SC ST-8 2016 free printable template

Show details

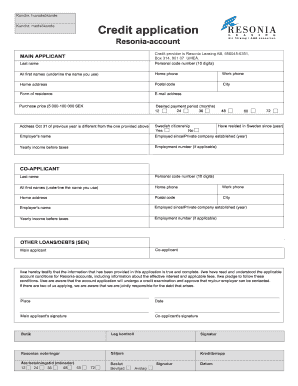

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE EXEMPTION CERTIFICATE FOR SALES AND USE TAX Single Sale Only Purchaser s Name Signature Please Print Date Amount of Sale Address ST-8 Rev. 7/14/16 This form is to be completed by purchaser and seller must maintain copy of exemption certificate. Do not send certificate to SC Department of Revenue. The undersigned hereby certifies that the purchases of tangible personal property made under this certificate are made in accordance with the exemption...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC ST-8

Edit your SC ST-8 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC ST-8 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC ST-8 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit SC ST-8. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC ST-8 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC ST-8

How to fill out SC ST-8

01

Obtain the SC ST-8 form from the appropriate government website or office.

02

Fill in your personal details such as name, address, and contact information.

03

Provide details regarding your caste or tribe, including certificates if required.

04

Fill in any additional information requested, such as family income or educational background.

05

Review the form for accuracy and completeness.

06

Sign the form where indicated.

07

Submit the completed form to the designated office or online portal.

Who needs SC ST-8?

01

Individuals belonging to Scheduled Castes (SC) or Scheduled Tribes (ST) seeking benefits or reservations in educational institutions and government jobs.

02

Those applying for caste certificates or various government schemes that require proof of SC/ST status.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

Who is exempt from paying NC sales tax?

Qualifying Farmers or Conditional Farmers. Commercial Fishermen. Commercial Loggers. Wildlife Managers.

Does a exemption certificate expire?

Certificates are valid for up to three years.

Does South Carolina sales tax exemption expire?

How long is my South Carolina sales tax exemption certificate good for? There is no explicitly stated expiration period for these exemption certificate, the business the apply to must simply still be in operation.

Do South Carolina sales tax exemption certificates expire?

To get a resale certificate in South Carolina, you will need to fill out the South Carolina Resale Certificate (Form ST-8A). How often should this certificate be renewed? Blanket certificates in South Carolina do not expire unless revoked in writing.

What is a tax exempt certificate in South Carolina?

How to use sales tax exemption certificates in South Carolina. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

What is the SC sales tax rebate?

Rebates are based on your 2021 tax liability, up to a cap. The rebate cap – the maximum rebate amount a taxpayer can receive – is $800. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. If your tax liability is over the $800 cap, you will receive a rebate for $800.

What is the ST 10 exemption in SC?

The Application for Certificate ST-10 is the document that must be filed in South Carolina in order for a business to claim the Utility Sales Tax Exemption. In South Carolina, a detailed energy study must be performed to identify the exact percentage of utility that is exempt from sales tax.

Is there sales tax on out of state purchases in SC?

Anyone who buys tangible personal property from out-of-state and brings it into South Carolina is responsible for paying a Use Tax of 6% on the sales price of the property. Businesses that regularly make non-taxed purchases from out of state report and pay the Use Tax on their monthly Sales & Use Tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit SC ST-8 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing SC ST-8 right away.

How do I fill out the SC ST-8 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign SC ST-8 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit SC ST-8 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign SC ST-8 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is SC ST-8?

SC ST-8 is a tax form used for reporting sales and use tax in specific jurisdictions.

Who is required to file SC ST-8?

Businesses or individuals engaged in selling goods or services that are subject to sales tax are required to file SC ST-8.

How to fill out SC ST-8?

To fill out SC ST-8, gather all sales and use tax data for the reporting period, complete the form with required financial figures, and submit it by the deadline.

What is the purpose of SC ST-8?

The purpose of SC ST-8 is to report and remit sales and use tax collected from customers to the relevant tax authority.

What information must be reported on SC ST-8?

SC ST-8 requires reporting of total sales, taxable sales, sales tax collected, and other pertinent sales tax information for the reporting period.

Fill out your SC ST-8 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC ST-8 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.