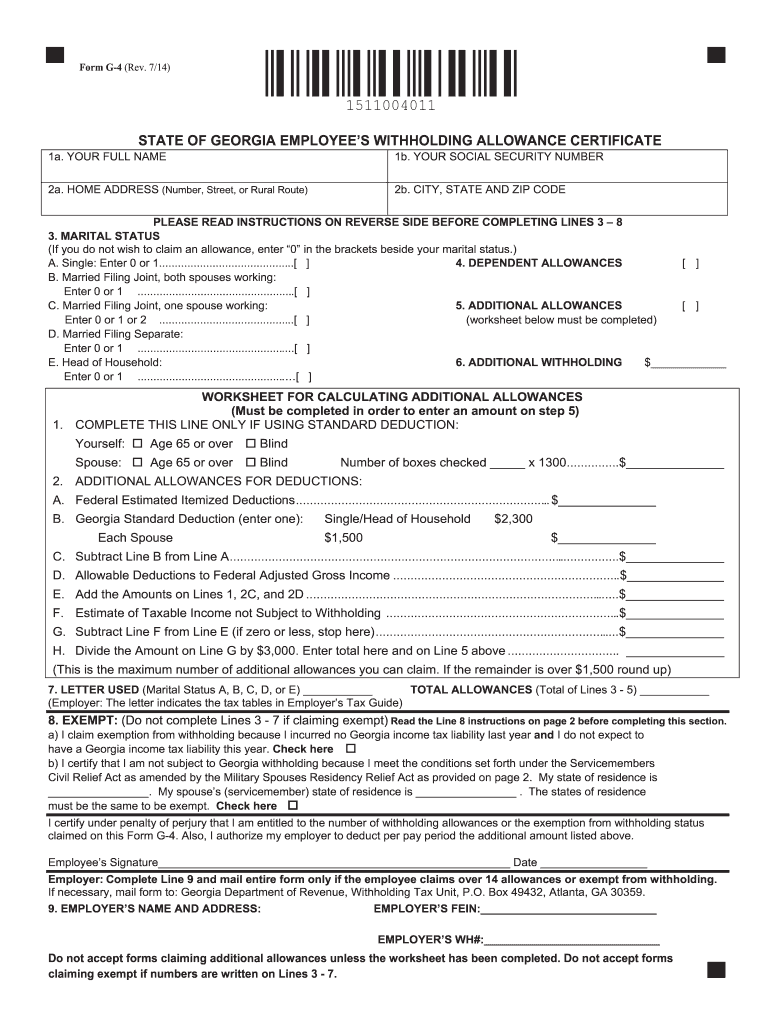

PRINT CLEAR Form G-4 Rev. 7/14 STATE OF GEORGIA EMPLOYEE S WITHHOLDING ALLOWANCE CERTIFICATE 1a. YOUR FULL NAME 1b. INSTRUCTIONS FOR COMPLETING FORM G-4 Enter your full name address and social security number in boxes 1a through 2b. O. C. G.A. 48-7-102 requires you to complete and submit Form G-4 to your employer in order to have tax withheld from your wages. Failure to submit a properly completed Form G-4 will result in your employer withholding tax as though you are single with zero...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA DoR G-4

Edit your GA DoR G-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA DoR G-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GA DoR G-4 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit GA DoR G-4. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA DoR G-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA DoR G-4

How to fill out GA DoR G-4

01

Obtain the GA DoR G-4 form from the official website or your local Department of Revenue office.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details, in the designated sections.

04

Provide any necessary identification numbers, such as your Social Security Number or Tax Identification Number.

05

Complete the specific sections related to the purpose of the form, such as tax exemptions or deductions, if applicable.

06

Double-check all information for accuracy and completeness before submitting.

07

Submit the completed form according to the instructions, either by mail or online as specified.

Who needs GA DoR G-4?

01

Individuals or businesses seeking tax exemptions in Georgia.

02

Taxpayers who need to report specific deductions or credits on their tax returns.

03

Those who are required to comply with state tax regulations for specific circumstances.

Fill

form

: Try Risk Free

People Also Ask about

How to fill out an employee withholding allowance certificate?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Indicate Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date Form W-4.

Which form is the Employee's withholding allowance Certificate?

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Who fills out the employee's withholding allowance Certificate?

Form W-4, the Employee's Withholding Certificate, is filled out by an employee to instruct the employer how much to withhold from your paycheck. The IRS requires that individuals pay income taxes gradually throughout the year.

What is the purpose of employee's withholding allowance certificate?

Purpose: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What should I put for my withholding allowance?

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

How to properly fill out Employee's withholding allowance Certificate?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Indicate Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date Form W-4.

Should my withholding allowance be 0?

Claiming 0 Allowances on your W4 ensures the maximum amount of taxes are withheld from each paycheck. Plus, you'll most likely get a refund back at tax time.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send GA DoR G-4 for eSignature?

When you're ready to share your GA DoR G-4, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out the GA DoR G-4 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign GA DoR G-4 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete GA DoR G-4 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your GA DoR G-4. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is GA DoR G-4?

GA DoR G-4 is a tax form used for reporting certain information related to real estate transactions in the state of Georgia.

Who is required to file GA DoR G-4?

Anyone involved in a real estate transaction in Georgia, such as buyers, sellers, or real estate agents, may be required to file the GA DoR G-4 form.

How to fill out GA DoR G-4?

To fill out the GA DoR G-4, provide all requested information related to the transaction, including names, addresses, property details, and amounts involved. Follow the instructions on the form carefully.

What is the purpose of GA DoR G-4?

The purpose of GA DoR G-4 is to ensure proper reporting of real estate transactions for tax purposes and to facilitate the collection of transfer taxes.

What information must be reported on GA DoR G-4?

The GA DoR G-4 must report information such as the names and addresses of the parties involved, the property description, the sales price, and other pertinent transaction details.

Fill out your GA DoR G-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA DoR G-4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.