ME MRS REW-5 2024 free printable template

Show details

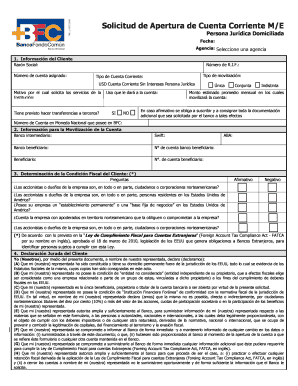

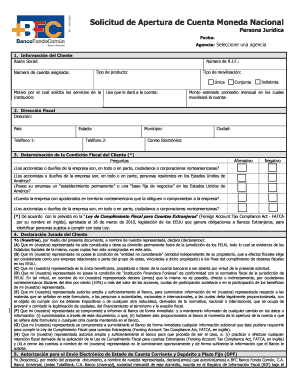

ClearPrintForm REW5Request for Exemption or Reduction in

Withholding of Maine Income Tax on the

Disposition of Maine Real Property2024File Form REW5 online at revenue.Maine.gov.

Note:This form is

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ME MRS REW-5

Edit your ME MRS REW-5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ME MRS REW-5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ME MRS REW-5 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ME MRS REW-5. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME MRS REW-5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ME MRS REW-5

How to fill out ME MRS REW-5

01

Obtain the ME MRS REW-5 form from the designated website or applicable office.

02

Carefully read the instructions provided with the form.

03

Fill in personal information such as name, address, and relevant identification numbers in the appropriate fields.

04

Provide detailed information about the purpose of the form and any relevant circumstances.

05

Ensure all sections of the form are completed as required, checking for accuracy and completeness.

06

Attach any necessary documents or supporting information as specified in the form’s instructions.

07

Review the entire form for any errors before submission.

08

Submit the form by the designated method (online, in-person, or by mail) and keep a copy for your records.

Who needs ME MRS REW-5?

01

Individuals applying for a specific program or service that requires the ME MRS REW-5 form.

02

Organizations or agencies that need to report information as mandated by regulations.

03

Anyone involved in legal or administrative processes related to the purpose of the form.

Fill

form

: Try Risk Free

People Also Ask about

What is the capital gains tax rate for 2022 on real estate?

If you have a long-term capital gain – meaning you held the asset for more than a year – you'll owe either 0 percent, 15 percent or 20 percent in the 2022 or 2023 tax year.

How long do you have to keep a property to avoid capital gains tax?

What is the 36-month rule? The 36-month rule refers to the exemption period before the sale of the property. Previously this was 36 months, but this has been amended, and for most property sales, it is now considerably less. Tax is paid on the 'chargeable gain' on your property sale.

How do I not pay capital gains on a home sale?

How to avoid capital gains tax on a home sale Live in the house for at least two years. See whether you qualify for an exception. Keep the receipts for your home improvements.

Do I have to buy another house to avoid capital gains?

You can avoid a significant portion of capital gains taxes through the home sale exclusion, a large tax break that the IRS offers to people who sell their homes. People who own investment property can defer their capital gains by rolling the sale of one property into another.

What age do you stop paying property taxes in Maine?

To be eligible for the program, you must be at least 65 years old or unable to work due to a disability.

How can I avoid paying tax on the sale of my house?

Home sales can be tax free as long as the condition of the sale meets certain criteria: The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

Do I have to pay taxes when I sell my house in Maine?

Note: Regardless of residency status, all individuals and entities are subject to Maine income tax on gains realized from the sale of real estate in Maine.

What is the capital gains tax on real estate in Maine?

Additional State Capital Gains Tax Information for Maine The Combined Rate accounts for Federal, State, and Local tax rate on capital gains income, the 3.8 percent Surtax on capital gains and the marginal effect of Pease Limitations (which results in a tax rate increase of 1.18 percent).

Do you have to pay capital gains when you sell your house in Maine?

Most homesellers in Maine, like all homesellers across the country, do not need to report the sale of their property. However, if you have capital gains of more than $250,000 or $500,000 as a couple filing a joint return, then the IRS will tax you on some of the gain.

How much is capital gains tax on real estate in Maine?

State Capital Gains Tax Rates RankStateRates 20219Wisconsin *7.65%10Hawaii *7.25%11Maine7.15%12South Carolina *7.00%47 more rows

How to order Maine income tax forms?

To request a single copy of a tax form(s), tax booklet(s) or instructions enter your name and address in the form below and check off the tax year using your mouse. To order forms not listed on this page, call 207-624-7894.

How do I calculate capital gains on sale of property?

Capital gains tax is the amount of tax owed on the profit (aka the capital gain) you make on an investment or asset when you sell it. It is calculated by subtracting the asset's original cost or purchase price (the “tax basis”), plus any expenses incurred, from the final sale price.

Can you avoid the Maine state tax when you sell your home?

A request for exemption or reduction in real estate withholding (Form REW-5) should be filed as soon as the seller and buyer have reached an agreement to transfer property. Sellers should allow 5 business days for Maine Revenue Services to respond to a Form REW-5 request.

Am I liable for capital gains tax when I sell my house?

Taxes when selling FAQs You normally won't pay capital gains tax on your main home, if you've been living in it. In fact, as long as you've lived in it the entire time you've owned it, you should be in the clear — ing to the government's website. But what if you rented out your home part of the time?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ME MRS REW-5 online?

pdfFiller makes it easy to finish and sign ME MRS REW-5 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out the ME MRS REW-5 form on my smartphone?

Use the pdfFiller mobile app to complete and sign ME MRS REW-5 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit ME MRS REW-5 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like ME MRS REW-5. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is ME MRS REW-5?

ME MRS REW-5 is a specific tax form used in Maine for reporting certain tax information related to financial activities or transactions.

Who is required to file ME MRS REW-5?

Individuals or businesses that meet certain financial thresholds or have specific types of reportable transactions in the state of Maine are required to file ME MRS REW-5.

How to fill out ME MRS REW-5?

To fill out ME MRS REW-5, you need to gather the necessary financial records, follow the instructions provided on the form, and accurately report your financial data in the designated fields.

What is the purpose of ME MRS REW-5?

The purpose of ME MRS REW-5 is to ensure compliance with Maine tax laws by collecting information that may be relevant for tax assessment or re-evaluation purposes.

What information must be reported on ME MRS REW-5?

The information that must be reported on ME MRS REW-5 typically includes details about income, deductions, credits, and any other pertinent financial information as required by the Maine Revenue Services.

Fill out your ME MRS REW-5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ME MRS REW-5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.