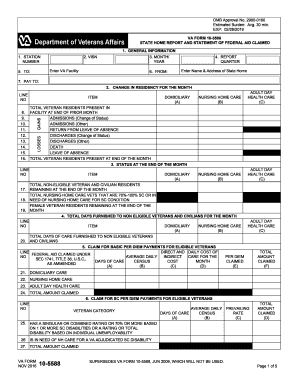

VA 10-5588 2024-2026 free printable template

Get, Create, Make and Sign 10 5588 fillable form

How to edit VA 10-5588 online

Uncompromising security for your PDF editing and eSignature needs

VA 10-5588 Form Versions

How to fill out VA 10-5588

How to fill out state home report and

Who needs state home report and?

Understanding the State Home Report and Form

Understanding the state home report

A state home report is an essential document summarizing vital information about a property, primarily used in real estate transactions. It encapsulates details pertinent to property ownership, including appraisals, tax assessments, and zoning regulations. Understanding the state home report's nuances is crucial for homeowners and real estate practitioners alike, as it directly influences property management decisions.

The importance of a state home report cannot be overstated. It serves as a significant resource for assessing a property’s market value and aids in making informed buying or selling decisions. This report often includes an array of factual data that informs various parties, including homeowners, real estate agents, appraisers, and potential buyers.

Purpose of the state home report

The state home report serves several key purposes. For homeowners, it acts as an informative tool that provides insights into property value, which can influence decisions related to selling or refinancing a home. For real estate professionals, this report is critical in establishing a competitive market price, guiding buyers during negotiations, and ensuring compliance with state regulations.

In terms of property taxes and insurance, the state home report plays a pivotal role. Tax authorities rely on the valuations within these reports to determine property tax liabilities, thus ensuring homeowners are paying the appropriate amounts based on their property's assessed value. Accurate assessment within the report can significantly affect insurance premiums, as property value correlates with coverage and replacement costs.

Types of state home reports

State home reports are available in various formats, typically falling into two categories: PDF and online formats. PDF reports are widely recognized for their consistent formatting and ease of sharing, while online formats often provide interactive capabilities that enhance usability. Understanding the pros and cons of each format can help users select the best approach for managing their property documentation.

Variations by state can significantly impact what a state home report looks like and the specific details included. For instance, some states require more information on property conditions and neighborhood characteristics than others. Learning about these differences is vital, especially for buyers and sellers operating in multiple regions. Example reports from states such as California might focus on environmental assessments, while Texas reports may include additional information regarding mineral rights.

Key components of a state home report

A comprehensive state home report comprises several essential components. These include property details such as the address, dimensions, square footage, and zoning information. This foundational data not only helps identify the property but also establishes its legality and potential uses based on local zoning laws.

The assessment of property value is another critical element of the state home report. The valuation process generally involves comparing the property to similar homes (comparables) within the area, which is essential for an accurate market analysis. Additionally, tax implications must be clearly outlined to inform property owners about assessment rates, exemptions, and taxes applicable in their jurisdiction.

The state home report form: Step-by-step filling guide

Filling out the state home report form requires careful preparation and accurate information gathering. Homeowners should compile all necessary documents before accessing the form. Important details might include previous tax assessments, property appraisals, and any alterations made to the property.

Step 1 involves entering the property information such as the full address, property type, and square footage. This step is vital as the report's accuracy begins with precise data capture. Progressing to Step 2 concerns completing the value assessment section; users should enter the estimated worth of the property based on comparable sales in the neighborhood.

Editing and managing your state home report

Once the state home report is complete, maintaining accurate records is key. Using platforms like pdfFiller allows homeowners and real estate professionals to edit and manage their state home reports seamlessly. Features such as easy editing, electronic signing, and cloud storage are invaluable for users who want to access their documents from anywhere.

Collaborating with team members becomes effortless when utilizing cloud-based document management tools. These platforms often allow multiple users to work on the same document simultaneously, ensuring that everyone involved in the real estate transaction has access to the most current information at all times.

Common challenges and solutions

Filling out the state home report form can be tricky, and many individuals encounter common challenges. For instance, misunderstanding the required property information often leads to inaccuracies. It's advisable to consult with a real estate professional or use state resources for clarification in such cases.

After submitting the report, it's crucial to know the follow-up steps. If there are questions or requests for additional information from authorities, responding promptly will streamline the process and avoid delays in property transactions.

Interactive tools for state home reports

Utilizing online calculators can simplify the process of estimating property values and understanding tax implications associated with state home reports. Many state government websites offer interactive tools designed for this purpose, helping individuals gain insight into how properties are assessed based on current market conditions.

Moreover, accessing state resources provides valuable information about the regulations governing property assessments and taxes. Connecting with these resources will keep individuals and teams informed about any changes in laws and practices related to state home reporting.

Understanding state regulations and updates

Staying informed about state regulations regarding home reports is essential for compliance. Many states regularly revise their laws, and property owners need to stay abreast of these changes to ensure their reports meet current standards. Periodic consultations with legal professionals or real estate consultants can help maintain compliance.

Resources such as state government websites often provide updates and clarifications surrounding laws and regulations, ensuring users have access to the most accurate and timely information. Users can set reminders or subscribe to alerts on these platforms for ongoing updates.

User stories: Success with state home reports

There are numerous success stories concerning state home reports that highlight their effective usage. For instance, a first-time homebuyer in New York was able to leverage the insights provided in their state home report to negotiate a significantly lower purchase price by presenting comparables from their report that highlighted discrepancies in value assessments.

Additionally, testimonials from users of pdfFiller showcase how the platform has streamlined their document processes, allowing for effortless edits and real-time collaboration. These user experiences underline the impact of utilizing effective tools in managing state home reports.

Frequently asked questions (FAQs)

Many individuals may have questions regarding their state home report, especially regarding assistance with filling out the form. A range of resources is available, including online support communities, state government services, and real estate professionals who can provide guidance.

pdfFiller also offers unique features designed to enhance the user experience when it comes to managing documents. From collaborative editing tools to electronic signatures, users can streamline their document workflows effectively, making their experience with state home reports more manageable and efficient.

People Also Ask about

Can I file a 5558 electronically?

How do I submit form 5558?

What is the 5558 form used for?

Does form 5558 have to be signed?

Who files IRS form 5558?

Can you electronically file form 5558?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify VA 10-5588 without leaving Google Drive?

Can I create an eSignature for the VA 10-5588 in Gmail?

How do I edit VA 10-5588 straight from my smartphone?

What is state home report?

Who is required to file state home report?

How to fill out state home report?

What is the purpose of state home report?

What information must be reported on state home report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.