NJ DoT NJ-1040X 2023 free printable template

Show details

New Jersey

Amended Resident Income Tax ReturnNJ1040X2023

7xFor Tax Year January 1, 2023 December 31, 2023, Or Other Tax Year Beginning, 2023, Ending, 2024Your Social Security NumberLast Name, First

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nj form return

Edit your new jersey amended form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nj form amended form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nj amended return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nj income tax resident form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT NJ-1040X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nj amended return form

How to fill out NJ DoT NJ-1040X

01

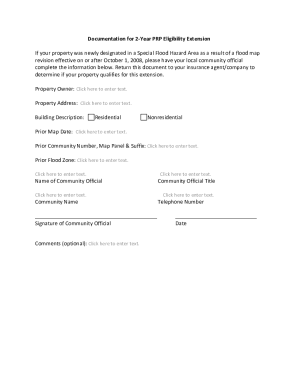

Gather all necessary documents, including your original NJ-1040 form and any supporting tax documents.

02

Obtain a copy of the NJ-1040X form from the NJ Division of Taxation website or local tax offices.

03

Fill in your personal information at the top of the form, ensuring accuracy.

04

Indicate the tax year you are amending in the designated space.

05

Review your original NJ-1040 form and make a list of the changes you need to make.

06

Complete the NJ-1040X by entering the corrected amounts in the appropriate sections.

07

Clearly explain the reason for each change in the space provided on the form.

08

Sign and date the form before submitting it.

09

Mail the completed NJ-1040X form to the address listed in the instructions.

Who needs NJ DoT NJ-1040X?

01

Individuals who need to correct errors on their previously filed NJ-1040 tax return.

02

Taxpayers who wish to claim additional deductions or credits not originally included.

03

Residents of New Jersey who have received a notice from the tax authority regarding discrepancies.

Fill

nj state amended tax

: Try Risk Free

People Also Ask about nj 1040x tax

Who is required to file a NJ tax return?

Who Must File your filing status is:and your gross income from everywhere for the entire year was more than the filing threshold:Single Married/CU partner, filing separate return$10,000Married/CU couple, filing joint return Head of household Qualifying widow(er)/surviving CU partner$20,000 Dec 15, 2022

Who is exempt from NJ filing fee?

FILING FEE EXCEPTIONS Exemptions include a partnership that has no New Jersey source income, expenses, or loss. To qualify for this exception, all of the partnership's operations and facilities must be located outside New Jersey.

What is form NJ 600?

NJ-600 Employer Notice of Adjustment of New Jersey Gross Income Tax.

Who must file a NJ nonresident return?

A nonresident serviceperson who has income from New Jersey sources such as a civilian job in off-duty hours, income or gain from property located in New Jersey or income from a business, trade or profession carried on in this State must file a New Jersey nonresident return, Form NJ-1040NR.

Do I have to file a NJ return?

If New Jersey income tax was withheld from your wages, you must file a New Jersey nonresident return to obtain a refund. To stop the with- holding of New Jersey income tax, complete a New Jersey Certificate of Nonresidence (Form NJ-165) and give it to your employer.

What is a NJ 165 form?

If you are a Pennsylvania resident and New Jersey Income Tax was withheld from your wages, you must file a New Jersey nonresident return to get a refund. To stop the withholding of New Jersey Income Tax, complete an Employee's Certificate of Nonresidence in New Jersey (Form NJ-165) and give it to your employer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nj 1040x for eSignature?

When you're ready to share your new jersey amended tax, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute form nj 1040x online?

pdfFiller has made it easy to fill out and sign new jersey amended return. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete new jersey form tax resident on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your nj 1040x. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NJ DoT NJ-1040X?

NJ DoT NJ-1040X is a form used by residents of New Jersey to amend their state income tax returns.

Who is required to file NJ DoT NJ-1040X?

Any taxpayer who needs to correct an error or adjust their previously filed NJ-1040 tax return must file NJ DoT NJ-1040X.

How to fill out NJ DoT NJ-1040X?

To fill out NJ DoT NJ-1040X, start by providing personal information, reference the originally filed return, indicate the changes being made, and then provide the corrected amounts or information as needed.

What is the purpose of NJ DoT NJ-1040X?

The purpose of NJ DoT NJ-1040X is to allow taxpayers to correct errors on their original tax return or to claim additional deductions or credits.

What information must be reported on NJ DoT NJ-1040X?

The information that must be reported on NJ DoT NJ-1040X includes the taxpayer's identification details, original income amounts, changes in deductions or credits, and the new corrected figures.

Fill out your NJ DoT NJ-1040X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Jersey Income Tax Brackets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.