Last updated on Feb 17, 2026

Get the free Non-Profit Organization Invoice Template

Show details

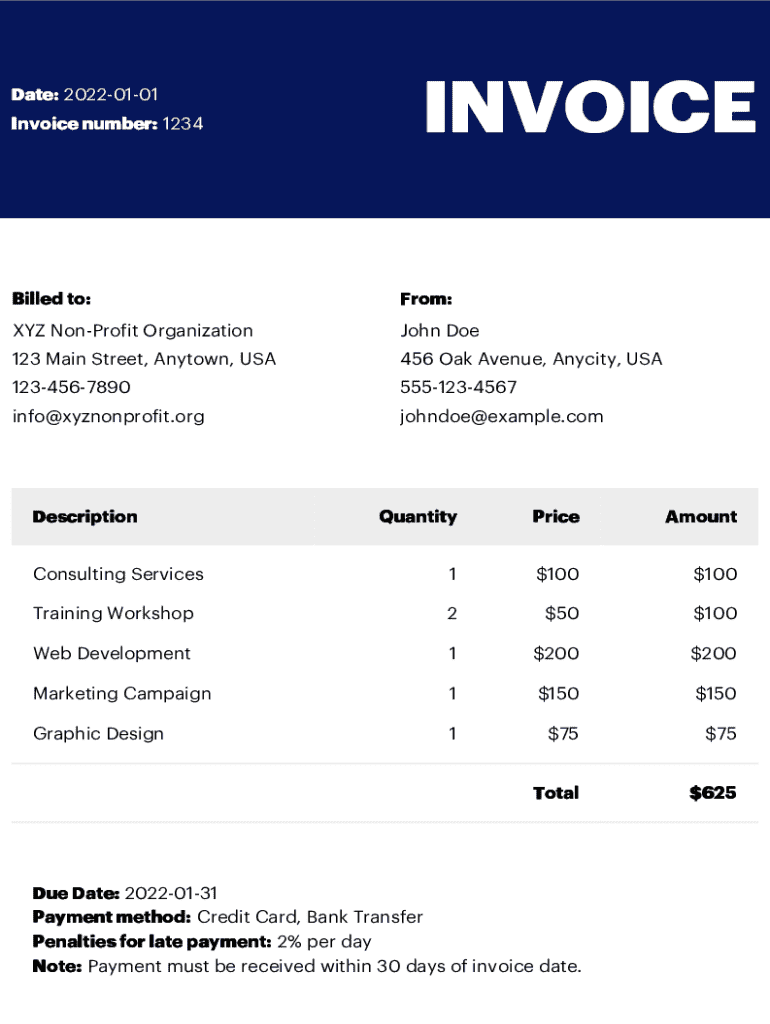

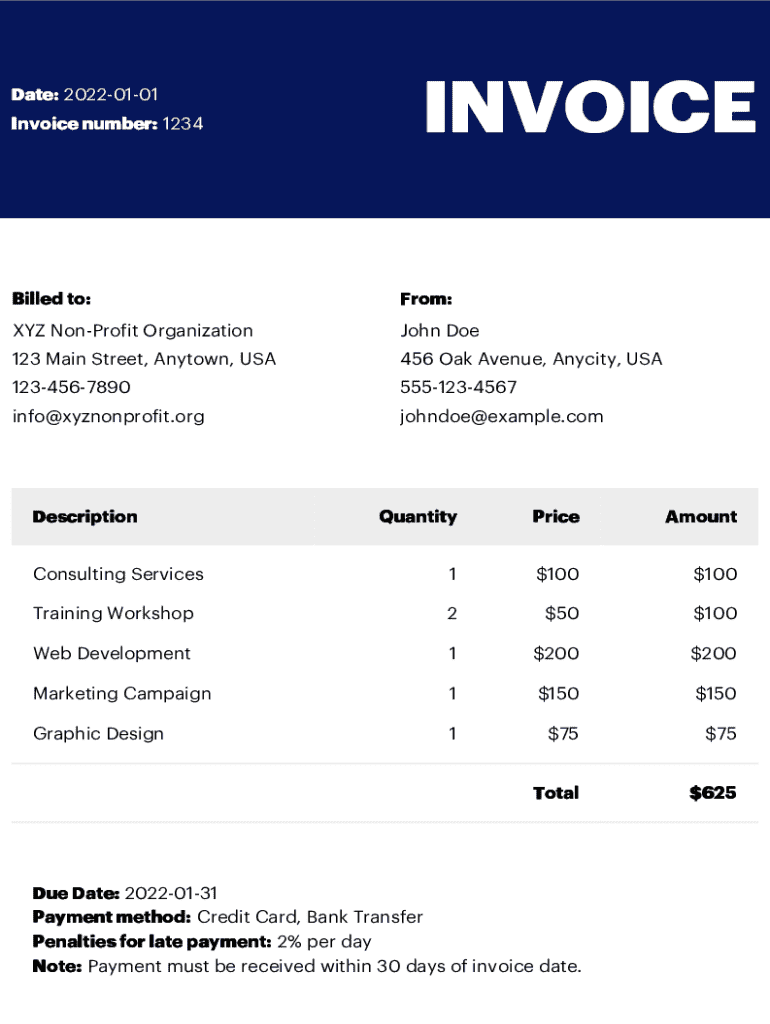

Date: 20220101

Invoice number: 1234INVOICEBilled to:From:XYZ Nonprofit Organization John Doe123 Main Street, Any town, USA456 Oak Avenue, Any city, USA12345678905551234567info@xyznonprofit.orgjohndoe@example.comDescriptionQuantityPriceAmountConsulting

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is non-profit organization invoice template

A non-profit organization invoice template is a pre-formatted document designed to itemize services or products provided by a non-profit entity and request payment for those items.

pdfFiller scores top ratings on review platforms

Who needs non-profit organization invoice template?

Explore how professionals across industries use pdfFiller.

How to create a non-profit organization invoice template form

How does understanding non-profit invoice templates benefit your organization?

Non-profit invoice templates are essential tools that streamline the billing process for charitable organizations. They ensure consistency, accuracy, and a professional appearance in financial transactions. By familiarizing yourself with various types of invoices, including standard, pro-forma, and recurring, you can effectively manage different billing scenarios, which is crucial for non-profits relying on donations and grants.

-

Typically used for one-time services or donations, these invoices provide a clear record clearly specifying the transaction.

-

This type serves as a preliminary invoice outlining anticipated costs before services are officially rendered.

-

Useful for regular donations or subscriptions, these invoices automatically bill donors on a scheduled basis.

Utilizing invoice templates helps in maintaining transparency and professionalism, making it easier for donors to understand the funding process and for organizations to keep organized financial records.

What are the essential components of a non-profit invoice?

-

Indicating the date of the transaction and a unique invoice number aids in tracking each invoice in your accounting records.

-

Clearly stating who the invoice is for and the organization issuing the invoice fosters transparency and identity.

-

Each service or donation amount needs to be clearly itemized. This includes Description, Quantity, and Price, ensuring clarity on what is being billed.

-

Summarizing the total amount owed and including a due date encourages timely payments.

-

Clearly specifying accepted methods of payment, such as credit cards or bank transfers, can facilitate smoother transactions.

-

Adding a brief note about any penalties for late payments promotes prompt settlement.

How can you create custom invoicing templates?

Customizing an invoice template allows it to reflect your organization's brand and specific needs. The process generally begins with selecting a base template via pdfFiller, which can then be adapted using their user-friendly editing tools.

-

Incorporate your logo and organization colors to align the invoice with your brand identity.

-

Adjust fields based on services offered, ensuring relevant information is prioritized.

-

Test various formats to find one that enhances readability and understanding for donors.

Utilizing pdfFiller’s features makes this customization process efficient, empowering non-profit organizations to create effective and visually appealing invoices.

What are the best practices for filling out a non-profit invoice?

-

Carefully input all required fields to avoid confusion and disputes. A small error can lead to significant issues.

-

Ensure all details, including amounts and descriptions, are correct to maintain professionalism.

-

Avoid vague descriptions or inaccuracies in total amounts, as they can delay payments or lead to misunderstandings.

Including a sample filled-out invoice in your guide can illustrate what a completed invoice looks like and can serve as a practical reference for your team.

How can you effectively share and manage non-profit invoices?

Sharing and managing invoices effectively is vital for tracking donations and payments efficiently. pdfFiller offers tools that facilitate seamless sharing with relevant stakeholders, ensuring everyone involved is informed and up-to-date.

-

Utilize pdfFiller’s collaboration options to allow team members to review and approve invoices together.

-

Regularly check the invoice status within pdfFiller to manage and monitor unpaid invoices actively.

-

Adopt best practices for follow-ups, such as reminders or personalized emails, to facilitate payment collection.

How to ensure compliance and security in non-profit invoicing?

Legal compliance is crucial for non-profit organizations to maintain donor trust and financial integrity. Understanding the invoicing regulations specific to the non-profit sector helps in crafting invoices that meet all necessary requirements.

-

Invoicing must comply with local laws concerning taxation, reporting, and donor communications.

-

Using secure platforms for invoicing, such as pdfFiller, ensures that sensitive donor information is protected.

-

pdfFiller incorporates compliance features that automatically update invoicing templates when regulations change.

What are the penalties for late payments, and how do you follow up effectively?

Understanding the implications of late payment penalties is vital for maintaining cash flow. Establishing clear expectations for payments by specifying due dates and potential penalties on your invoices can help mitigate payment delays.

-

Develop polite yet firm communication strategies for following up with late-paying clients.

-

Utilize pdfFiller’s automated payment reminders to streamline follow-up processes.

What are the next steps to get started with invoicing today?

Getting started with invoicing using pdfFiller is straightforward. First, signing up for the service grants access to a variety of templates tailored for non-profit organizations.

-

Create an account on pdfFiller to begin accessing templates and tools.

-

Explore the array of invoicing templates available, selecting the one that best suits your needs.

-

Encourage hands-on learning by filling out your first invoice using the selected template. This will provide practical experience and confidence.

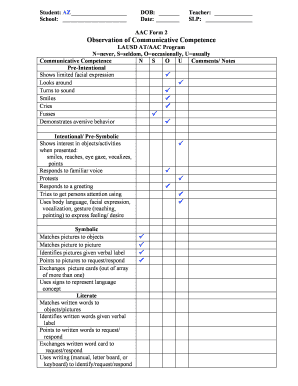

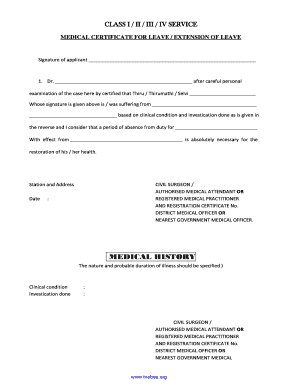

How to fill out the non-profit organization invoice template

-

1.Begin by opening the non-profit organization invoice template in pdfFiller.

-

2.Fill in the header section with your non-profit's name, address, contact information, and logo, if applicable.

-

3.Enter the invoice number and the date of issue to ensure tracking and record-keeping.

-

4.Provide the recipient's name and address in the 'Bill To' section, ensuring accuracy.

-

5.List the services or products provided in the itemized section, detailing each item with descriptions, quantities, and costs.

-

6.Calculate the subtotal, applicable taxes, and total amount due at the bottom of the invoice.

-

7.Include payment terms, methods accepted, and due date for the invoice payment.

-

8.Review all entered information for accuracy before saving or printing the invoice.

-

9.Finalize by saving the document in the desired format or sending it directly to the recipient via email.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

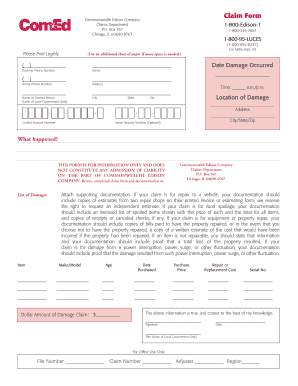

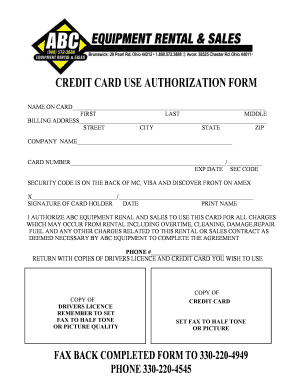

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.