MA DoR 1099-HC 2015 free printable template

Show details

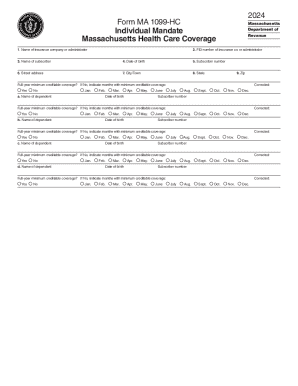

Form MA 1099-HC Individual Mandate Massachusetts Health Care Coverage 1. Name of insurance company or administrator Department of Revenue 2. FID number of insurance co. or administrator 3. Name of subscriber 4. Date of birth 6. Street address 7. City/Town 5. Subscriber number 8. State 9. Zip Full-year minimum creditable coverage If No check months with minimum creditable coverage Yes No a* Name of dependent Jan* Feb. FID number of insurance co. or administrator 3. Name of subscriber 4. Date...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR 1099-HC

Edit your MA DoR 1099-HC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR 1099-HC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA DoR 1099-HC online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MA DoR 1099-HC. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR 1099-HC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR 1099-HC

How to fill out MA DoR 1099-HC

01

Obtain the MA DoR 1099-HC form from the Massachusetts Department of Revenue website or your tax provider.

02

Fill in your taxpayer identification number, which is usually your Social Security Number.

03

Provide the name and address of the health insurance provider in the appropriate sections.

04

Enter your health insurance policy number.

05

Indicate the months during which you were covered by the insurance in the designated fields.

06

Review all information for accuracy.

07

Submit the completed form to the Massachusetts Department of Revenue by the required deadline.

Who needs MA DoR 1099-HC?

01

Individuals who had health insurance coverage in Massachusetts during the tax year.

02

Taxpayers who are required to prove their health insurance coverage under Massachusetts state law.

03

Anyone who received health insurance coverage through their employer or purchased it individually in Massachusetts.

Fill

form

: Try Risk Free

People Also Ask about

Can I file my taxes without a 1099-HC?

If we send you MA 1099-HC, you will need it to fill out your state income tax return. Like the federal 1095-B form, the 1099-HC shows each month you had MassHealth coverage in 2022. Important: If you do not receive a 1099-HC form, you do not need it to fill out your state income tax return.

How do I get my 1099-HC from MassHealth?

If you can't find your 1099-HC, you can call us at (866) 682-6745; TDD/TTY: 711 for a replacement copy. You can also contact the MassHealth Customer Service Center at (866) 682-6745; TDD/TTY: 711. You will need your MassHealth member ID, last name, and date of birth to request your Form 1095-B.

Do I need 1099-HC to file taxes in Massachusetts?

FORM 1099-HC (REQUIRED FOR MASS. STATE TAX RETURN) Form 1099-HC is needed to complete your MA state tax return. This form serves as proof of health insurance coverage for Massachusetts residents age 18 and older.

What is the difference between a 1095 and a 1099-HC?

What is the difference between Form 1095-A and Form 1099-HC? Form 1095-A is a federal tax document, while Form 1099-HC is a Massachusetts state tax document. Both forms report the months someone had health insurance the previous year.

What is a 1099-HC form?

Form 1095-B and 1099-HC are tax documents that show you had health insurance coverage considered Minimum Essential Coverage during the last tax year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find MA DoR 1099-HC?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the MA DoR 1099-HC in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit MA DoR 1099-HC online?

With pdfFiller, it's easy to make changes. Open your MA DoR 1099-HC in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit MA DoR 1099-HC on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share MA DoR 1099-HC from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is MA DoR 1099-HC?

MA DoR 1099-HC is a tax form used in Massachusetts to report health insurance coverage to the Department of Revenue. It is specifically used to verify that individuals had health insurance coverage for the reporting year, as per the state's health care law.

Who is required to file MA DoR 1099-HC?

Employers providing health insurance coverage, along with insurance companies and other entities offering health plans, are required to file MA DoR 1099-HC for individuals that were covered under their plans during the tax year.

How to fill out MA DoR 1099-HC?

To fill out MA DoR 1099-HC, you need to provide details such as the name and address of the covered individual, the identification number of the provider, the months of coverage, and any other required information according to the instructions provided by the Massachusetts Department of Revenue.

What is the purpose of MA DoR 1099-HC?

The purpose of MA DoR 1099-HC is to serve as a record for the state and individuals to confirm that they had qualifying health insurance coverage, thereby fulfilling the requirements of the Massachusetts health care law and aiding in tax filings.

What information must be reported on MA DoR 1099-HC?

The information that must be reported on MA DoR 1099-HC includes the name and address of the covered individual, the taxpayer identification number, months of coverage, the provider's information, and any other details outlined in the form's instructions.

Fill out your MA DoR 1099-HC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR 1099-HC is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.