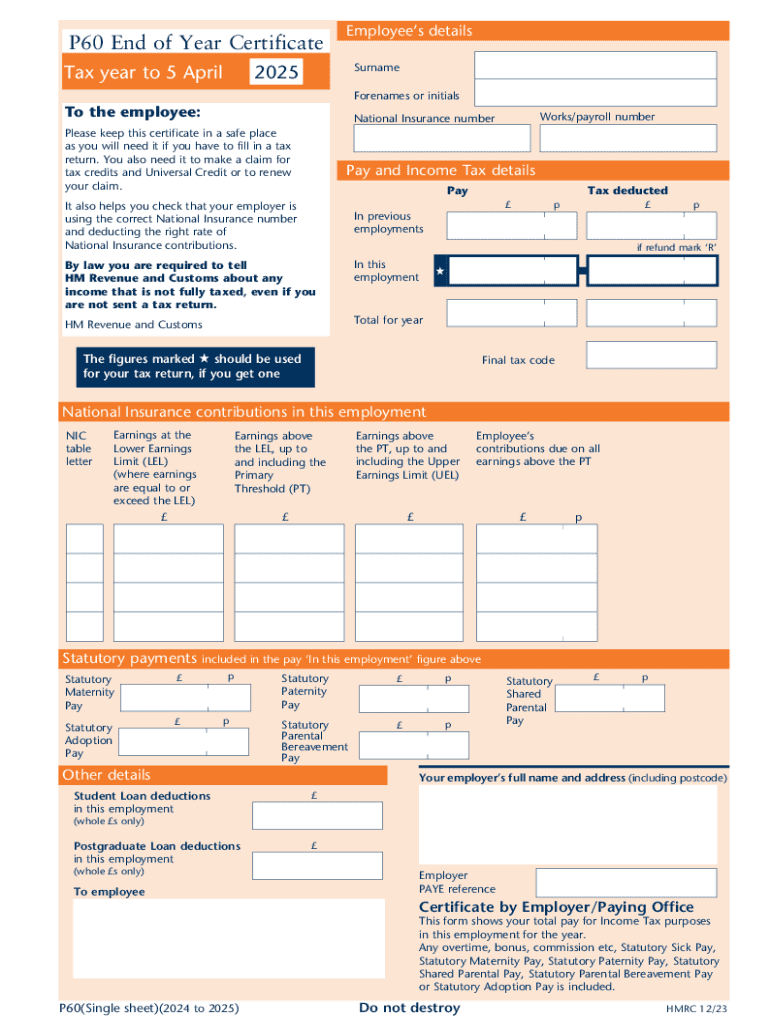

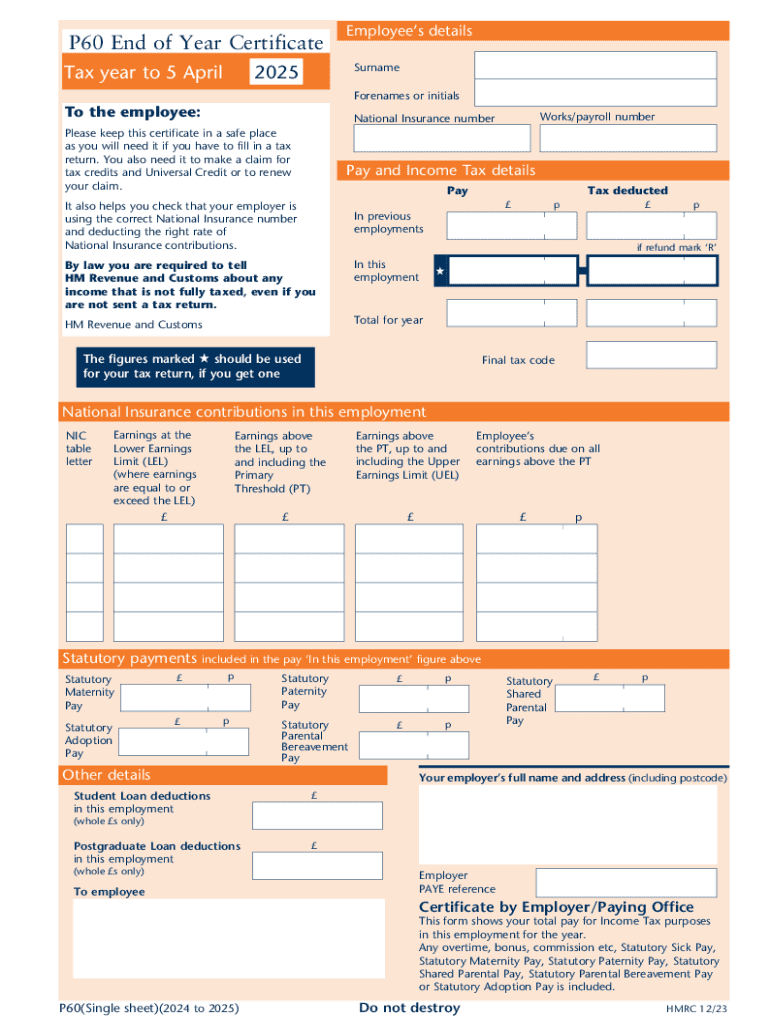

UK HMRC P60(Single sheet) 2024-2025 free printable template

Get, Create, Make and Sign p60 template hmrc form

How to edit printable p60 form online

Uncompromising security for your PDF editing and eSignature needs

UK HMRC P60(Single sheet) Form Versions

How to fill out p60 form online

How to fill out 2020-2024 form uk hmrc

Who needs 2020-2024 form uk hmrc?

Video instructions and help with filling out and completing p60

Instructions and Help about p60 pdf

Music hello this is Julius from basic financials today were going to talk about your form p60 if you're employed and at the end of the tax year which is a fifth of April which was just gone by we've just gone by the fifth of April 2019, and then you will get a piece sixty-four ends of year pay summary and paying tax summary and now some people already have received it some people will get it a bit later on I think that's 31st of May is the time when you should get it by, but most people get it fairly soon after these days, or you might not get it a print version you might get it online might be stored in your portal somewhere and anyway what I'd like to do today is to show you roughly what that p 6d is and how to check it on these from the tax point of view which is a two-stage process really there's the tax code that you need to think about and then also if that tax code is then being shown through properly on your pay and tax which you should do these things there should be no reason for it not to be right but its always worth having a little look to check, and you can see what's going on so the P 60 first is quite a good document to keep hold of and for the future because you might need it for example if you're applying for a mortgage and quite often you don't want to see a copy of your P 60 and live various other things forms of identity you know it has your new address on your National Insurance number it proves that you're employed or were employed on the 5th of April anyway and various other things so its worth what's holding on to it's a good piece of ID information now you want to get a p60 if you're not employed at the 5th of April if you left a job during the year you would get a p45 lever for the p45 now if you hadn't restarted in with another employer by the 5th of April then you wouldn't get a P 60 from them that 45 shows the information you would need for they'll show your gross pay to the point when you left and also show the tax deducted up to the point you left if you do start a new job then what you should do is pass that P 45 on to your new employer, and then they will be able to see what your previous paint being and tax deducted for the year, and they would then be able to carry on a cumulative pay in tax method which is the way it works I think I've described it in a previous video that I've done and then on your P 60 if that were the case you would see pay from a previous employer or employment because it could be more than one employment and then pay from this employment and then the total for the year, and it should work out the totals for the year you should be able to check to see that the tax is correct so working out if the tax is correct well I'm going to assume that for the year into 5th of April 2019 that you had a standard tax code which is basically means that you had 11850 tax-free personal allowance that would mean that you would have a 1 1 8 5 all tax code now the other important thing is that if is its on a...

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my missing p60 form directly from Gmail?

How do I edit p60 forms uk straight from my smartphone?

How do I complete how to get a p60 on an iOS device?

What is form uk hmrc p60single?

Who is required to file form uk hmrc p60single?

How to fill out form uk hmrc p60single?

What is the purpose of form uk hmrc p60single?

What information must be reported on form uk hmrc p60single?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.