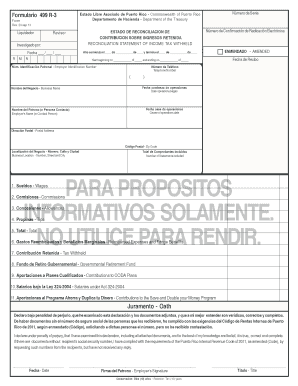

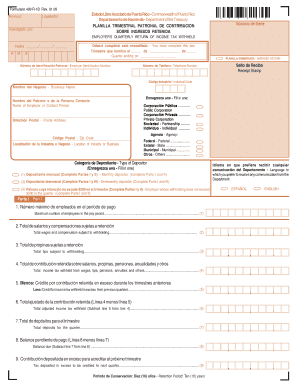

Who needs the 449 R-1B Form?

The 449 R-1B Form is the Puerto Rico Employer's Quarterly Return of Income Tax Withheld. Every employer must file this form in order to deduct and withhold income tax form salaries as Section 1062.01 of the Puerto Rico Internal Revenue Code of 2011 prescribes. However, there is an exemption stating that in case an employee’s gross annual salary is less than $20,000, they are not subject to income tax withholding at source from such wages.

What is the purpose of the the 449 R-1B form?

The Employer’s Quarterly Return of Income Tax Withheld should be submitted in order to officially report the amount of taxes withheld from the employee's salary for a quarter period.

When is the Employer’s Quarterly Return of Income Tax Withheld due?

The employer should submit the Quarterly Return on, or prior to, the last day of the month following the close of the quarter. The end dates of the quarters are fixed and are March 31, June 30, September 30, and December 31.

Is the 449 R-1B Form accompanied by any other forms?

If the return form is completed by an authorized representative, it is necessary to attach the AS from 2778.1 which is the Power and Declaration of Representation for Digital Signature by Returns, Declarations and Refund Claims Specialists.

If it is necessary to make a payment, the check or money order must be included along with the deposit coupon.

How do I fill out the Employer’s Quarterly Return form?

The 449 R-1B Form is a 22-page document that contains 16 pages of comprehensive instructions that describe the filling procedure. You should read these instructions and complete the form accordingly.

Where do I send the completed 449 R-1B Form?

The Employer’s Quarterly Return and the accompanying payment should submitted to the Treasury Department of Puerto Rico.