TTB F 5000.24sm 2015 free printable template

Show details

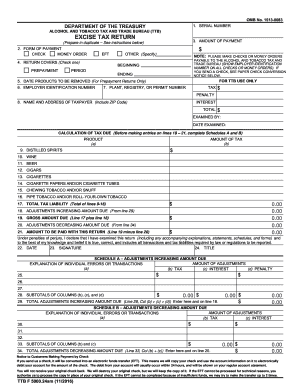

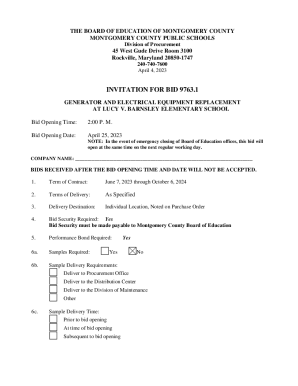

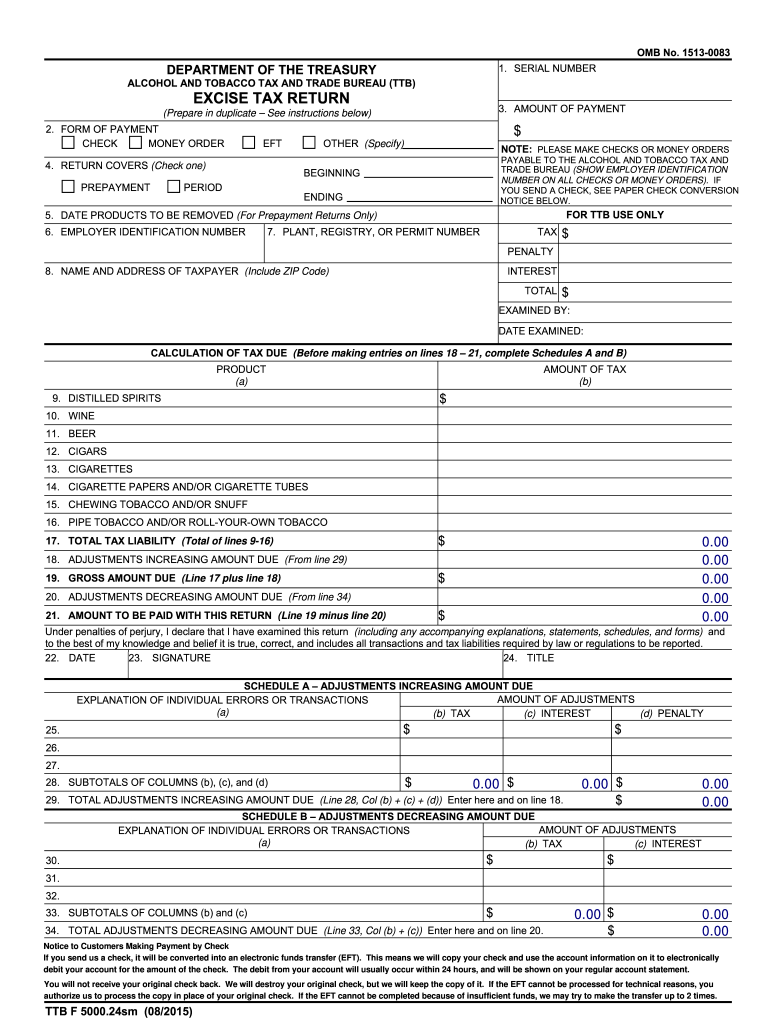

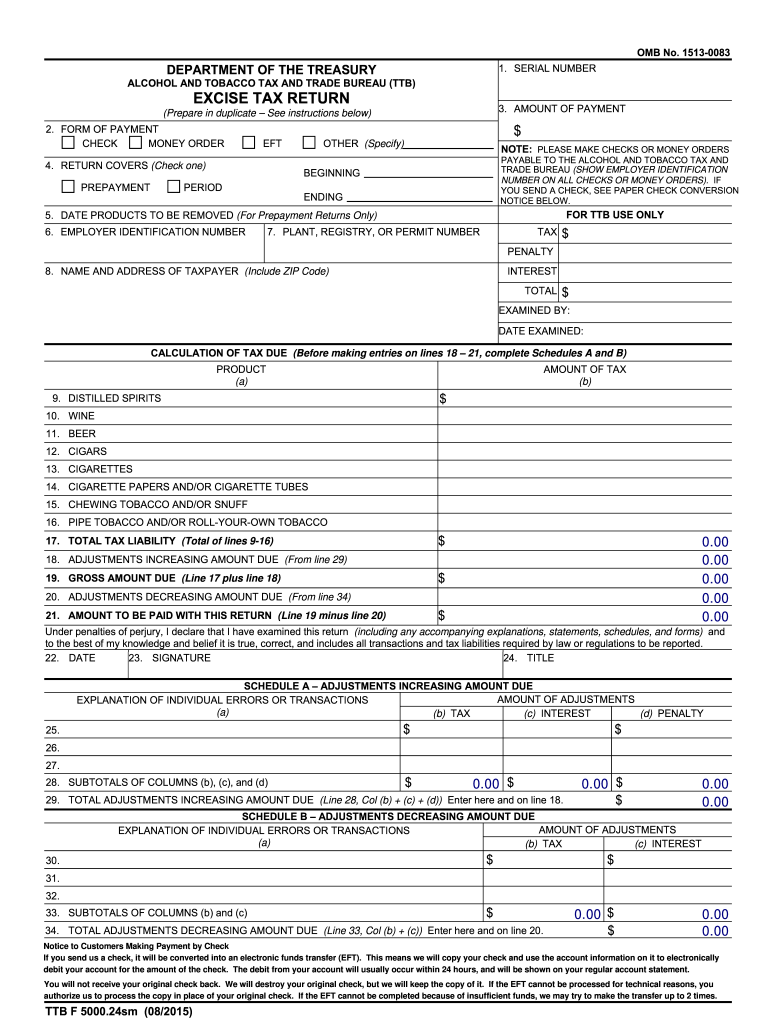

Reset Print Blank Form Print Completed Form OMB No. 1513-0083 DEPARTMENT OF THE TREASURY 1. SERIAL NUMBER ALCOHOL AND TOBACCO TAX AND TRADE BUREAU TTB EXCISE TAX RETURN 3. Prepare TTB F 5000. 24 Excise Tax Return in duplicate. The return must cover all tax liabilities incurred or discovered during the tax period. 2. Prepare a separate TTB F 5000. 24 for each distilled spirits plant bonded wine cellar or winery brewery tobacco products factory or cigarette papers and tubes factory from which...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form excise tax 2015

Edit your form excise tax 2015 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form excise tax 2015 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form excise tax 2015 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form excise tax 2015. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TTB F 5000.24sm Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form excise tax 2015

How to fill out TTB F 5000.24sm

01

Begin by downloading the TTB F 5000.24sm form from the TTB website.

02

Fill in the top section with your business name, address, and contact information.

03

Provide the date of the application submission.

04

Indicate the type of application in the specified area.

05

Complete the section detailing the reason for filing the form.

06

Verify that all parts of the form are filled out accurately and completely.

07

Review all information to ensure there are no errors.

08

Sign and date the form where indicated.

09

Submit the completed form to TTB via the specified submission method.

Who needs TTB F 5000.24sm?

01

Businesses involved in the production or distribution of alcohol products.

02

Entities seeking to establish federal permits or registrations regarding alcohol.

03

Individuals or organizations applying for specific exemptions or alterations related to alcohol production.

Instructions and Help about form excise tax 2015

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form for excise tax?

Filing Excise Tax Returns To report your excise tax liability, you must: Complete Form 720, Quarterly Federal Excise Tax Return. File Form 720 electronically for immediate acknowledgement of receipt and faster service with an IRS-approved software provider.

Who files form 720 excise tax?

Often, the retailer, manufacturer or importer must pay the excise tax to the IRS and file the Form 720. They may pass the cost of the excise tax on to the buyer. Some excise taxes are collected by a third party. The third party then sends the tax to the IRS and files the Form 720.

What is 5330 filing?

File one Form 5330 to report all excise taxes with the same filing due date. However, if the taxes are from separate plans, file separate forms for each plan. Generally, filing Form 5330 starts the statute of limitations running only with respect to the particular excise tax(es) reported on that Form 5330.

Who needs to file form 5330?

An employer or an individual required to file an excise tax return related to employee benefit plans can file Form 5330 electronically. All filers are encouraged to file Form 5330 electronically because it is safe, easy to complete, and you have an immediate record that the return was filed.

What is a form 720 for excise tax?

IRS Form 720, the Quarterly Federal Excise Tax Return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes. IRS Form 720 consists of three parts, as well as Schedule A, Schedule T and Schedule C sections and a payment voucher (called Form 720-V).

What is form 5330 for excise tax return?

What is form 5330? The Form 5330 has one job – to accompany remittances of certain excise taxes that are associated with qualified retirement plans and 403(b) plans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form excise tax 2015?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the form excise tax 2015. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the form excise tax 2015 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit form excise tax 2015 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing form excise tax 2015, you can start right away.

What is TTB F 5000.24sm?

TTB F 5000.24sm is a form used by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for reporting certain information related to the production and distribution of alcoholic beverages.

Who is required to file TTB F 5000.24sm?

Producers and importers of alcohol regulated by the TTB are required to file TTB F 5000.24sm if they engage in activities that necessitate reporting under TTB regulations.

How to fill out TTB F 5000.24sm?

To fill out TTB F 5000.24sm, individuals must provide accurate information regarding their operations, including production quantities, types of alcohol, and other relevant details as specified in the form's instructions.

What is the purpose of TTB F 5000.24sm?

The purpose of TTB F 5000.24sm is to ensure compliance with federal regulations by documenting the production and distribution activities of alcoholic beverages, thereby aiding in tax collection and monitoring.

What information must be reported on TTB F 5000.24sm?

TTB F 5000.24sm requires reporting information such as the name and address of the filer, the type and volume of alcoholic beverages produced or imported, dates of production, and any other required operational details.

Fill out your form excise tax 2015 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Excise Tax 2015 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.