Get the free tx ifta 2015 form

Show details

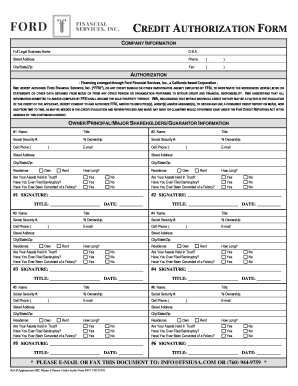

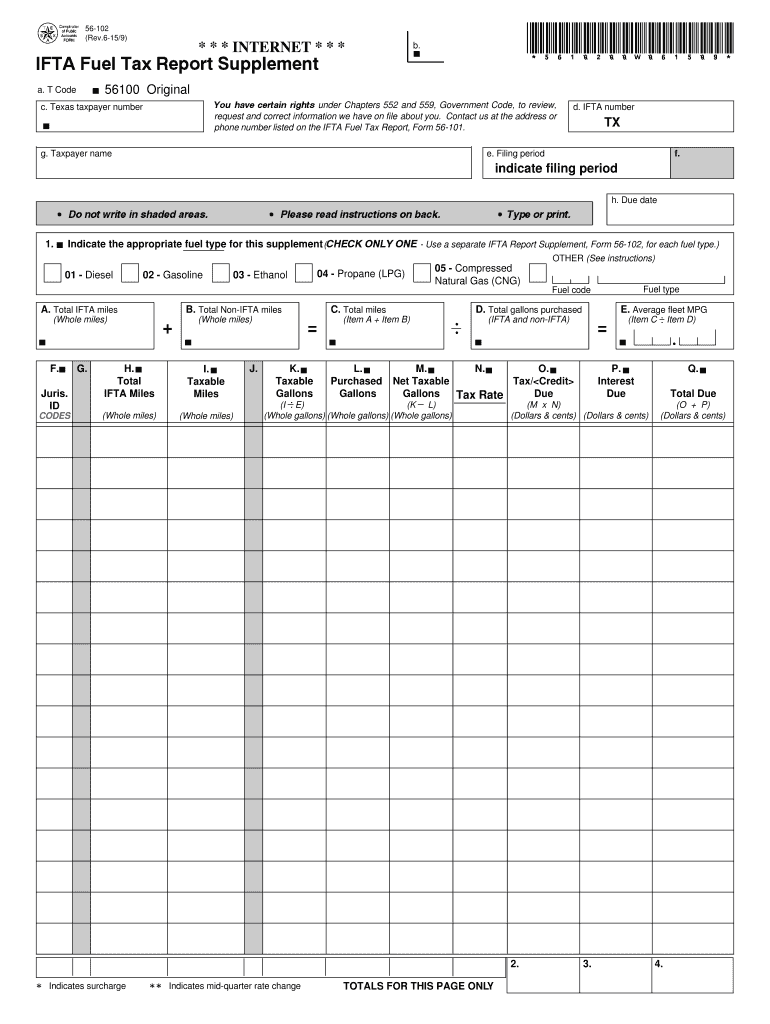

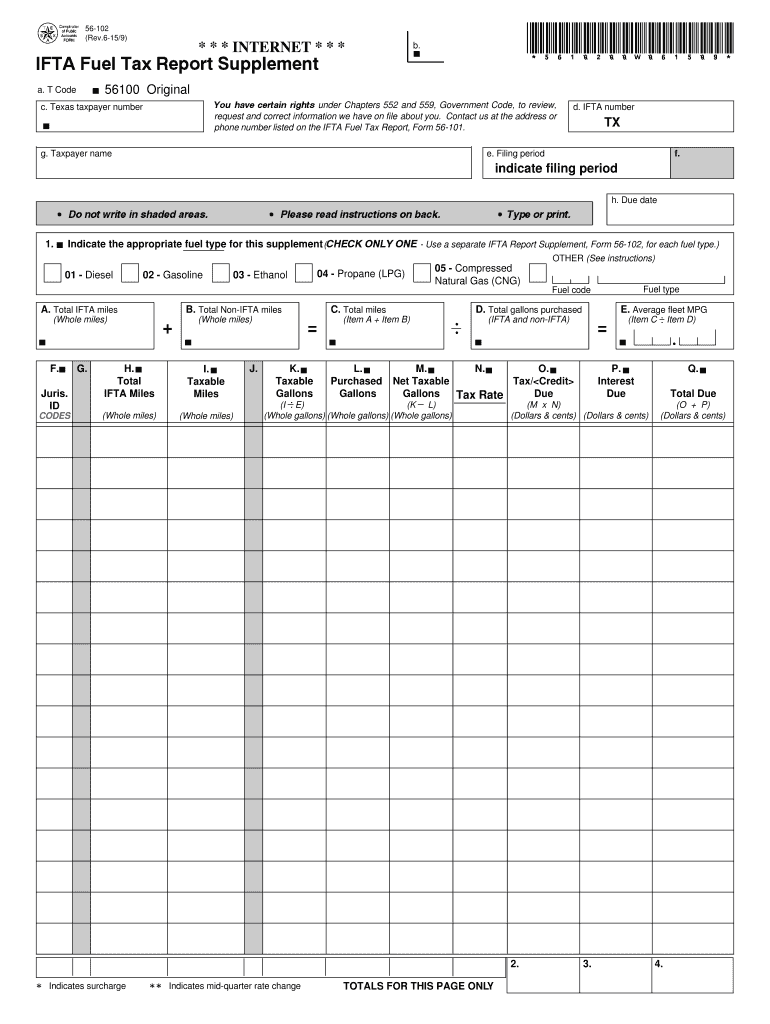

Taxpayer name d. IFTA number TX e. Filing period f. indicate filing period h. Due date Do not write in shaded areas. Contact us at the address or phone number listed on the IFTA Fuel Tax Report Form 56-101. You have certain rights g. Use a separate Form 56-102 for each fuel type. 56-102 Rev.6-15/9 IFTA Fuel Tax Report Supplement PRINT FORM CLEAR FIELDS 5610200W061509 Instructions in English b. Cpa.state. tx. us/taxinfo/fuels/biodiesel.pdf for additional information on reporting biodiesel....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tx ifta 2015 form

Edit your tx ifta 2015 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tx ifta 2015 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tx ifta 2015 form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tx ifta 2015 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tx ifta 2015 form

How to fill out TX Comptroller 56-102

01

Visit the Texas Comptroller's website to download Form 56-102.

02

Provide your name and address in the designated fields at the top of the form.

03

Enter your Texas taxpayer identification number, if applicable.

04

Fill out the type of exemption you are applying for by selecting the appropriate box.

05

Include any supporting documentation that may be required for your exemption.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to the Texas Comptroller's office via mail or online as instructed.

Who needs TX Comptroller 56-102?

01

Any individual or business entity in Texas seeking a tax exemption.

02

Organizations that qualify under specific exemption criteria outlined by the state.

03

Entities that wish to assert their tax-exempt status for sales tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I get an IFTA in Texas?

To be issued a Texas IFTA license, Texas must be your base jurisdiction. For Assistance - If you have any questions about this application, filing tax returns or any other tax-related matter, contact the Texas State Comptroller's office at 1-800-252-1383. We process applications in the order they are received.

Can I drive without IFTA sticker in Texas?

Operating a motor vehicle in Texas without a valid IFTA license, interstate trucker license or fuel trip permit may subject you to a penalty under Subchapter E of the Texas Motor Fuels Tax Code.

How much is IFTA in Texas?

There is no fee for the Texas IFTA license and decals. Once the application is received, if any additional information is needed you will be contacted by phone, so be sure to provide a phone number where you can be reached.

Is IFTA required in Texas?

If you were wondering whether or not you're exempt, know that you must register and file for IFTA if you have: Any vehicle with two axles and a gross vehicle weight of over 11,797 kilograms or 26,000 pounds. A vehicle of any weight but with three or more axles. A vehicle that exceeds 11,797 kilograms or 26,000 pounds.

What is the IFTA reporting form for Texas?

IFTA Reporting IFTA fuel tax reports can be filed electronically using Webfile or EDI software, or on paper using Form 56-101, International Fuel Tax Agreement (IFTA) Fuel Tax Report (PDF), and Form 56-102, IFTA Fuel Tax Report Supplement (PDF).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tx ifta 2015 form in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing tx ifta 2015 form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit tx ifta 2015 form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute tx ifta 2015 form from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out tx ifta 2015 form on an Android device?

Use the pdfFiller Android app to finish your tx ifta 2015 form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is TX Comptroller 56-102?

TX Comptroller 56-102 is a form used by Texas taxpayers to report certain information related to their tax obligations, often connected to state and local taxes.

Who is required to file TX Comptroller 56-102?

Any taxpayer or business entity operating in Texas that meets specific criteria outlined by the Texas Comptroller's office is required to file TX Comptroller 56-102.

How to fill out TX Comptroller 56-102?

To fill out TX Comptroller 56-102, taxpayers must provide the required information such as their taxpayer identification number, business details, and any relevant financial data, ensuring all sections of the form are completed accurately.

What is the purpose of TX Comptroller 56-102?

The purpose of TX Comptroller 56-102 is to assist the Texas Comptroller in collecting necessary data for tax administration, ensuring compliance with state tax laws.

What information must be reported on TX Comptroller 56-102?

Taxpayers must report their taxpayer identification number, business name and address, financial information, and any specific details related to their tax obligations as required by the form.

Fill out your tx ifta 2015 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tx Ifta 2015 Form is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.