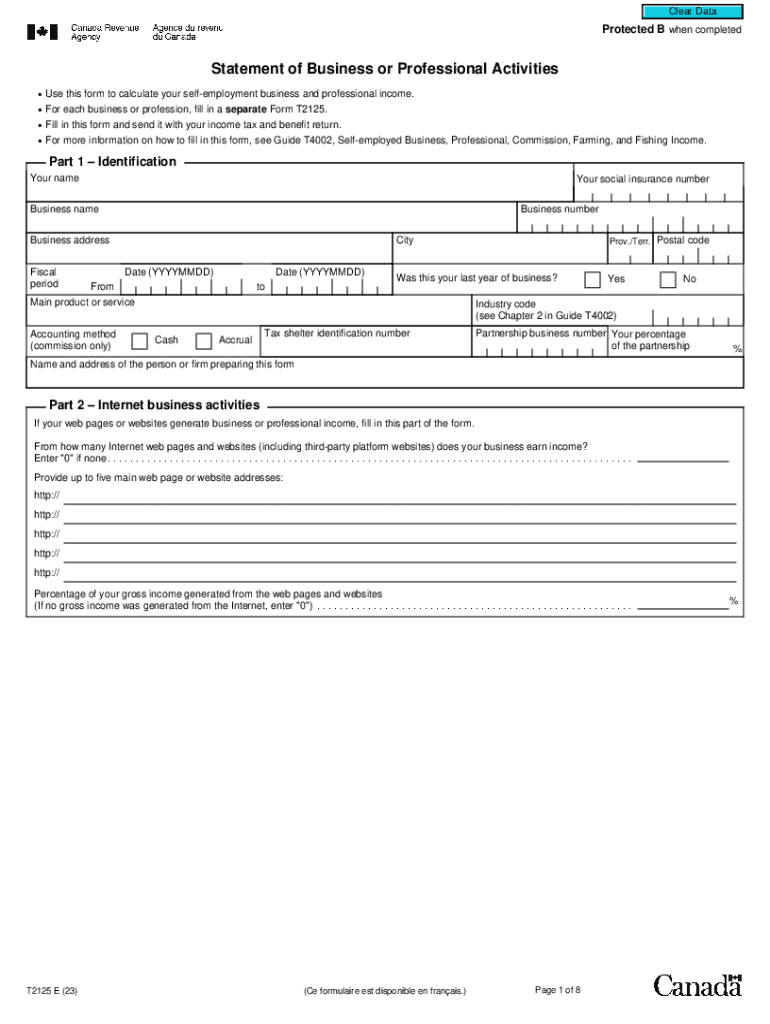

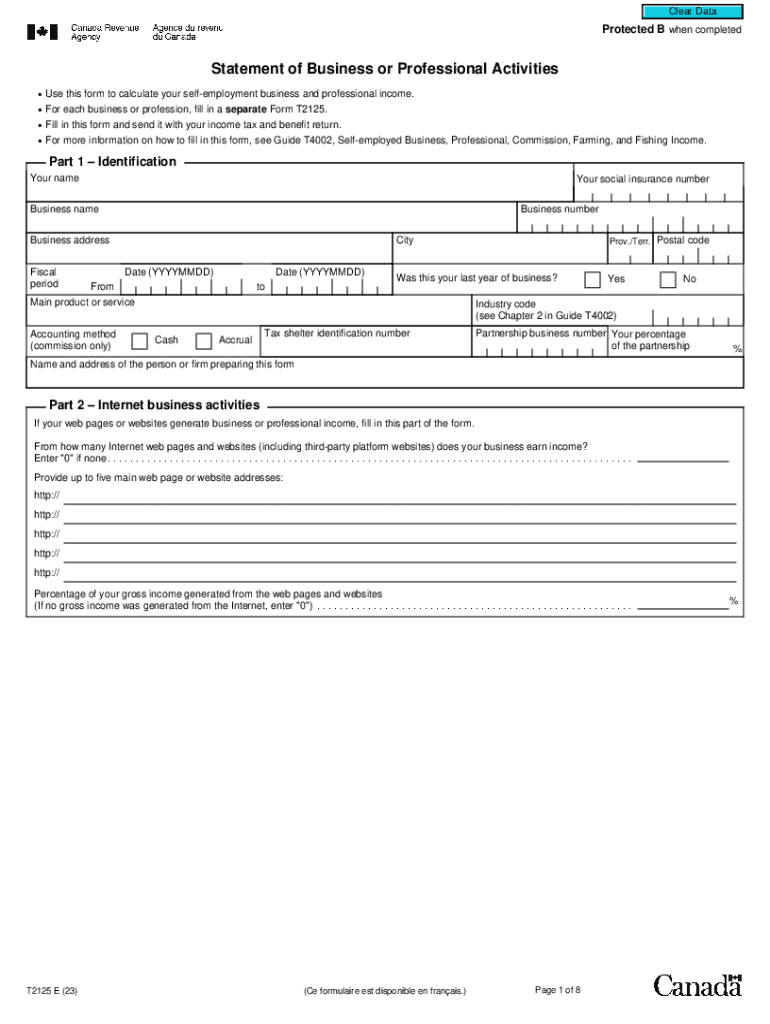

Canada T2125 2023 free printable template

Show details

If you have both business and professional income you have to fill out a separate Form T2125 for each. If no income was generated from the Internet enter 0. T2125 E 19 Ce formulaire est disponible en fran ais. For each business or profession fill in a separate Form T2125. Fill in this form and send it with your income tax and benefit return. For more information on how to fill in this form see guide T4002 Self-employed Business Professional Commission Farming and Fishing Income. Protected B...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T2125

Edit your Canada T2125 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T2125 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T2125 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada T2125. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T2125 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T2125

How to fill out Canada T2125

01

Gather your income information from self-employment sources.

02

Record all your business income in part 1 of the T2125 form.

03

List all business expenses in part 2 of the form, categorizing them appropriately (e.g., vehicle expenses, supplies, etc.).

04

Calculate your net income by subtracting total expenses from total income.

05

Fill out the applicable sections regarding your business structure and personal information.

06

Review the completed form for any errors or omissions.

07

Submit the form along with your personal income tax return.

Who needs Canada T2125?

01

Self-employed individuals in Canada.

02

Freelancers and contractors who earn income from their work.

03

Business owners operating sole proprietorships.

Fill

form

: Try Risk Free

People Also Ask about

What is a T2125 form?

You can use Form T2125, Statement of Business or Professional Activities, to report your business and professional income and expenses. This form can help you calculate your gross income and your net income (loss), which are required when you complete your Federal Income Tax and Benefit Return.

Who needs to fill out a T2125?

Who needs to file a T2125? If you run a sole proprietorship or you are part of a business partnership with five or fewer partners, the T2125 is for you. If you have more than five partners, you'll need to file a T5013 Partnership Information Return filing requirements.

Can you file a T2125 without a business number?

When you receive self-employment income (including contractor income) you must report it on a form T2125. You may need to complete this form even if you didn't know you have a business. You don't need a business number (or to have registered with the CRA) to complete this form.

How do I file a 1099 NEC without a business?

How do I enter my 1099-NEC without entering a business? The IRS considers consulting or contractor income as business income that needs to be entered on a Schedule C. If you have self-employment income from a 1099-NEC, which is the case with most Form 1099-NECs, you'll need to report the income on Schedule C.

What is the difference between business income and professional income T2125?

Business income is income from any activity you do for a profit and includes sales, commissions, or fees. For example, income earned as a plumber is considered business income. Professional income is the same except that your income is from a profession that has a governing body.

Do you need to have a business to be self-employed?

You don't have to have a formal company, such as a partnership, S corporation or limited liability company, to be self-employed. The simplest business structure is a sole proprietorship, and those don't have much structure at all.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada T2125 to be eSigned by others?

Once your Canada T2125 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I edit Canada T2125 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share Canada T2125 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out Canada T2125 on an Android device?

Complete Canada T2125 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is Canada T2125?

Canada T2125 is a form used by self-employed individuals to report their business income and expenses to the Canada Revenue Agency (CRA).

Who is required to file Canada T2125?

Individuals who earn income from a sole proprietorship or a partnership are required to file Canada T2125.

How to fill out Canada T2125?

To fill out Canada T2125, you need to provide information about your business income, expenses, and any capital cost allowance. It requires detailed records of earnings and expenditures.

What is the purpose of Canada T2125?

The purpose of Canada T2125 is to calculate the net income or loss from self-employment activities for taxation purposes.

What information must be reported on Canada T2125?

You must report information such as gross income, operating expenses, professional fees, and any deductions relevant to your self-employment activities on Canada T2125.

Fill out your Canada T2125 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t2125 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.