Get the free Accounting Invoice Template

Show details

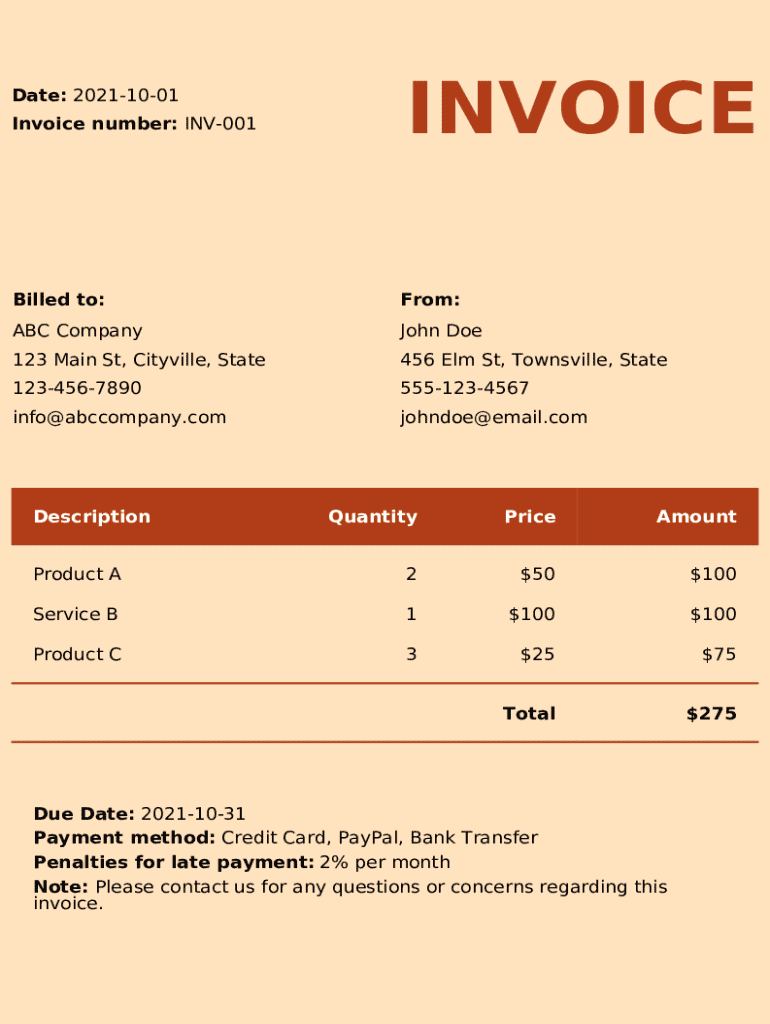

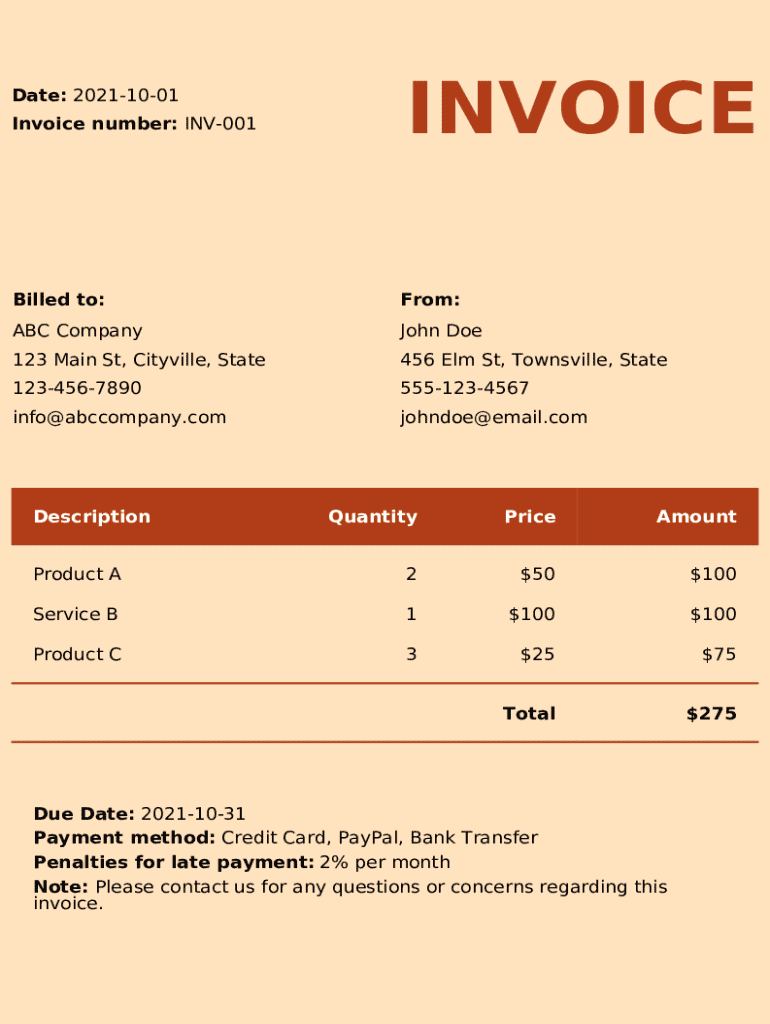

Date: 20211001

Invoice number: INV001INVOICEBilled to:From:ABC Company John Doe123 Main St, Amityville, State456 Elm St, Townsville, State12345678905551234567info@abccompany.comjohndoe@email.comDescriptionQuantityPriceAmountPro$2ct

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is accounting invoice template

An accounting invoice template is a pre-formatted document used to itemize and bill clients for goods or services provided.

pdfFiller scores top ratings on review platforms

Who needs accounting invoice template?

Explore how professionals across industries use pdfFiller.

How to effectively use an accounting invoice template form

How does an accounting invoice template work?

An accounting invoice template form serves as a standardized format designed for billing clients. It streamlines the invoicing process by providing essential fields that can be filled out quickly and accurately. Utilizing a template reduces the risk of errors, ensuring invoices are professional and consistent, ultimately facilitating better payment processing.

Templates are beneficial for businesses of varying sizes, enhancing efficiency by allowing users to focus on their core tasks rather than format design. Moreover, electronic platforms like pdfFiller enhance accessibility, enabling businesses to create and customize their invoices from anywhere with ease.

What are the key components of an effective invoice?

-

Every effective invoice should include crucial information like the date, invoice number, billed-to information, and sender details. This information helps establish clarity and legal standing.

-

Invoices must clearly outline each service or product provided, including a description, quantity, price, and total amount due. This transparency reduces disputes and enhances customer relations.

-

The invoice should detail the total amount due and clearly state payment instructions, including acceptable payment methods and due dates to ensure timely payments.

How do fill out my invoice using pdfFiller?

pdfFiller provides an intuitive, step-by-step process to fill out your accounting invoice template form. Users can easily input data into designated fields using their web-based platform, which allows for quick modifications and updates.

-

Begin by selecting your desired accounting invoice template on pdfFiller’s platform.

-

Enter necessary information such as the date, invoice number, and client details into the appropriate fields.

-

Add items in the invoice section that detail the services provided, making sure each line is clear and comprehensive.

-

After completing the form, take a moment to review all entries for accuracy before saving and sending.

How can customize my invoice template?

Customization is key to branding your invoices. You can easily add your business logo and incorporate your company colors and fonts directly in pdfFiller, making each invoice uniquely yours.

-

Including your logo and business colors not only enhances aesthetics but also strengthens brand recognition.

-

With pdfFiller, users can rearrange sections to fit their specific needs, ensuring clarity and relevance.

-

By indicating various accepted payment methods, you give clients more flexibility in settling their invoices.

What are the steps to signing and sending my invoice?

Once your invoice is filled out, pdfFiller enables you to electronically sign documents easily. This feature is not only convenient but also complies with e-signature laws, ensuring legality.

-

Utilize pdfFiller’s e-signature feature to add your signature directly onto the document, streamlining the approval process.

-

You can share the invoices directly through email or download them to send manually, making the process adaptable to your workflow.

-

With pdfFiller, you can track whether your recipient has viewed or paid the invoice, giving you insights into payment statuses.

How do manage invoice payments and follow-ups?

Establishing clear payment terms is vital to ensure timely payments. Set due dates, and consider including penalties for late payments to incentivize prompt settlements.

-

Specify due dates on your invoices to create urgency. Implementing late fees can also encourage faster payments.

-

Additionally, set a schedule for following up on unpaid invoices to maintain cash flow and strengthen client relationships.

-

Keep thorough records of all transactions and payment methods used to ensure accurate accounting and to address any disputes.

What are the compliance and legal considerations?

Adhering to legal requirements when issuing invoices is essential. Different regions may have specific rules regarding what must be included in an invoice and regulations for e-signatures.

-

Research the legal requirements for invoices in your region. This may include mandatory fields and tax regulations.

-

Properly documenting tax charges is crucial to avoid misfiling taxes or legal ramifications.

-

Ensure the platform you are using, like pdfFiller, conforms to electronic signature laws to safeguard the legitimacy of your documents.

What other templates are available on pdfFiller?

pdfFiller offers an extensive variety of templates tailored for different industries, making it a versatile tool for many professionals. Whether you’re looking for cost reimbursable invoice templates or simple accounting invoice template forms, there's likely a suitable option for your needs.

-

Explore templates that cater to various fields, ensuring that you find a format that meets your specific business requirements.

-

Comparing options, like the cost reimbursable invoice template, may highlight unique features or benefits that suit your budget and needs.

-

Utilizing pdfFiller’s templates can streamline your document creation process and enhance overall workflow efficiency.

How can maximize invoice efficiency?

In conclusion, leveraging an accounting invoice template form can significantly enhance your invoicing efficiency. By taking advantage of tools like pdfFiller, businesses can ensure their invoicing processes are streamlined and compliant with legal standards.

Engagement with the pdfFiller community and exploring ongoing support can further refine your invoicing strategy, leading to better financial management and client relations.

How to fill out the accounting invoice template

-

1.Open the accounting invoice template on pdfFiller.

-

2.Begin by entering your business name and contact information at the top of the invoice.

-

3.Fill in the client's name and address in the designated section.

-

4.Include the invoice number and the date of issuance.

-

5.List the products or services provided in the itemization table, including descriptions, quantities, unit prices, and any applicable taxes.

-

6.Calculate the total amount due by summing up the line items.

-

7.Specify the payment terms, including due dates and acceptable payment methods.

-

8.Review the invoice for accuracy, ensuring all information is correct and clearly presented.

-

9.Save the filled-out invoice as a PDF or send it directly to the client through pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.