Last updated on Feb 17, 2026

Get the free Flat Rate Invoice Template

Show details

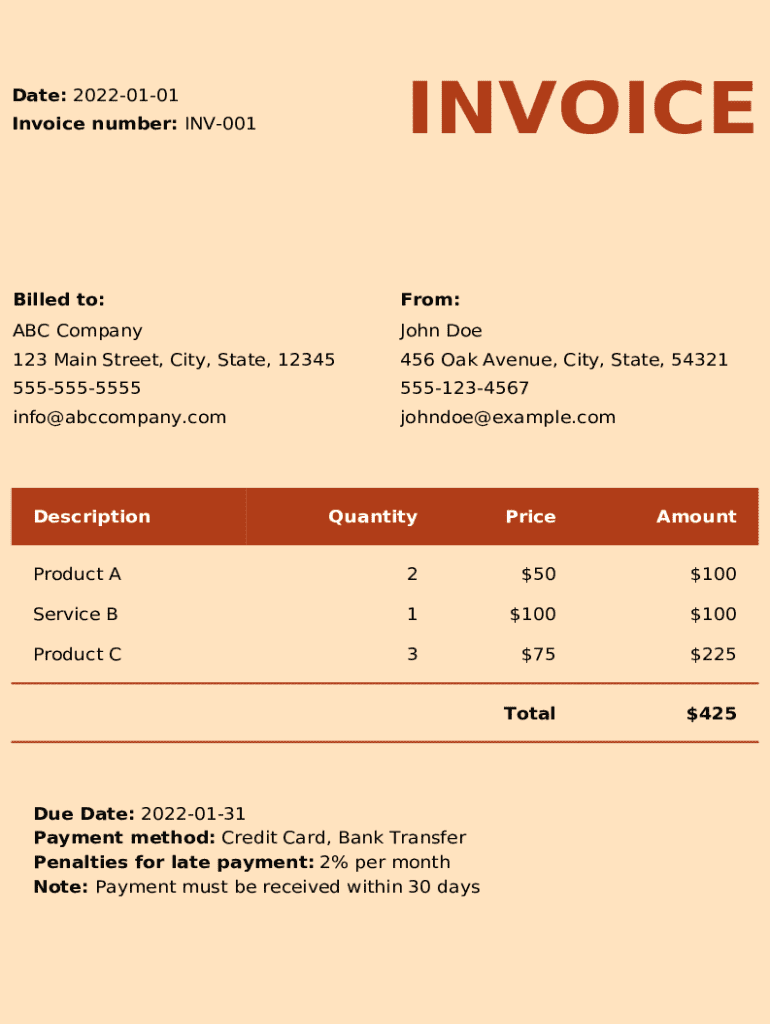

INVOICED ate: 20220101

Invoice number: INV001Billed to:From:ABC Company John Doe123 Main Street, City, State, 12345456 Oak Avenue, City, State, 5432155555555555551234567info@abccompany.comjohndoe@example.comDescriptionQuantityPriceAmountP$2duct

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is flat rate invoice template

A flat rate invoice template is a standardized document used to bill clients for services rendered at a fixed price.

pdfFiller scores top ratings on review platforms

Who needs flat rate invoice template?

Explore how professionals across industries use pdfFiller.

Flat Rate Invoice Template Guide

What are flat rate invoices?

Flat rate invoices serve as an efficient billing method for services rendered at a predetermined price, rather than hourly based charges. This invoicing system simplifies transactions, making financial agreements more transparent for both service providers and clients. Understanding flat rate invoices may help businesses streamline operations, but let’s delve into their key differences, benefits, and definitions.

-

Definition and purpose: Flat rate invoices designate a fixed fee for specific services, often preferred by clients who appreciate having clear costs ahead of time.

-

Key differences: Unlike hourly billing, which can fluctuate based on time, flat rates provide a stable, predictable charge for particular projects.

-

Benefits: Using this system allows for easier budgeting, promotes efficient communication with clients, and reduces disputes over billing.

What are the essential components of a flat rate invoice?

A well-structured flat rate invoice should include several key components that affect both clarity and utility. Each element plays a vital role in ensuring all transactions are professionally communicated and documented, as well as helping in efficient tracking and management of your accounting.

-

Date and Invoice Number: These elements are crucial for tracking invoices in your accounting system, allowing you to maintain organized records.

-

Billed To and From: Clearly stating both parties ensures that recipients are properly identified, minimizing potential confusion.

-

Detailed Description of Services/Products: This section outlines the services rendered, giving clients a comprehensive view of what they are being charged for.

-

Quantifying Items: Accurate listing of quantities helps in reflecting the exact nature of the services or products delivered.

-

Setting Your Prices: Establish guidelines for pricing your services based on market rates and project complexity.

-

Calculating Amounts: Finally, total the charges accurately to reflect the complete due amount to be paid.

How to create a flat rate invoice step-by-step?

Creating a flat rate invoice is a straightforward process, especially with tools like pdfFiller available at your disposal. By utilizing the right template and following a structured approach, you can enhance productivity and ensure invoices are both professional and accurate.

-

Utilizing pdfFiller: Start by accessing the flat rate invoice template on pdfFiller's user-friendly platform.

-

Filling Out the Template: Take the time to complete all relevant fields, making sure to include accurate service descriptions and pricing.

-

Editing and Customizing: Tailor your invoice to reflect your business’s branding and any specifics that relate to the client.

-

Saving and Exporting: After completing your invoice, save it securely and export it in your desired format, such as PDF.

How can you customize your invoice interactively?

Customization is key to creating invoices that not only represent your services but also reinforce your brand identity. Using interactive tools can enhance ease of use and increase professionalism in communication with clients.

-

Using pdfFiller’s Interactive Tools: These tools allow for modifications in real-time, making it possible to add personal touches easily.

-

Adding eSignatures: Signing invoices electronically adds a layer of authenticity and professionalism, instilling confidence in clients.

-

Collaborating on Invoice Details: Work alongside your team members to ensure every detail on the invoice meets the project’s specifications.

How to manage payments and track transactions?

Managing payments efficiently is crucial for maintaining healthy cash flow and fostering positive client relationships. An organized system can facilitate smoother transactions and ongoing contract management.

-

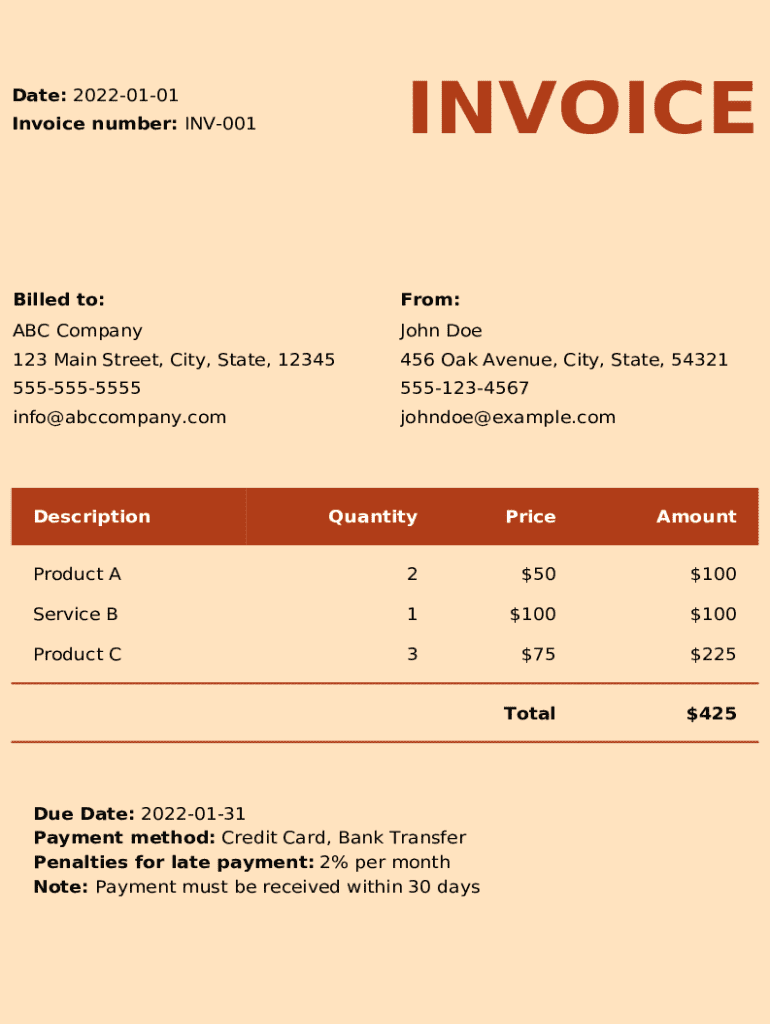

Payment Methods: It's essential to offer multiple payment options, such as accepting credit cards and bank transfers, to cater to your clientele's preferences.

-

Setting Due Dates: Clearly communicate due dates and any associated penalties for late payments to incentivize prompt payments.

-

Tips for Follow-Up: Develop strategies for effectively following up on unpaid invoices, including reminders and clear communication about consequences.

How to register for a live demo?

Joining a free live demo can help you understand how to effectively utilize pdfFiller and its array of tools for managing invoices. Attending such sessions is a proactive way to enhance your invoicing capabilities.

-

Steps to Register: Navigate to the demo registration page on pdfFiller and complete the requested form to secure your spot.

-

What to Expect: During the session, you will explore features that simplify the invoicing process and get tips from professionals.

-

Feedback and Support: Post-demonstration, maintain communication to receive further support and share your experience with the team.

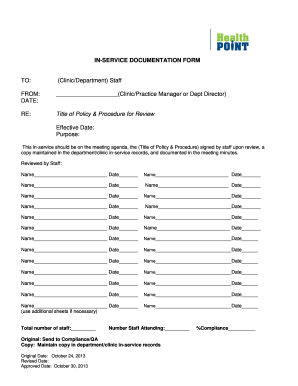

How to fill out the flat rate invoice template

-

1.Open the flat rate invoice template on pdfFiller.

-

2.Begin by entering your business name and contact information at the top of the invoice.

-

3.Next, fill in the client's name and contact details in the designated section.

-

4.In the 'Invoice Number' field, assign a unique identifier for tracking purposes.

-

5.Set a date for the invoice to indicate when it was issued.

-

6.Specify the services provided in the itemized list, including quantity and a brief description for each service.

-

7.Enter the fixed price for each service in the appropriate column.

-

8.Calculate the total amount due by summing the prices of all services listed.

-

9.Include payment terms, such as due dates and accepted payment methods, clearly at the bottom of the invoice.

-

10.Review all details for accuracy before saving or sending the invoice to the client.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.