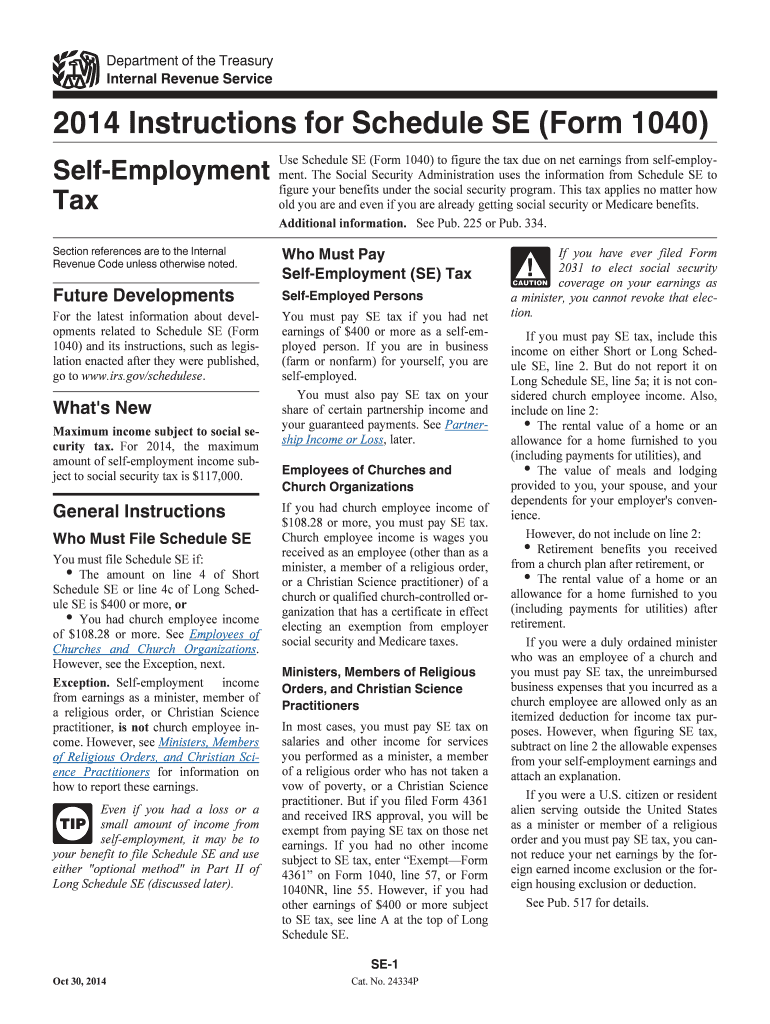

Who Should Read the Instructions for Form 1040 Schedule SE?

An applicant can make use of Form 1040 Schedule SE upon two conditions: when the financial calculations in the statement (the sum on both lines 4 and 4c) are not less than $400 and when a person has income from a church employee that equals $108.28. For more information, you can investigate Employees of Churches and Church Organizations. Besides, the main requirement for the Form is to pay a self-employment tax.

What Is the Purpose of Form 1040 Schedule SE?

The fundamental purpose of Form 1040 Schedule SE is to calculate the tax rate on the assumption of the net earnings available due to self-employment. The Social Security Administration is eligible to avail of the data from the statement for figuring all benefits considering the social security program. This SE tax does not have any age restrictions.

What are the Deadlines?

The deadline may only refer to the period when the applicant pays the tax. There is a fiscal year and Form 1040 Schedule SE should cover all information considering the net earnings on an annual basis.

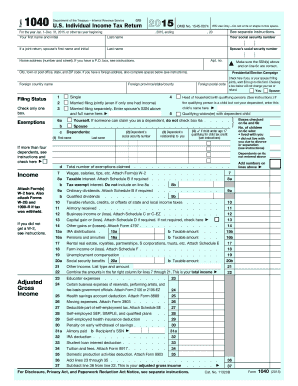

Which Forms Accompany 1040 Schedule SE?

Form 1040 Schedule SE is considered as an attachment to such other templates as a usual 1040 or 1040NR. It does not require any other statements to be added.

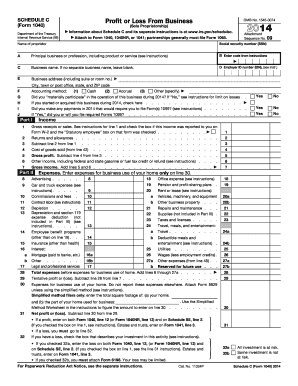

What Information Must be Included in Form 1040 Schedule SE?

First and foremost, you will see a special note informing about the requirements. It is a scheme-like part. Then, there are two sections. The first one is devoted to a Short Schedule SE. The next section is divided into two parts as well. Part 1 includes data about the Self-Employment tax and Part 2 requests to calculate and point out the net earnings.