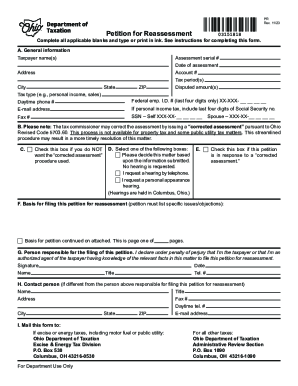

OH ODT PR 2015 free printable template

Show details

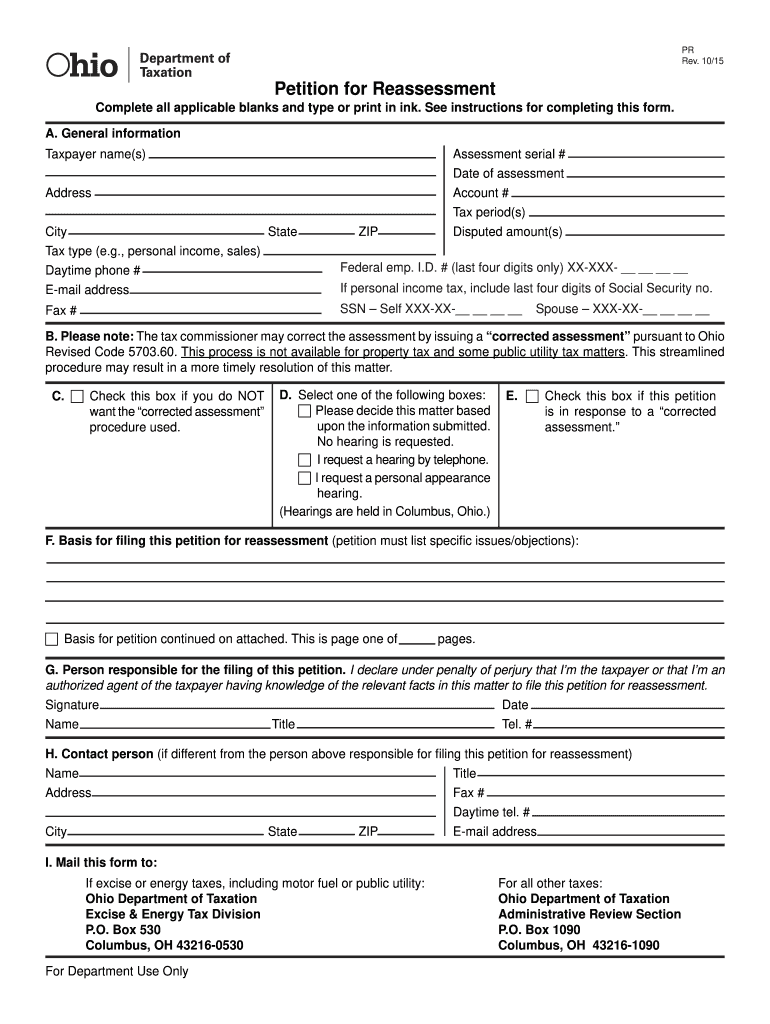

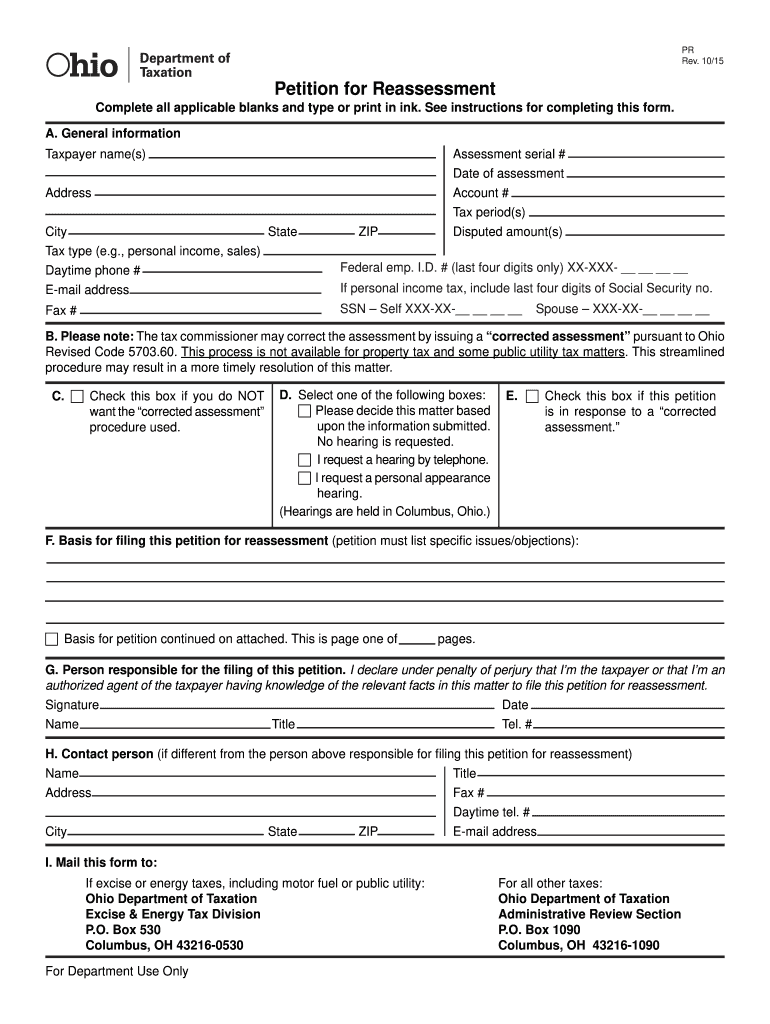

O. Box 530 Columbus OH 43216-0530 For Department Use Only For all other taxes Administrative Review Section P. O. Box 1090 Instructions for Completing Petition for Reassessment This is a generic form that may be used to file a Petition for Reassessment for any tax. Signature Date Name Title Tel. H. Contact person if different from the person above responsible for ling this petition for reassessment Daytime tel. I. Mail this form to If excise or energy taxes including motor fuel or public...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your petition for reassessment ohio form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petition for reassessment ohio form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit petition for reassessment ohio online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ohio petition for reassessment form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

OH ODT PR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out petition for reassessment ohio

01

First, gather all the necessary information regarding your property. This includes the property address, parcel number, current assessed value, and any relevant documentation such as recent sale prices of similar properties in the area.

02

Visit the official website of the Ohio Board of Tax Appeals or the county auditor's office to access the petition for reassessment Ohio form. Ensure you have the most recent version of the form, as it may be updated periodically.

03

Fill out the petition form accurately and completely. Provide your personal information, including your name, contact information, and the capacity in which you are filing the petition (e.g., property owner, attorney representing the property owner).

04

Clearly state the reason for your request for reassessment. This could be due to an incorrect assessment, changes in the property's value or condition, or any other relevant factors that may impact its assessed value.

05

Attach any supporting documentation to strengthen your case. This may include recent property appraisals, sales contracts, photographs showing the property's condition, or any other evidence that supports your claim for reassessment.

06

Carefully review the completed form and attached documentation to ensure accuracy and completeness. Any mistakes or missing information may delay the processing of your petition.

Who needs petition for reassessment Ohio?

01

Property owners who believe that their property has been assessed incorrectly and are seeking a higher or lower property value, which could impact their property taxes.

02

Individuals or entities who have recently purchased a property and believe that the current assessed value does not reflect the property's fair market value.

03

Property owners who have made significant improvements or renovations to their property that may impact its assessed value and wish to have it reassessed accordingly.

Video instructions and help with filling out and completing petition for reassessment ohio

Instructions and Help about petition reassessment form

Fill oh petition : Try Risk Free

People Also Ask about petition for reassessment ohio

How do I appeal my Ohio property tax assessment?

What is Section 5715.19 in Ohio Revised Code?

How do I appeal property taxes in Hamilton County Ohio?

How do I appeal the Board of Revision in Ohio?

How do I complain about the Board of Revision in Ohio?

What is an assessment notice from state of Ohio?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is petition for reassessment ohio?

A petition for reassessment in Ohio refers to a legal process that allows property owners to challenge the assessment value of their property for taxation purposes. Property taxes are typically based on the assessed value of the property, which is determined by the county auditor. If a property owner believes that the assessed value is too high, they can file a petition for reassessment to request a review and potentially obtain a lower valuation. This can result in a lower property tax liability for the owner. The petition for reassessment usually needs to be filed within a specific timeframe and may require the property owner to provide supporting evidence or documentation to support their claim.

Who is required to file petition for reassessment ohio?

In Ohio, only the property owner or their authorized representative is allowed to file a petition for reassessment. This usually includes homeowners or commercial property owners who wish to challenge the assessed value of their property for tax purposes.

How to fill out petition for reassessment ohio?

Filling out a petition for reassessment in Ohio involves the following steps:

1. Obtain the necessary forms: Visit the website of your local county auditor's office or contact them directly to obtain the petition form for reassessment. You can also find the forms at the Ohio Department of Taxation's website.

2. Read and understand the instructions: Carefully review the instructions provided with the petition form to ensure you understand the process and requirements.

3. Gather required information: Collect all the necessary information needed to complete the petition, including the property details such as address, owner's name, parcel number, and current assessed value. Additionally, gather any supporting evidence or documentation that shows why you believe the property should be reassessed.

4. Complete the petition form: Fill out the petition form accurately and thoroughly. Provide all the requested information, ensuring that it is legible and well-organized. Be clear and concise in your explanations and include any supporting evidence or documentation as attachments.

5. Submit the completed form: Once you have filled out the petition form, make copies for your records and submit the original to the appropriate county auditor's office. Check the instructions or the county auditor's website for the preferred method of submission, whether by mail, in-person, or electronically.

6. Follow up: After submitting the petition, it is recommended to follow up with the county auditor's office to confirm receipt and inquire about the timeline for the reassessment process. They may request further information or documentation if needed.

It's important to note that the process and requirements for petitioning for reassessment may vary slightly depending on the county where the property is located. Therefore, referring to the specific instructions and guidelines provided by your local county auditor's office is highly recommended.

What is the purpose of petition for reassessment ohio?

The purpose of a petition for reassessment in Ohio is to allow property owners to request a review of their property's assessed value for tax purposes. This petition is typically filed with the county auditor's office and is meant to address any concerns or discrepancies the property owner may have regarding the assessed value, which directly affects the amount of property taxes they are required to pay. The reassessment process provides an opportunity for property owners to present evidence or arguments to support their claim for a change in the assessed value, potentially reducing their tax burden.

What information must be reported on petition for reassessment ohio?

In Ohio, the following information must be reported on a petition for reassessment:

1. The name and address of the taxpayer or their authorized representative.

2. The specific description of the property that is subject to reassessment, including the parcel number or legal description.

3. The current assessed value of the property.

4. The taxpayer's proposed value or requested reduction in the assessed value.

5. A detailed explanation of the grounds for the reassessment, including any evidence or supporting documentation.

6. Any relevant statutes, case law, or regulations that support the taxpayer's position.

7. Any previous decisions or actions related to the property that may affect the reassessment.

8. The signature of the taxpayer or their authorized representative, along with the date of signature.

It is important to note that the specific requirements for a petition for reassessment may vary depending on the county or municipality in Ohio. Therefore, it is recommended to consult the local Board of Revision or the website of the county auditor's office where the property is located for detailed instructions and any additional required information.

What is the penalty for the late filing of petition for reassessment ohio?

In Ohio, the penalty for the late filing of a petition for reassessment depends on the specific circumstances and the county's regulations. Generally, a taxpayer who fails to file a petition for reassessment within the mandated timeframe may lose the opportunity to challenge the assessment for that tax year. It is crucial to consult with a qualified tax professional or attorney familiar with Ohio tax laws and local county regulations for accurate and up-to-date information on penalties related to late filing.

Can I create an electronic signature for the petition for reassessment ohio in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your ohio petition for reassessment form in minutes.

How do I fill out petition reassessment using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign ohio petition. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete petition for reassessment on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your petition reassessment your form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your petition for reassessment ohio online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petition Reassessment is not the form you're looking for?Search for another form here.

Keywords relevant to ohio reassessment form

Related to ohio petition reassessment

If you believe that this page should be taken down, please follow our DMCA take down process

here

.