Get the free Whole Number --1086

Get, Create, Make and Sign whole number --1086

How to edit whole number --1086 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out whole number --1086

How to fill out whole number --1086

Who needs whole number --1086?

Understanding Form -1086: A Comprehensive Guide

Overview of Form -1086

Form -1086 is a crucial document used for reporting income, deductions, and credits to the IRS. Its purpose is to provide a clear and organized method for taxpayers to disclose their financial information accurately. This form is particularly important as it plays a vital role in determining potential tax liabilities and ensuring compliance with federal tax obligations.

Using the correct form is imperative; submitting the wrong document could lead to delays in processing, penalties, or even audits. Taxpayers who earn income or claim certain deductions and credits will find this form necessary, making it essential to understand its components and how to complete it efficiently.

Detailed insights on Form -1086

Understanding the structure of Form -1086

Form -1086 is structured to facilitate easy completion and ensure comprehensive reporting. It contains several sections, each dedicated to collecting specific information necessary for accurate tax reporting. These sections include personal information, income reporting, deductions and credits, and other relevant fields.

Common terminology used in Form -1086 includes terms like 'qualified deductions,' 'tax credits,' and 'adjusted gross income,' which are crucial for correctly interpreting and filling out the form. Knowing these terms can greatly enhance the accuracy of the completion process.

Importance of accuracy in Form -1086

Accuracy in completing Form -1086 cannot be overstated. Inaccuracies can lead to several consequences, such as audits by the IRS, penalties for false statements, or delays in processing tax returns. These issues can create a financial burden and stress for taxpayers who may be trying to comply with tax laws.

On the other hand, properly filling out Form -1086 offers numerous benefits. It ensures that you receive any eligible tax refunds promptly and helps avoid additional scrutiny from tax authorities. A well-prepared form reflects diligence and responsibility, affirming your commitment to meeting tax obligations lawfully.

Step-by-step guide to filling out Form -1086

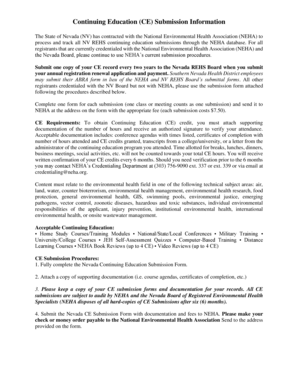

1. Gather required information

Before starting to fill out Form -1086, it's essential to gather all necessary documentation. Key personal details include your name, address, and social security number, along with required income documentation. This may consist of W-2 forms, 1099 statements, or other proof of income. Additionally, gather any relevant documentation for deductions and credits that you plan to claim.

2. Filling out the sections

When filling out Form -1086, carefully take your time with each section. Start with your personal information. Ensure every detail is accurate before moving on to income reporting. Here are tips to help you complete each field:

Common mistakes to avoid include transposing numbers, missing fields, or providing inconsistent figures. These oversights can cause significant setbacks in tax processing.

3. Editing and reviewing the form

Proofreading your form before submission is crucial. This is the final chance to catch errors. Start by reading through the entire document, checking for typographical errors or missing information. For those using digital formats, tools for editing Form -1086, such as pdfFiller, allow for easy adjustments and highlight any incomplete fields.

4. Signing and submitting Form -1086

Once you've reviewed the form, finalize your submission with a signature. Many platforms, including pdfFiller, offer eSignature options, streamlining the signing process. Be mindful of submission deadlines, which can vary annually, to ensure your form is filed on time.

Managing your Form -1086 related documents

Storing and organizing filled forms

To manage your filled Form -1086 efficiently, implement a systematic approach for storing and organizing your documents. Consider maintaining digital copies in a secure cloud storage solution, where you can access them anytime. Utilizing recommended naming conventions like 'Form--YourName' will enhance searchability and ease of retrieval.

Tracking submission and responses

Keeping meticulous records of your submissions is vital. Maintain copies of all forms submitted, along with any communications received from the IRS. To confirm your submission was successful, utilize online tracking systems provided by the IRS when available, or contact them directly for acknowledgment.

Collaboration tools within pdfFiller

If you're working within a team, pdfFiller's collaboration tools allow for seamless sharing of Form -1086. Team members can provide input, suggest edits, and concurrently edit the document, enhancing the quality and accuracy of the final submission.

Troubleshooting common issues with Form -1086

Encountering issues when filling out Form -1086 is not uncommon. Frequently asked questions often include concerns about missing information, how to handle errors after submission, and clarification on terms found on the form. Knowing common problems can help avoid unnecessary complications.

Should you face difficulties, having contact information for IRS assistance or tax professionals can expedite the resolution process. Additionally, reaching out to user communities online can provide practical tips and peer support.

Additional tools and resources

Interactive tools available at pdfFiller

pdfFiller provides interactive tools that enhance the user experience when dealing with Form -1086. For instance, preview tools allow you to see how the form looks during completion, while interactive checklists help ensure all required fields are filled out correctly. These tools improve the efficiency and accuracy of the document preparation process.

Accessing related forms and templates on pdfFiller

Navigating the digital landscape of tax forms can be overwhelming, but pdfFiller simplifies this with quick links to related forms necessary for tax filing. Understanding Form -1086-related paths and accessing other relevant forms can streamline your document handling process.

Best practices for document management

Leveraging pdfFiller's cloud-based solutions

Utilizing cloud-based document management systems like pdfFiller is essential for today’s document handling practices. The accessibility and convenience offered by such solutions mean you can work from anywhere, ensuring that your Form -1086 is always available right when you need it. This cloud access improves collaboration as well, allowing multiple users to work on documents from different locations.

Keeping updated on Form -1086 guidelines

Staying informed about any changes to Form -1086 guidelines is vital for compliance. Regularly checking the IRS website, subscribing to mailing lists that provide updates, or utilizing pdfFiller resources can help ensure you're in line with current regulations and best practices.

Networking and community engagement

Engaging with networks and user groups focusing on tax documentation can provide valuable support. Sharing experiences, tips, and resources can foster a sense of community among users of pdfFiller, leading to more effective practices and solutions for completing Form -1086.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send whole number --1086 for eSignature?

How do I fill out whole number --1086 using my mobile device?

How do I complete whole number --1086 on an Android device?

What is whole number --1086?

Who is required to file whole number --1086?

How to fill out whole number --1086?

What is the purpose of whole number --1086?

What information must be reported on whole number --1086?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.