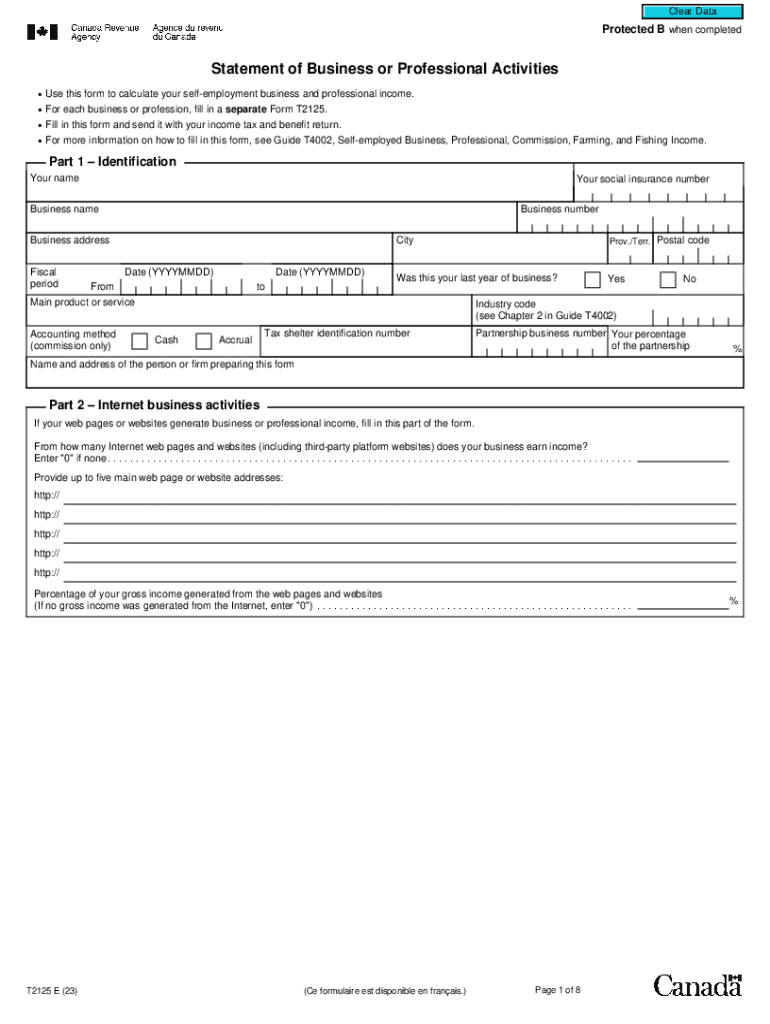

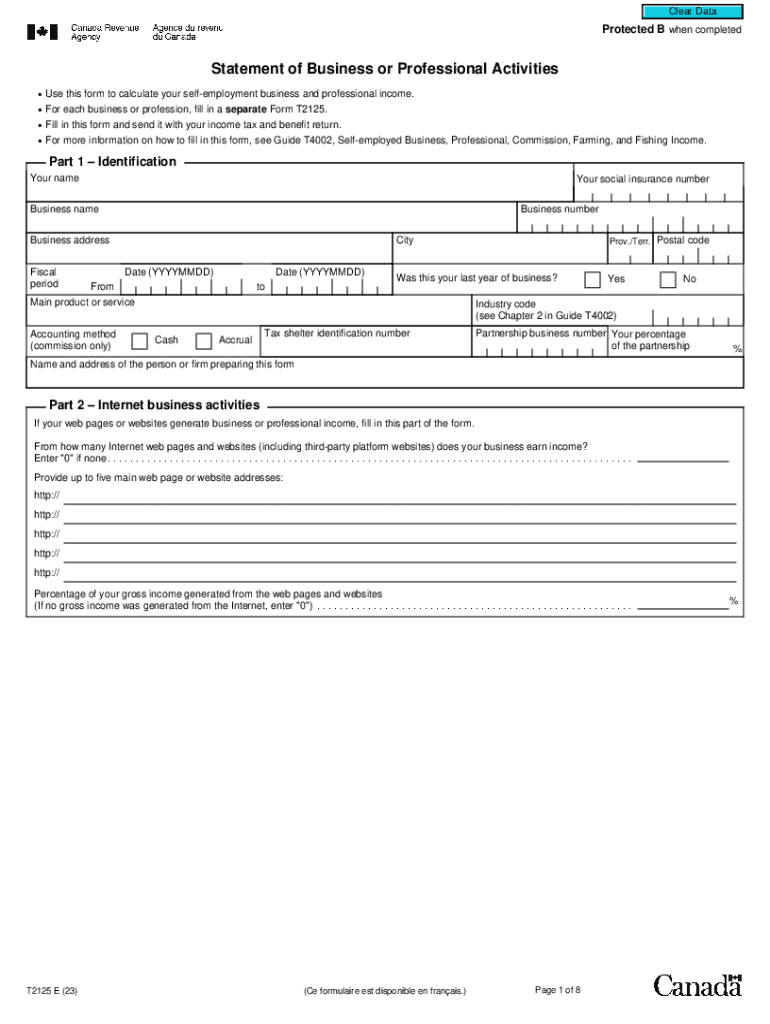

Canada T2125 2023 free printable template

Get, Create, Make and Sign cra form t2125

Editing t2125 tax form online

Uncompromising security for your PDF editing and eSignature needs

Canada T2125 Form Versions

How to fill out form t2125 canada

How to fill out Canada T2125

Who needs Canada T2125?

Video instructions and help with filling out and completing form t2125

Instructions and Help about t2125 return fill

Greetings my name is Andy, and I'm part of the profile support team in this video I will show you how to complete the t2125 statement of business or professional activities the t2125 is for self-employment or small business income or expenses first you need to enter the province of self-employment in the residency section of the personal information form then open your forum Explorer and type in t2125 to open up the business forum itself enter your business information in the identification area make sure this is completely filled out if the current tax year was the last year of your business answer yes to the question here enter your industry code you can use f6 to open the menu click the drop-down menu or even start typing a number two I would autocomplete if you don't have an account number tax shelter identification number or a partnership business number sign off these fields to prevent any auditor errors later on this is particularly important for Quebec returns if you have business partners once you've entered their information your percentage will adjust accordingly here let's add some partner information now we'll a lot our spouse another business partner 25% of the business each this includes expenses as well as income notice how the percentage has changed once we've entered their information select the type of self-employment business or professional by selecting the relevant box in part 1 or part 2 if you select business select also the type of income business or Commission in part 3 gross business or professional income you can add other income such as goodwill or a client list that you've sold to another business part for cost of goods sold and gross profit is for entering only business income let's add some wage costs here part 5 debt income or loss before adjustment is primarily for entering expenses generally you can find the appropriate category here otherwise enter your expenses in the free form area now open your motor vehicle expenses for business the boss auto form allocates your expenses to the t2125 created previously and choose 100 percent because this business has other partners' now will be selected by default for owned by business it is owned by this taxpayer and all partners have to enter their vehicle expenses on the t2125 in their own returns on this form you only enter the cost for what you've used and paid for your partners will do the same on theirs in chart a Center your motor vehicle expenses chart B is where you would enter the available interest expense for a passenger vehicle in this example we don't have any if on your t2125 you have 100% of the partnership meaning no partners you don't have to fill out chart c capital cost allowance for motor vehicles you would enter it on the t2125 CCA and t2125 asset forms in our example we have a 50% ownership if you've rented the vehicle fill out chart D eligible leasing costs for passenger vehicles instead of chart C open the t2125 CC a form to enter the capital cost...

People Also Ask about cra form

What is a T2125 form?

Who needs to fill out a T2125?

Can you file a T2125 without a business number?

How do I file a 1099 NEC without a business?

What is the difference between business income and professional income T2125?

Do you need to have a business to be self-employed?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cra forms t2125 to be eSigned by others?

Can I edit fillable t2125 on an iOS device?

How do I fill out formt2125 on an Android device?

What is Canada T2125?

Who is required to file Canada T2125?

How to fill out Canada T2125?

What is the purpose of Canada T2125?

What information must be reported on Canada T2125?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.