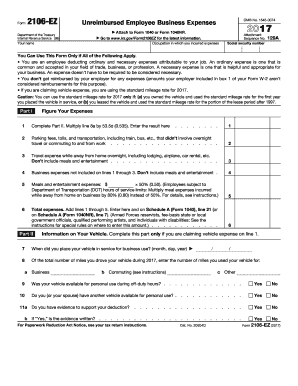

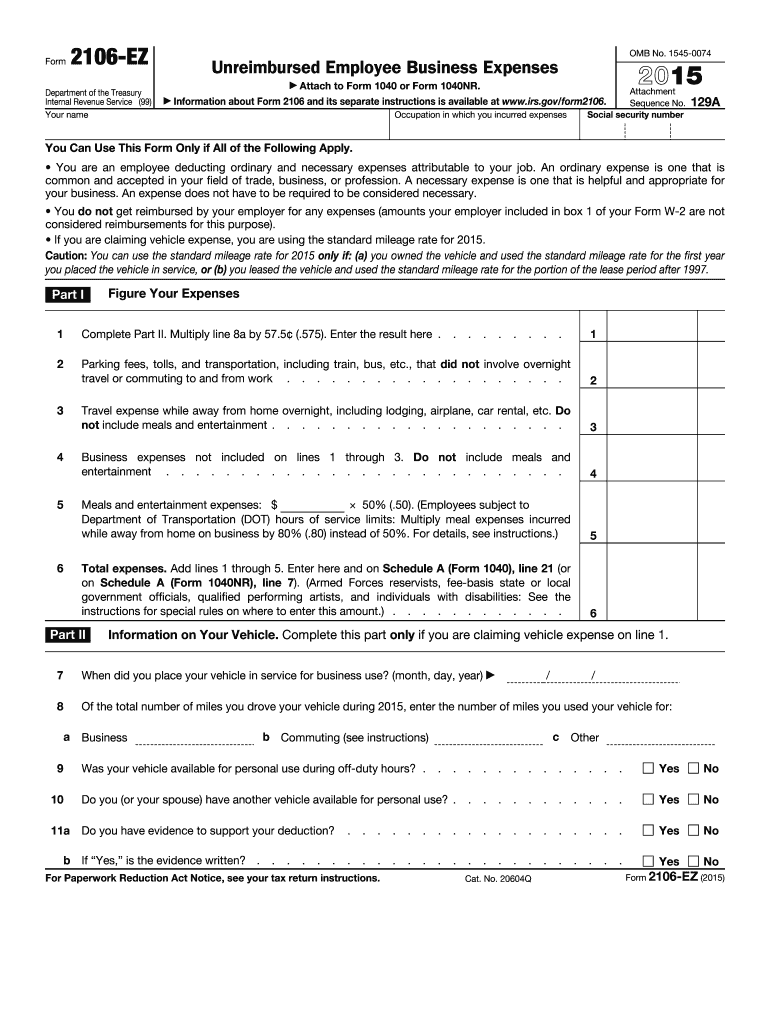

IRS 2106-EZ 2015 free printable template

Instructions and Help about IRS 2106-EZ

How to edit IRS 2106-EZ

How to fill out IRS 2106-EZ

About IRS 2106-EZ 2015 previous version

What is IRS 2106-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 2106-EZ

Where do I find [SKS]?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the [SKS] in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for signing my [SKS] in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your [SKS] and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit [SKS] on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute [SKS] from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IRS 2106-EZ?

IRS 2106-EZ is a simplified form used by employees for reporting expenses related to business use of their vehicle, primarily for deducting these expenses from their taxable income.

Who is required to file IRS 2106-EZ?

Employees who use their personal vehicles for business purposes and want to claim vehicle-related deductions on their tax returns are required to file IRS 2106-EZ.

How to fill out IRS 2106-EZ?

To fill out IRS 2106-EZ, gather information on business miles driven, total miles driven, and applicable expenses. Complete the form by entering your personal details, the required mileage information, and total expenses before submitting with your tax return.

What is the purpose of IRS 2106-EZ?

The purpose of IRS 2106-EZ is to provide a simplified way for employees to report unreimbursed business-related expenses and claim deductions for their vehicle use.

What information must be reported on IRS 2106-EZ?

The information that must be reported on IRS 2106-EZ includes the number of business miles driven, total miles driven for the year, and any expenses related to the vehicle that are being claimed for deduction.