UT TC-62S 2015 free printable template

Show details

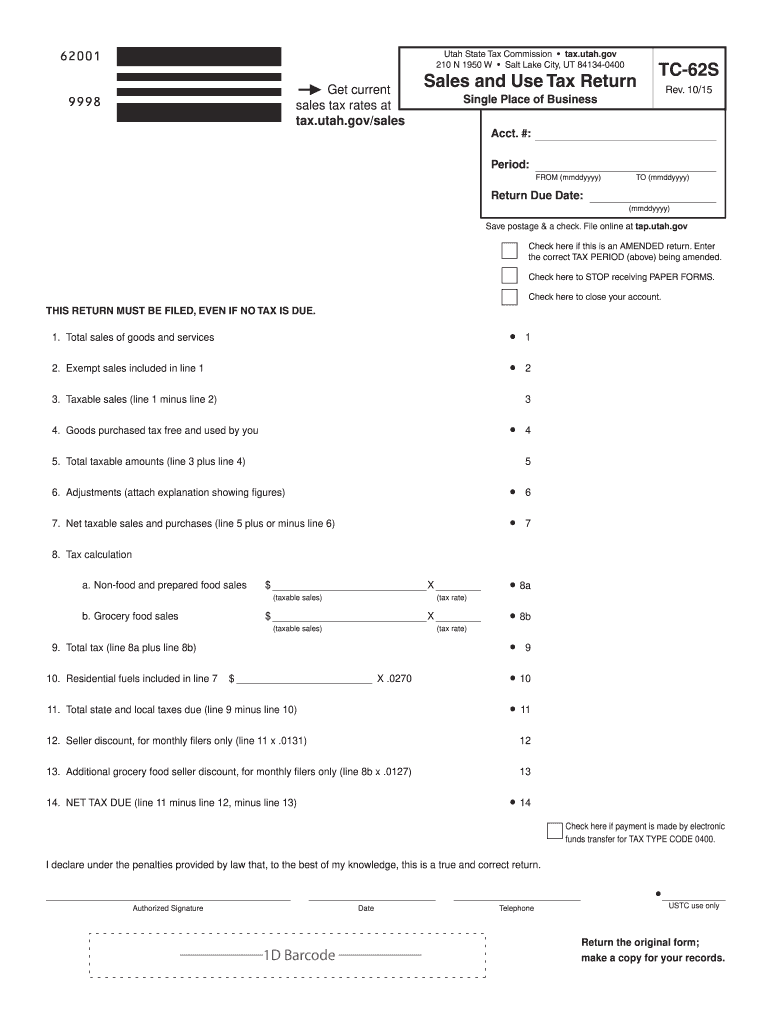

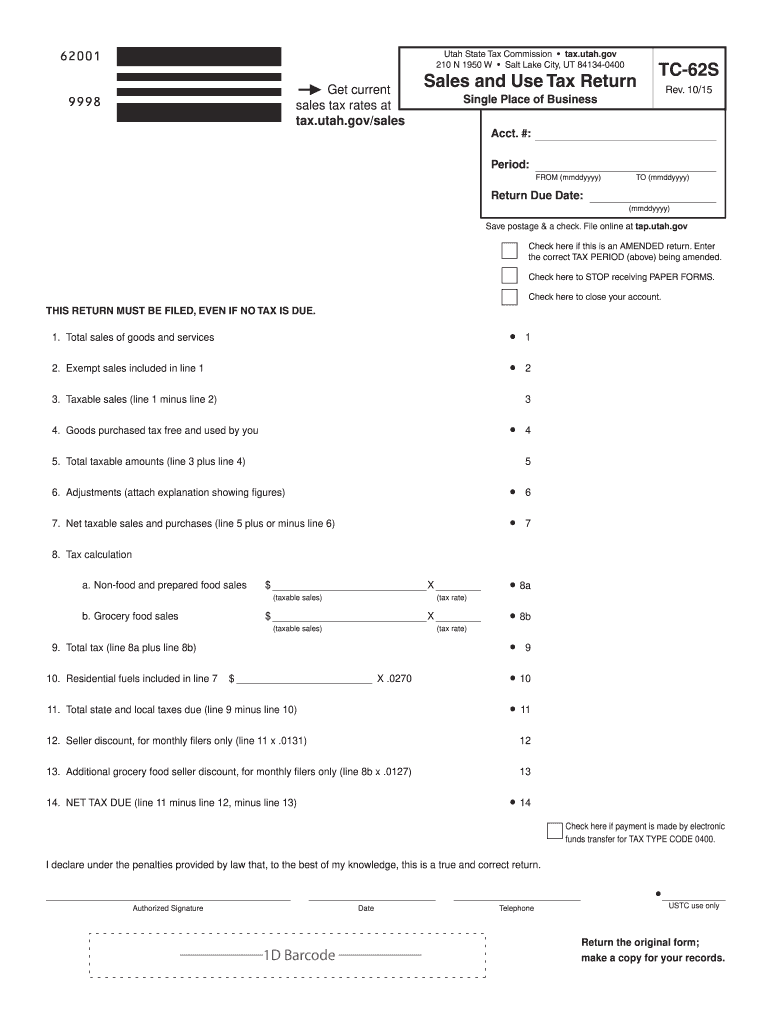

IMPORTANT To protect your privacy use the Clear form button when you are finished. 62000 Instructions for the TC-62S Return Form TC-62S is for filing periods beginning on or after Jan 1 2008. Original ustc form Clear form Print Form tax. utah. gov 62001 Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84134-0400 Sales and Use Tax Return TC-62S Single Place of Business Rev. 10/15 Acct. Start below this line. Enter your company name and address. Period FROM mmddyyyy Return Due Date...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-62S

Edit your UT TC-62S form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-62S form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT TC-62S online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UT TC-62S. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-62S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-62S

How to fill out UT TC-62S

01

Gather all necessary information required for the form.

02

Start with the header section by filling out your name and contact information.

03

Provide the details of the transaction or event that necessitates the form.

04

Complete any required declarations or acknowledgments.

05

Review all filled sections for accuracy before submission.

06

Sign and date the form where indicated.

Who needs UT TC-62S?

01

Individuals or businesses involved in certain transactions that require documentation.

02

Anyone who is filing for a specific tax exemption or credit.

03

Entities needing to report specific financial activities to the tax authority.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to get a tax ID in Utah?

Applying for an EIN for your Utah LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

How do I get a seller's permit in Utah?

How do you register for a sales tax permit in Utah? You can register online at Utah's One Stop Business Registration System. You can also file by mail using form Form TC-69, Utah State Business and Tax Registration.

How do I get a business tax ID number in Utah?

If you need a Utah state tax ID number, your first step should be getting a federal tax ID number. Once you have that, make use of our Utah state tax ID number obtainment services. You can fill out the application online, and get your state tax ID number in 4 to 6 weeks.

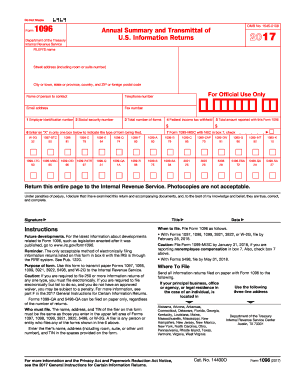

Is there a Utah withholding form?

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

What is the current sales tax in Utah?

Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent. Utah's tax system ranks 8th overall on our 2023 State Business Tax Climate Index.

Do you pay taxes on services in Utah?

Taxable services performed in Utah are subject to Utah sales and use tax even if the service is performed on goods later shipped to another state.

What are the taxes for retirees in Utah?

Utah tax and retirement Social Security benefits are taxed in Utah at 4.85%, but you may be eligible for a partial or full credit depending on how much income you earn. Pension benefits are also taxed. You only pay tax on 55% of your primary residence's value and up to one acre of land.

What services are taxable in Utah?

What's taxable in Utah? Services include professional services provided by lawyers, architects, landscapers, etc. Tangible products, as you might guess, are physical items. The threshold in Utah is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first.

What is the tax rate for services in Utah?

The Utah (UT) state sales tax rate is 4.7%. Depending on local jurisdictions, the total tax rate can be as high as 8.7%. Local-level tax rates may include a local option (up to 1% allowed by law), mass transit, rural hospital, arts and zoo, highway, county option (up to .

What types of goods are generally exempt from a sales tax?

ingly, most states offer product-specific exemptions for items such as food, clothing, prescription medicines, and medical (prosthetic) devices. Those states that don't provide a complete exemption for these items often impose a lower tax rate on them. Exemptions based on type of purchaser.

How is Utah state income tax calculated?

Utah Income Taxes There is a single, flat rate paid by all income earners: 4.85% of their taxable income. Taxable income is calculated by subtracting all personal exemptions from total income. In Utah, you can claim a personal exemption of $579 for each dependent you claimed on your federal tax return.

How do I file CT sales tax?

Form OS‑114, Connecticut Sales and Use Tax Return, must be filed and paid electronically using myconneCT. DRS myconneCT allows taxpayers to electronically file, pay, and manage state tax responsibilities. Click here to File, Pay, or Register Now on myconneCT!

What is exempt from sales tax in Utah?

While the Utah sales tax of 4.85% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Utah. CategoryExemption StatusManufacturing and MachineryRaw MaterialsEXEMPTUtilities & FuelEXEMPTMedical Goods and Services16 more rows

Are medical devices exempt from sales tax in Utah?

Purchases of prosthetic devices are exempt from sales tax if they are used in or on a human and: 1. the buyer presents a prescription for the device, or 2. the buyer is a hospital or other medical facility.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the UT TC-62S in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your UT TC-62S in minutes.

How do I edit UT TC-62S on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as UT TC-62S. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete UT TC-62S on an Android device?

On an Android device, use the pdfFiller mobile app to finish your UT TC-62S. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is UT TC-62S?

UT TC-62S is a form used in the state of Utah for the filing of franchise and income tax return modifications.

Who is required to file UT TC-62S?

Businesses and individuals who need to report adjustments related to their franchise or income tax returns in Utah are required to file UT TC-62S.

How to fill out UT TC-62S?

To fill out UT TC-62S, you need to provide accurate financial information, including your federal adjusted gross income, adjustments, and any additional required documentation as specified by the form instructions.

What is the purpose of UT TC-62S?

The purpose of UT TC-62S is to allow taxpayers in Utah to report modifications to their previously filed franchise or income tax returns.

What information must be reported on UT TC-62S?

The information that must be reported on UT TC-62S includes details of the tax modifications, financial figures, and any necessary supporting documentation to justify the adjustments.

Fill out your UT TC-62S online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-62s is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.