Get the free COMMERCIAL UMBRELLA LIABILITY COVERAGE

Get, Create, Make and Sign commercial umbrella liability coverage

How to edit commercial umbrella liability coverage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commercial umbrella liability coverage

How to fill out commercial umbrella liability coverage

Who needs commercial umbrella liability coverage?

Understanding Commercial Umbrella Liability Coverage Form

Understanding commercial umbrella liability coverage

Commercial umbrella liability insurance is a vital component for businesses seeking to protect themselves from financial liabilities that extend beyond standard insurance policy limits. This type of insurance provides additional coverage that kicks in after an entity's primary liability limits have been exhausted, which is crucial in high-risk industries where claims can be substantial. Without an umbrella policy, businesses may face significant out-of-pocket expenses due to litigation, settlements, or judgments.

The importance of liability coverage cannot be overstated, especially as businesses face increasing risks from lawsuits and claims. Having adequate coverage not only protects company assets but also ensures continuity in operations. Key terminology in umbrella policies, such as 'excess liability' and 'primary coverage', are essential for business owners to understand to make informed purchasing decisions.

The role of the commercial umbrella liability coverage form

The commercial umbrella liability coverage form serves as the official document outlining the parameters of the insurance coverage. This form specifies the amount of additional coverage that will be provided above and beyond the limits set by the underlying policies. It is critical for businesses to distinguish between basic liability coverage and umbrella coverage as the latter provides a broader safety net against high-cost claims.

By enhancing liability protections, the umbrella coverage form ensures businesses are safeguarded against unexpected events. This proactive stance can save a company from severe financial loss, underscoring the importance of reviewing such forms carefully.

Key components of the coverage form

There are several key components to be aware of when examining the commercial umbrella liability coverage form. Coverage limits are at the forefront; these limits determine how much the policy will pay in the event of a claim, consisting of primary and excess limits. Primary limits refer to the amount covered by an underlying policy before the umbrella coverage kicks in, while excess limits are what the umbrella protects against in terms of additional payment coverage.

Despite the extensive coverage, it's crucial to understand common exclusions that may apply. For instance, certain intentional acts, professional errors, or pollution-related incidents might not be covered under umbrella policies, highlighting the need for thorough reading and comprehension of the form.

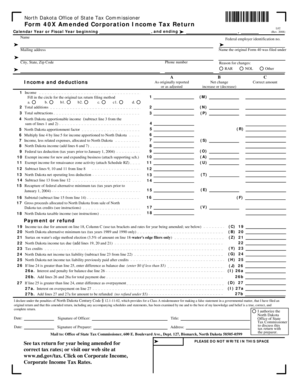

How to fill out the commercial umbrella liability coverage form

Filling out the commercial umbrella liability coverage form is a critical step that needs a systematic approach to ensure accuracy and completeness. Begin by gathering all necessary information about your business, including its legal name, address, and type of operations, as well as any existing underlying insurance policies.

Next, identifying coverage needs is essential. Conduct a risk assessment to determine the potential exposure your business faces and how much additional coverage may be necessary. Choosing coverage limits involves understanding both industry standards and your risk appetite while reviewing common exclusions will help clarify areas that may not be covered.

Lastly, avoid common mistakes by double-checking all information and ensuring everything aligns with the understanding of your business’s risks.

Editing and customizing the coverage form

Editing and customizing the commercial umbrella liability coverage form is made easier through online platforms like pdfFiller. Users can leverage tools for document editing, enabling precise changes to tailor the form to specific business needs. From adjusting coverage limits to adding pertinent business information, customization is key to reflecting unique organizational contexts.

Additionally, pdfFiller's collaboration features allow teams to input their insights directly on the document, contributing to a more comprehensive review and ensuring all viewpoints are considered in the final form.

Signing and finalizing the coverage form

Proper signing and finalizing of the commercial umbrella liability coverage form is paramount to validate your insurance application. Understanding eSignature legality is important, as electronic signatures hold the same weight as handwritten signatures in most jurisdictions, offering convenience and security.

When using pdfFiller, the process to electronically sign the document is straightforward, allowing users to complete the process quickly and efficiently. Employing best practices for document management, such as keeping digital copies and ensuring secure storage, further enhances the management of important business forms.

Managing your commercial umbrella liability coverage

Managing your commercial umbrella liability coverage involves periodic reviews and updates to ensure that your coverage remains adequate as your business evolves. Businesses should regularly reassess their risk exposure to adapt their coverage limits accordingly. It's also essential to know how to handle claims effectively, with clear procedures in place that can facilitate rapid response to incidents.

Integrating this coverage with other business policies can enhance overall risk management strategy, further safeguarding the business against unexpected liabilities.

Case studies: Real-world applications of coverage

Examining real-world applications of the commercial umbrella liability coverage form reveals its critical value for businesses. For example, a small construction company faced a lawsuit due to a workplace accident resulting in injuries to an employee. Their commercial umbrella policy covered the judgments that exceeded their primary liability limits, thus saving the firm from a financial catastrophe.

Conversely, companies that underestimated their coverage needs have faced dire consequences. A retail business without ample umbrella coverage faced a costly lawsuit resulting from an advertising error, leaving them exposed to significant financial hardship. These scenarios underscore the importance of understanding the coverage form and ensuring adequate limits.

FAQs about the commercial umbrella liability coverage form

Many business owners have common queries regarding the commercial umbrella liability coverage form. For instance, a prevalent concern is whether certain types of claims are covered under the umbrella policy or if they fall under exclusions. It's important to seek expert insights to clarify these complex scenarios, helping businesses realize the full potential of their coverage.

Additionally, understanding the implications of having multiple policies and how they interact with the umbrella coverage can be daunting. Expert advice can illuminate these intricacies, ensuring businesses are fully informed when selecting their coverage.

Unlocking additional resources for comprehensive coverage knowledge

Accessing additional resources on platforms like pdfFiller can provide ongoing education about commercial umbrella liability insurance. Subscription-based resources often include updates on regulations and trends, case studies, and expert analyses that can enhance understanding and management of insurance coverage.

These tools are invaluable for individuals and teams striving to make informed decisions about their insurance needs, ensuring their business remains compliant and protected in an ever-evolving risk landscape.

Interactive tools and features on pdfFiller

pdfFiller offers interactive tools and features that streamline document management for users engaging with the commercial umbrella liability coverage form. Document templates relevant to umbrella coverage simplify the initial steps of form completion, allowing for quick customizations to align with specific business needs.

Furthermore, collaborative features enhance efficiency, enabling real-time input from different departments or team members, which is crucial for accurate and comprehensive insurance documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify commercial umbrella liability coverage without leaving Google Drive?

How do I make changes in commercial umbrella liability coverage?

How can I edit commercial umbrella liability coverage on a smartphone?

What is commercial umbrella liability coverage?

Who is required to file commercial umbrella liability coverage?

How to fill out commercial umbrella liability coverage?

What is the purpose of commercial umbrella liability coverage?

What information must be reported on commercial umbrella liability coverage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.